The gold market remained resilient to aggressive rate hikes by the Federal Reserve. However, balancing forces continue to dominate the precious metal. Therefore, according to analysts, the sentiment in the market may cause prices to remain in the neutral zone.

“The gold market remains in contention in this environment”

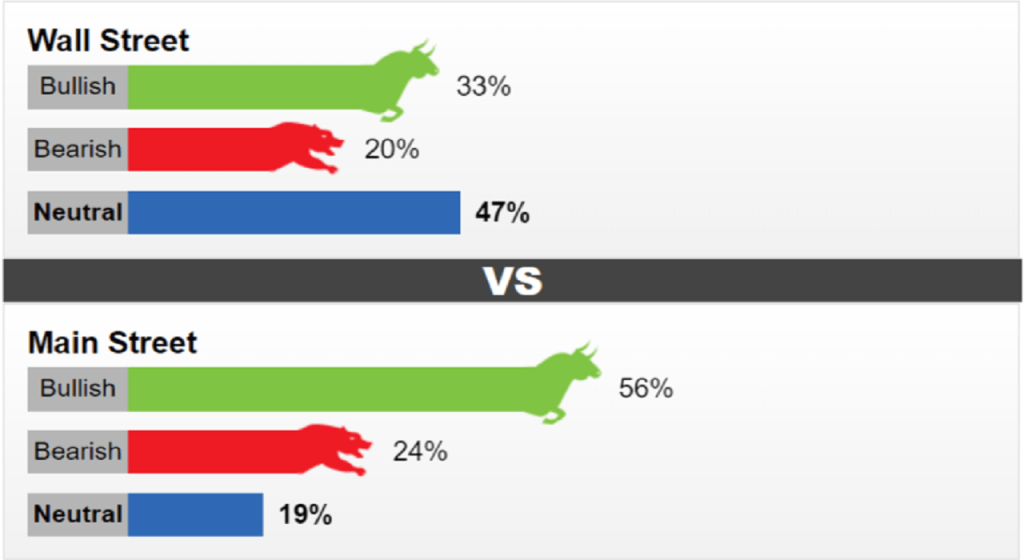

According to the latest Kitco News Weekly Gold Survey, Wall Street analysts predict gold prices will trade sideways in the near-term and for retail investors. Also, the survey points to a bullish trend in the precious metal. In addition, it shows that sentiment has dropped from its recent highs.

The Federal Reserve is trying to curb inflation and cool the economy by rapidly raising interest rates. Analysts explain that in this environment, the gold market remains in contention. As you follow on Kriptokoin.com , on Wednesday, the Fed increased interest rates by 75 basis points. This increase went down in history as the largest in 28 years. At the same time, the committee’s updated projections show interest rates potentially rising by 3.5% by year’s end.

Colin Cieszynski: Gold is doing what it’s supposed to!

On the other hand, despite the Fed’s hawkish stance, gold prices managed to maintain their ground. Colin Cieszynski, Chief Market Strategist at SIA Wealth Management, comments:

All things considered, gold’s performance was impressive. This week’s price action has encouraged me. The yellow metal is doing what it’s supposed to. It is rising against all other currencies except the US dollar.

However, Colin Cieszynski states that prices are stuck between the $1,800 support and $1,880 resistance. Therefore, the analyst adds that he is neutral on bullion in the short term.

What do the gold survey results show?

This week, 15 Wall Street analysts took part in Kitco News’ gold survey. Among respondents, five analysts, or 33%, predict gold will rise in the near term. At the same time, three analysts, or 20%, for the next week were bearish for the yellow metal. The other seven analysts, or 47%, chose to remain neutral for bullion.

Meanwhile, 1,145 votes were cast in online Main Street polls. Of these, 646, or 56%, expect gold to rise next week. Another 280, or 24%, voters predict it will be lower. 219 voters, or 19%, remained neutral in the near term.

“It is possible for investors fleeing stocks to go gold”

In the current mixed mood, gold prices finished the week down almost 2%. The last trade was around $1,839. However, the precious metals market continues to outperform stocks. The S&P 500 sees sharp losses fall around 6% in its second week.

Interest rates are rising. However, rising recession fears reflected in significant stock market losses will support gold prices around $1,800, according to analysts. Equity Capital Market Analyst David Madden comments on the current situation as follows:

The precious metal is stuck in a gap and I don’t think it will be gushing anytime soon. Interest rates are rising. This is negative for gold, but also negative for stock markets. Investors fleeing the stock markets will likely want to hedge some of their capital in gold.

Adam Button: Yellow metal will surpass $2,000 when this happens

Analysts also point out that inflation, which the Federal Reserve sees as the biggest threat to the economy, will keep gold prices high. After all, the yellow metal is seen as a safe-haven asset.

However, some analysts also warn that the drop in equity markets could work against the precious metal in the near term. They see it as likely that investors will have to liquidate their gold holdings to meet their margin requirements. Forexliv Chief Currency Strategist Adam Button explains:

There is nowhere to hide in such a fall. However, bullion will do better than most assets. When the Fed comes to a standstill or governments start spending again, gold will exceed $2,000.