Gold prices climbed above $2,000 on Tuesday, supported by a weakening dollar, as investors sought greater clarity on the Federal Reserve’s rate hike.

The rise of gold rests on its safe-haven role

According to Han Tan, chief market analyst at Exinity, gold’s close to 10% rise to date is largely due to its safe-haven role as markets remain cautious about the risks of recession and financial instability. However, Tan adds that bids for a new record level may be curtailed later this year until more certainty is provided on Fed rate cuts.

Data remains supportive for gold prices

cryptocoin.com As you follow, the CME FedWatch tool is pricing in an 83.5% probability that the markets will increase by 25 basis points in May. It also shows that the expectation of a pause later in the year increases after that. In a note, StoneX analyst Rhona O’Conell says the background effects remain supportive for gold, with much of the US data over the past few days pointing to an economic slowdown and a weakening dollar.

This week’s focus will be on comments from Fed officials before the central bank’s May 2-3 meeting, before it enters a blackout from April 22. OANDA senior market analyst Craig Erlam said in a note that gold will continue to be supported if investors remain skeptical that the scars from the banking crisis will lead to tighter credit conditions.

Gold prices may have reached their near-term high

Gold remains well supported in technical uptrends, but is losing momentum as hedge fund positions in the precious metal market become more nuanced. Despite renewed selling pressure, analysts say gold remains on a long-term uptrend as investors shield themselves from constantly rising inflation and global economic uncertainty. TD Securities analysts note that besides speculative positioning, other market indicators also indicate that gold prices may have reached their near-term peak. In this context, analysts make the following assessment:

We warn that CTA positioning appears to have effectively reached its ‘maximum long’ level, with nearly every single trend signal on our radar already pointing up. At the same time, although discretionary traders have closed their short positions, this group has not yet joined the rally. But interestingly, other reportables have still increased their positions. However, this was more than offset by money manager exits. Also, gold holdings in ETFs have been lackluster to date.

Gold could push prices to all-time high

For some analysts, it’s no surprise that gold is profiting. Ole Hansen, head of commodities strategy at Saxo Bank, says gold has seen its strongest four-week buying spree since mid-2019. Hansen states that gold is still 38,000 contracts below last year’s record level of $2,070.

As gold prices continue to test the support around $2,000, many analysts state that gold is still in an uptrend as prices hold above $1,950 to $1,960. Swissquote Bank senior analyst İpek Özkardeskaya notes that investor demand for gold will continue to be determined by the trend in the US dollar. Accordingly, Özkardeskaya makes the following prediction:

There is resistance at $2,050, but further weakening of the dollar could push the gold price per ounce to an all-time high in the coming weeks.

This time it’s different!

A weakening dollar and rising country risk mean gold is poised to reap big and sustained gains, according to Charlie Morris, Founder and Chief Investment Officer of ByteTree Asset Management. “Econometrics is very simple If you’re under it, it’s absolutely clear you’re not going to have a bad day,” Morris says. Also, Morris believes the markets are witnessing the early stages of a major bull market for precious metals.

Charlie Morris says he has seen the price of gold rise for the first time in a generation, despite the lack of support from Wall Street. In this context, Morris said, “I have been watching the gold market for 25 years and this is the first time I have seen the divergence between fund flows and gold price. This time it is different,” he says.

This is the recipe for a bull market

According to Charlie Morris, the more government risks in the world, the higher the gold price must be. Under these circumstances, Morris says it’s important that Wall Street investments have recently turned to gold. Based on this, Morris makes the following statement:

This is important, they’ve finally woken up to what’s going on. For geopolitical reasons, we’re starting to see a big jump in central bank activity. At the same time, we’re starting to see Wall Street step in… Gold isn’t finicky, it takes anyone’s money from anywhere in the world, and there’s plenty of demand. If central banks and Wall Street investors buy gold at the same time, it’s a recipe for a bull market.

Gold prices technical analysis

Technical analyst Anil Panchal assesses the technical outlook for gold. Gold price aggregates bids within a one-month uptrend channel, indicating overall upward momentum. However, the latest break of the 10-DMA support and the latest bearish Moving Average Convergence and Divergence (MACD) signals are keeping XAU/USD sellers hopeful.

However, the lower line of the indicated channel at around $1,964 precedes the February 2023 high surrounding $1,960 to short the bright metal’s short-term gold price to the downside. Meanwhile, gold recovery needs to be confirmed no later than 10-DMA support-reversal resistance near $2,010.

Following this, the upper line of the indicated channel near $2,045 could act as the last defense for gold price before it diverts gold to the previous annual top around $2,070. Above all, the all-time high of around $2,075 marked in 2020 acts as the last defense of gold sellers. In summary, despite the pullback in gold price, gold continues to stay stronger within a bullish chart pattern.

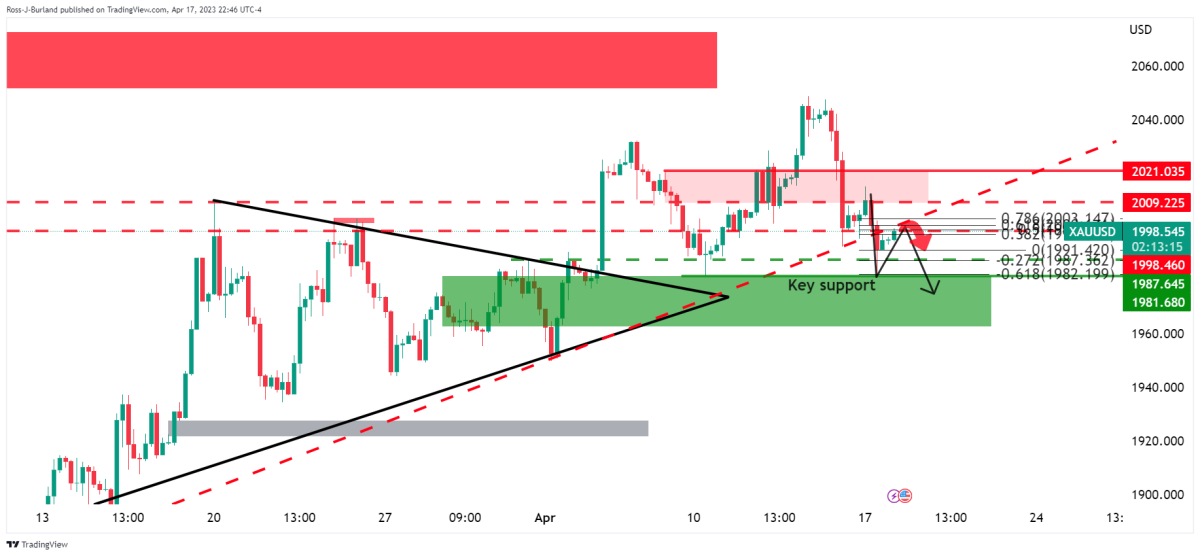

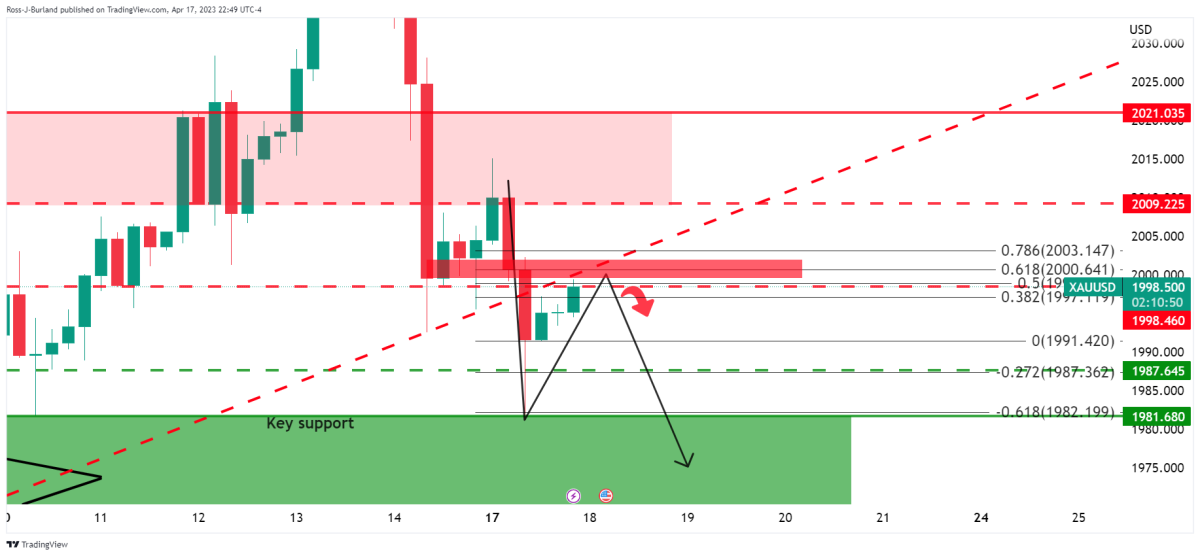

Gold technical analysis-2

Technical analyst Ross Burland draws attention to the following levels in the technical picture of gold. Gold price remains in the key support area in Asia as the bulls seek bearish commitments from the psychological $2,000 level. Gold soared from the lowest $1,993.41 to the highest $1,999.41 ever.

Despite the bid, technically, the bears are currently in the market while below the trendline support, which acts as a counter trendline.

There is a bullish correction in place but the bears lurk at this point and hold $2,000 near the 61.8% Fibonacci retracement of the previous 4-hour bearish retracement.

Next target is 2023 high

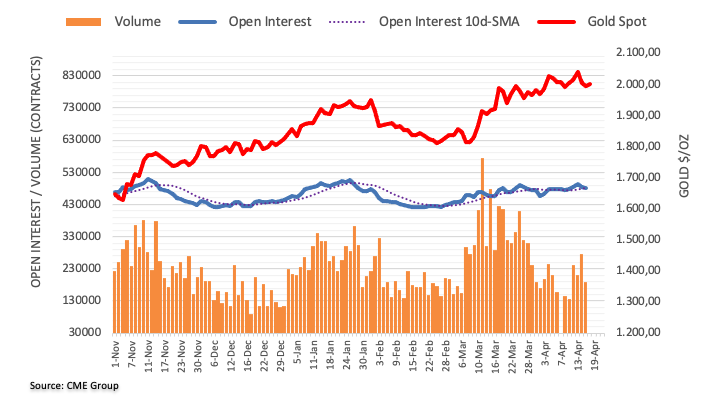

CME Group’s latest data on gold futures markets noted that traders cut their shorts by around 2.7K contracts this time, for the second consecutive session on Monday. Volume followed, contracting by around 21.2K contracts, while also reversing four consecutive days of gains.

Market analyst Pablo Piovano states that gold started the week with a decline due to the contraction in short positions and volume. However, a sustained pullback seems undesirable at the moment and occasional bouts of strength continue to target the 2023 high near $2,050 (April 13).