Silvergate executives, like insiders at other major crypto firms, managed to time the peak of the Bitcoin bull market quite well.

Silvergate executives earned $103 million at Bitcoin peak

Crypto-focused bank Silvergate has closed its operations as of today and is liquidating all its assets. In a nutshell, Silvergate is shutting down completely. Investors are probably upset, shorts are probably grinning, but 11 insider traders at the once-largest crypto bank sold out hugely at the peak, raising more than $103 million.

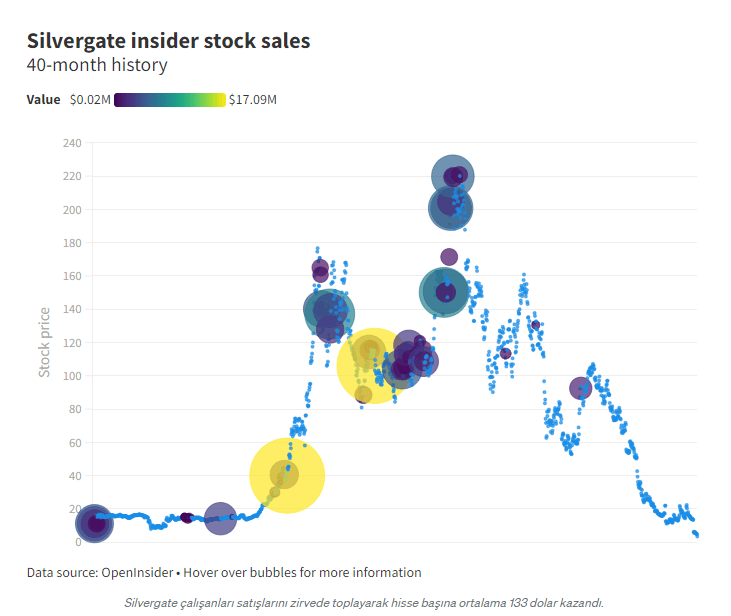

Former chairman Dennis Frank, who led the board from 1996 to 2021, accounted for about 25% of those sales. Between March and November 2021, Frank sold approximately 189,000 shares of Silvergate at an average of $140 each. Meanwhile, Bitcoin was at the top of $69,000 and Silvergate stock was pushing the limits of the bull run at $220.

Insider Dennis S Frank reports selling 23,690 shares of $SI for a total cost of $2,802,961.60 https://t.co/FlveV790o0

— Fintel (@fintel_io) August 13, 2021

Silvergate stock is currently trading below $4. It announced this week that it will shut down completely and go into liquidation. The firm has struggled to maintain customer trust after one of its key customers, FTX, went bankrupt last November, resulting in billions of dollars in withdrawals.

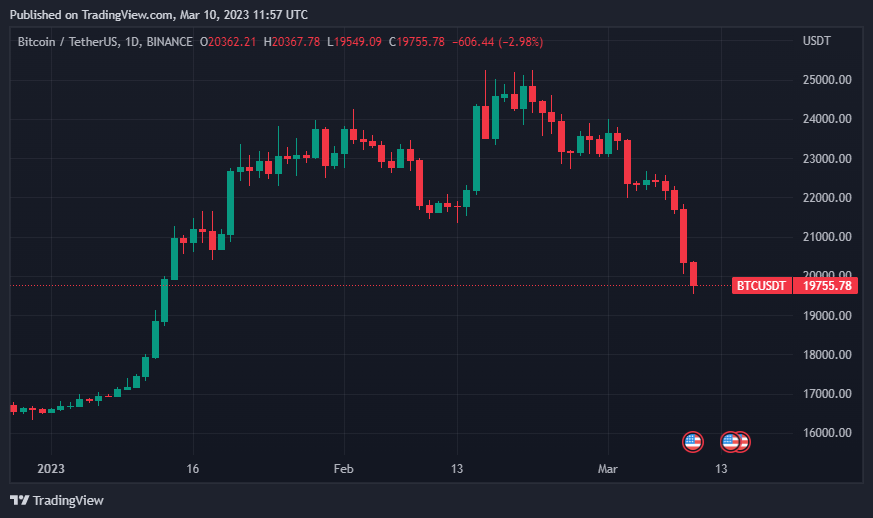

News of the bankruptcy led to the second devastation in the cryptocurrency market

cryptocoin.com In this article, we have included the devastation caused by the Silvergate bankruptcy news that came to the agenda at the weekend that started on March 3rd. The bankruptcy, which became clear on March 10, led to a double-digit decline on all cryptocurrencies. Bitcoin breached the $20,000 support level this time around.

11 executives sold at the top

Executive Vice President Derek Eisele and CEO Alan Lane also cashed in at $20.6 million and $17.1 million, respectively, according to OpenInsider data based on SEC filings.

Other vendors at the time included Chief Strategy Officer Ben Reynolds ($2.5 million) and Chief Operating Officer Kathleen Fraher ($2.8 million). In total, the value liquidated by Silvergate executives represents 4% of the firm’s average market cap ($3.6 billion) during the crypto market peak.

Among others, CEO Lane and director Thomas Dircks made a $18.6 million acquisition in November 2019, well before the peak. Lane, along with other executives, continued to buy stock options throughout this period.

An executive, Michael Lempres, tried to buy the dip and spent $56,100 on 500 shares in February 2022. The same shares are worth $2,000 today. It has yet to disclose any sales with the SEC.

Silvergate employees are not alone

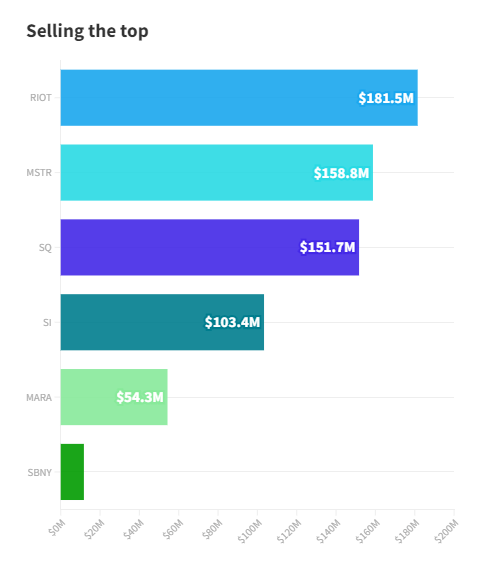

Along with direct competitor Signature, Bitcoin whale software firm MicroStrategy, Block (formerly Square) and executives at miners Marathon and Riot, 41 cryptocurrency experts averaged $661.4 million in shares, worth more than $16 million each, as markets peaked in the last bull run. sold it.

Some sales were part of pre-made trading plans with the SEC (but not all). While the markets were bubbling in the second quarter of 2021, the positions of Coinbase, which went public, are not included in this amount.

Coinbase executives raised more than $5 billion in cash on initial trades alone, but those sales were a function of their direct listing, so they shouldn’t be compared to other stocks.