The cryptocurrency market experienced a new low on the evening of September 20. After this drop, the total value of the crypto market fell by 2.5% to $921.9 billion. The recent depreciation in the price of Bitcoin, Ethereum and other altcoins came as investors were locked into the Fed decision. On September 21, the Federal Open Market Committee (FOMC) will meet. After the meeting, Fed Chairman Jerome Powell will announce the new US interest rates.

6 Analysts shared their price expectations for Bitcoin

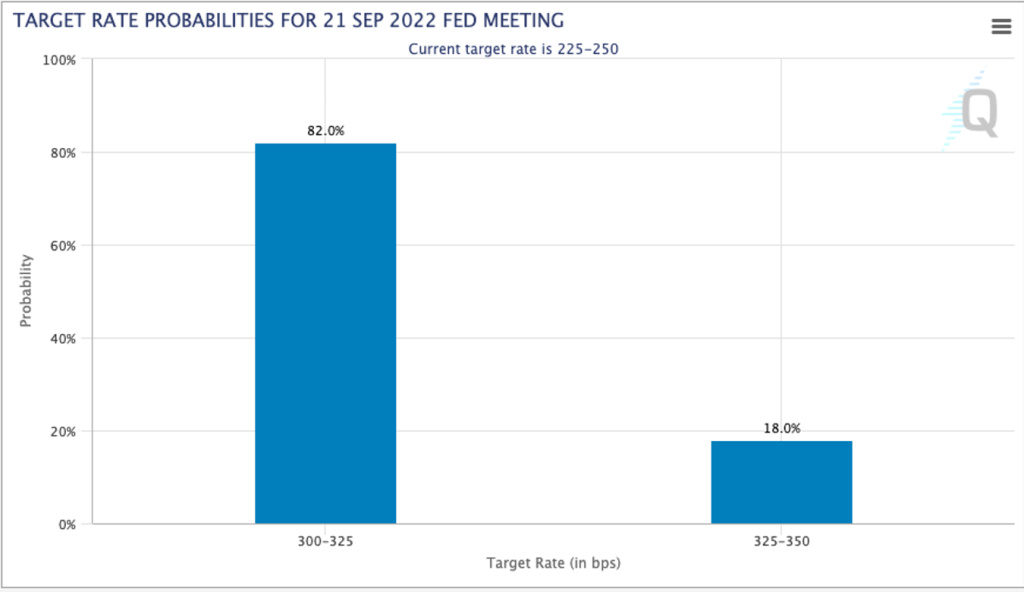

Meanwhile, many respondents expect a rise in interest rates as inflation has not fallen at expected rates. According to the FedWatch Tool, 80% of investors are betting on the Fed’s announcement of a 75 basis point rate hike. This is a sign that investors are expecting a hawkish move from the Fed at the end of the FOMC meeting. Let’s also mention that the remaining 20% of investors expect a 100 basis point interest rate increase. So what does all this mean for Bitcoin? cryptocoin.comWe have compiled the expectations of analysts.

“Bitcoin is waiting for FED decision”

Senior market analyst Edward Moya says that the fate of Bitcoin will be determined by the Fed decision this week. He warns that if the rate decision turns high, a drop to $17,600 and below is among the possibilities. According to him, this event may cause BTC to see the lows it reached in the summer of 2022. Moya also adds that the long-term hawkish stance of the FED means more pessimism for cryptocurrencies.

“BTC will see 2018 low of $12,000”

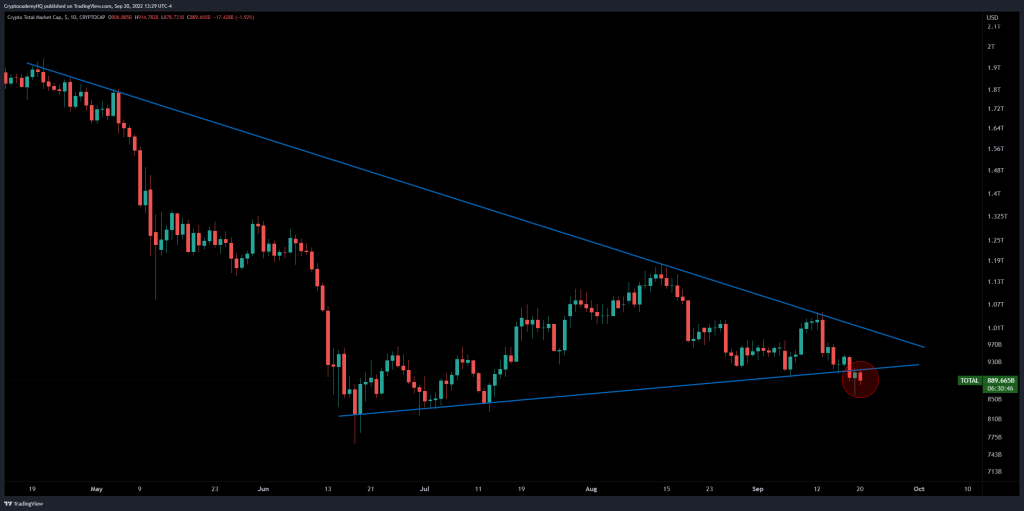

Cryptocurrency trader Justin Bennett is also not optimistic about the market. Bennett analyzed the total value of the cryptocurrency market instead of Bitcoin. According to him, the graph does not look good before the Fed decision. He underlines that the crypto market, which has a value of $ 889 billion, has a resistance of $ 913 billion. According to Bennett, reversing this resistance level will trigger the rise for cryptos like BTC and ETH.

Also, Justin Bennett said that since May, when the crypto crash began, a bearish trend has been formed in Bitcoin. According to him, Bitcoin will see the lows of the bear market in 2018. This will cause a sharp decline. The 2018 lows that Bennett mentioned mean $12,000. So BTC price may revisit $12,000 years later.

“The interest in Bitcoin is very low”

Cryptocurrency analyst Michaël van de Poppe said on Twitter that interest in Bitcoin is “very low at this point.” He also talked about how “impressive” it was. According to him only a year ago everyone was jumping on top of each other to get into BTC. But now there is no such interest. Poppe says that this period of apathy is the best time to buy BTC.

Impressive that the interest in #Bitcoin is terribly low at this point, while a year ago everyone was hopping over each other to get in.

The irony on this is that the silent period is the best period to look for an asset like #Bitcoin, which is now.

— Michaël van de Poppe (@CryptoMichNL) September 20, 2022

“BTC price will drop to $16,000 due to selling pressure”

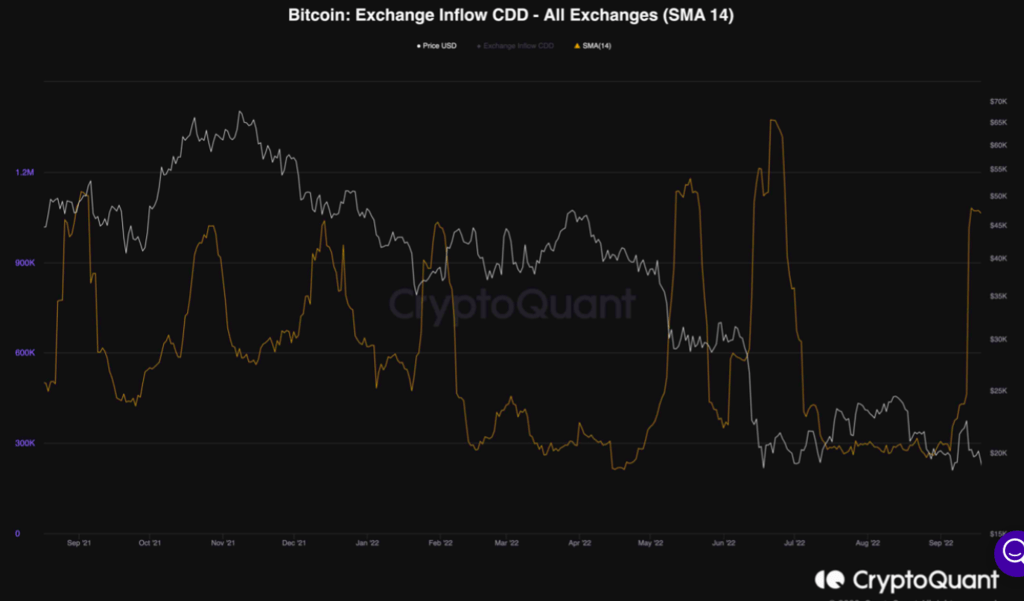

Community-focused analytics platform CryptoQuant shared a tweet. Accordingly, he claimed that the long-term holders exerted selling pressure. The analyst warned his followers that the leading cryptocurrency could fall further due to this selling pressure. CryptoQuant strengthened its thesis with a metric called CDD. According to him, the metric shows that long-term holders are moving their money for the purpose of selling. The analyst adds that due to the rise in the metric, the price of Bitcoin will most likely fall to $ 16,000.

“A drop to $12,000 is extremely likely”

Crypto analyst Doctor Profit warned that the FED’s decision would create a bloodbath. Profit tweeted, “Please consider the next decisions of the FED. The 0.75 rate hike is already priced in, 1 basis point and blood is in expectations.” said. He also wrote that the Bitcoin price has entered the lower stage at current levels. Then it published a price-performance comparison between 2012-2016 and 2020-2022.

“A new low is coming”

Jason Pizzino, a cryptocurrency analyst, predicts a final capitulation phase for Bitcoin. In a YouTube video, Pizzino said that Bitcoin has failed to follow a classic bottom pattern. He then revealed that a new bear market looks poised to hit the lows. According to him, we should be ready for new lows significantly below $18,600. Pizzino’s forecast predicts a bottom between $13,000 and $16,000 for the BTC price.