Market sentiment remains relatively low, according to a recent gold survey. Therefore, the gold market could be stuck around $1,850 per ounce. While precious metal prices hold steady at $1,850 an ounce in the near term, Wall Street analysts say the precious metal still has plenty of long-term potential as the Federal Reserve cannot ease inflation pressures. Here are the expectations and the comments of the analysts…

Gold experienced a price change after the inflation data

Blue Line Futures Chief Market Strategist Phillip Streible said, “The FED has taken control of inflation, which is no longer in question. lost. All they can do is destroy demand. How far would they go to do that?” used the phrases. Some analysts said Friday’s early morning rally in gold is a sign that investors are beginning to doubt the US central bank’s ability to rein in inflation.

Cryptokoin.com rally, the US Department of Labor’s Consumer Price Index annual percent in May. It came after it announced that it had increased by 8.6. Consumer prices reached their highest level in 40 years, driven by rising food and energy prices. “Finally, gold is responding to higher inflation. He is no longer afraid of the ‘Big Bad Fed’. “This is potentially a game changer for gold,” said Adrian Day, President of Adria Day Asset Management.

What are Wall Street analysts’ expectations for gold?

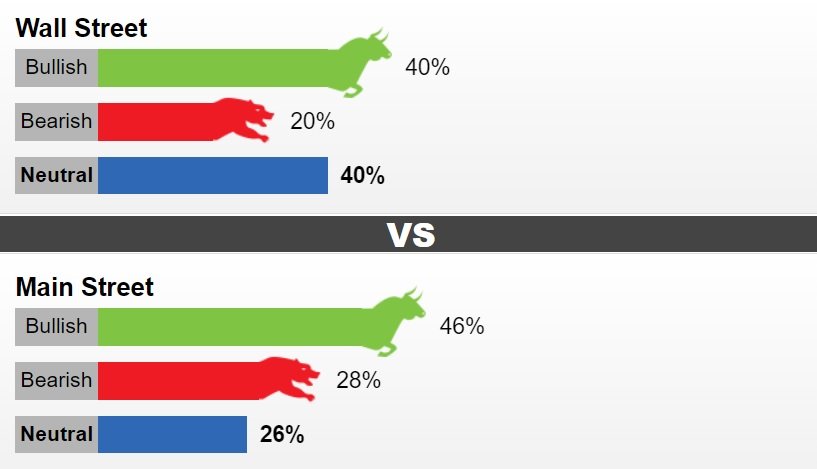

This week, 15 Wall Street analysts took the Kitco gold survey. Among the participants, the number of bullish and unbiased analysts was equal. At the same time, three analysts, or 20 percent, were bearish for gold in the short term. Meanwhile, 598 votes were cast in the Main Street polls conducted online and attended by individual investors. Of these, 274, or 46 percent, think that gold will rise next week. Another 167 voters, or 28 percent, expect lower levels. Finally, 157 voters, or 26 percent, remained neutral in the short term.

Sentiment among individual investors dropped sharply. Last week, 70 percent of online respondents were optimistic about gold. While analysts generally continue to see long-term potential for gold in an inflationary environment, the market is still facing rising interest rates. Some analysts have said that next week’s Fed rate policy decision could create more short-term selling pressure for gold. The US central bank is on track to raise interest rates by 50 basis points.

Forexlive strategist: FED drives US into recession

Forexlive.com chief currency strategist Adam Button, “Gold around US inflation report it was choppy, but ultimately the direction is lower. The Fed is losing credibility about inflation. “With the bond curve, the probability of having to put the US into recession increases,” he said. However, some analysts noted that the FED is already at its peak in terms of monetary policy, which could cause the US dollar to lose momentum and mitigate a significant upside head for gold. Colin Cieszynski, Market Strategist at SIA Wealth Management, said:

Currency market action for the past few days has mainly been around the strengthening US dollar ahead of next week’s Fed meeting. took shape. Afterwards, it is possible to see a “buy the news” type correction. Aside from the rising US dollar, the picture for gold is otherwise encouraging. Inflation is high and markets are volatile. Gold’s role as a store of value, a haven of defense and a hedge against inflation keeps volatility down.

What to expect in the coming days?

According to neutral analysts, gold continues to remain in the conflict between the FED and inflation. Ole Hansen, Head of Commodity Strategy at Saxo Bank, said it will remain neutral on gold until there is a clear break above $1,875 an ounce. Marc Chandler, Managing Director of Bannockburn Global Forex, also said he is watching $1,875 per ounce, which looks like strong resistance. “Fed and BOE can be expected to raise rates next week. The ECB can be expected to weigh in on the bottom of the macro picture with its hawkish turn, but the inflation story may keep the golden bears at bay.