The crypto analyst who accurately predicted Bitcoin’s 2018 bottom, an AI coin that has been rallying since January, also said that collapse is imminent.

Smart Contracter expects drop in AI coin market

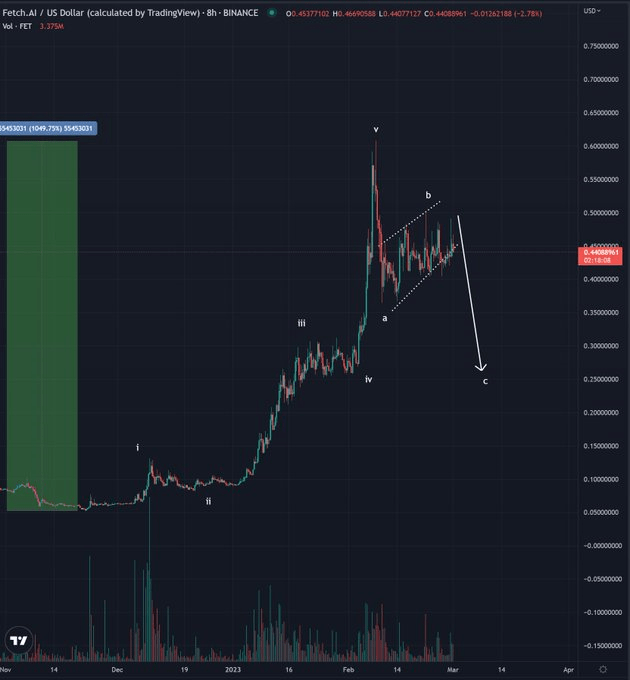

Smart Contracter correctly predicted that Bitcoin would peak at $63,000 in the 2021 bull. cryptocoin.com In this article, we have included the analyst’s other accurate predictions. In his current analysis, Contracter talks about the bearish trend about the artificial intelligence project Fetch.ai (FET). According to the analyst, FET’s rally since January has come to an end and may now be ready to turn bearish. According to the latest tweets from Smart Contracter:

FET current levels seem to be exhausted, it was one of the strongest altcoins in the last three months, outperforming the lowest level more than 10 times.

According to the analyst’s technical chart, Fetch.ai could decline by about 50% from current levels in a three-wave correction pattern that started in February. With the FET cooling its rally and may now go bearish, Bitcoin could visit lower levels amid declining momentum, according to Smart Contracter.

Smart Contracter expects Bitcoin to drop in the short term

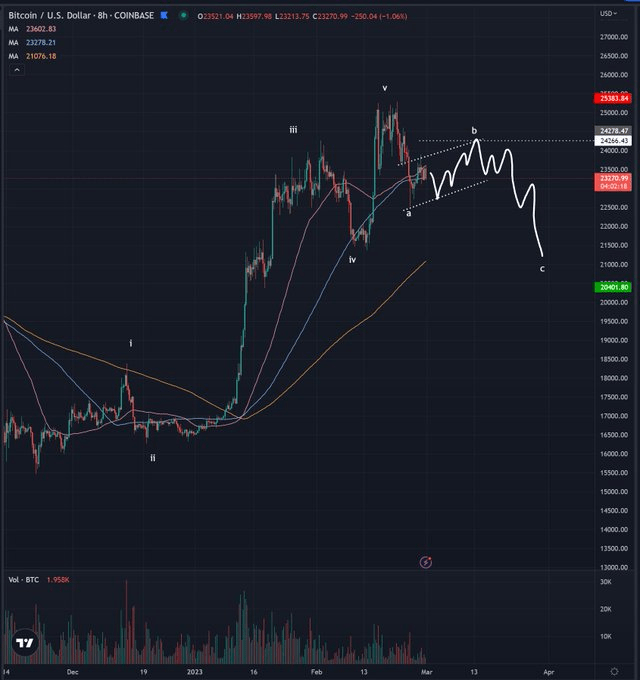

The crypto analyst said that after FET analyzes, Bitcoin could see its old bottoms amid declining momentum. On the other hand, Bitcoin’s performance in February reveals that investors are optimistic about long-term prospects. According to Smart Contracter, this trend may prove insufficient in the short term and BTC price may retest its old lows above the 20,000 region:

Momentum is waning in BTC and distribution is likely to continue, with a slow fluctuating drop to $24,000 and ultimately another bottom to be expected.

A look at the analyst’s technical chart shows that Bitcoin, completing the three-wave correction pattern that started late last month, could drop to just over $20,000. According to Elliott Wave theory, the main trend of a crypto’s price moves in a five-wave pattern, while a correction occurs in a three-wave pattern. At an important point, data for February reveals that investors tend to buy on these dips.

What does on-chain data say about Bitcoin’s current position?

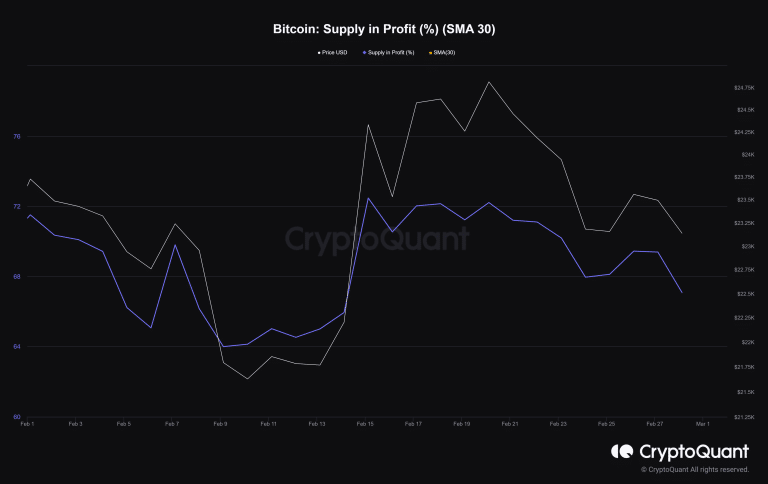

Bitcoin’s performance in February can give some information about the current state of the cryptocurrency market and expectations for March. BTC’s profit supply fell to 67% at the end of February after peaking at 72.2% in the same month. This decline confirms ample accumulation near recent highs in anticipation of continued prices. It also confirms that most of its current investors bought it in January.

In contrast, the current level of Bitcoin supply in profit is still above the last four-week low. Supply in profit bottomed out at 63.99% for the month. This metric could mean there is still room for further declines before reaching the perceived lower range below 45%.