With gold prices falling 4%, the market recorded its worst weekly performance in two months. According to analysts, gold prices are likely to see a short-term bounce next week. But the sensitivity remains depressed.

“It is possible that there will be a correction in the price of gold”

According to the latest Kitco News Weekly Gold Survey, market analysts view price action as significantly oversold. At the same time, the mixed mood in the precious metals markets does not indicate a significant recovery any time soon. Investors expect the Fed to continue raising interest rates aggressively to defuse mounting inflation pressures. So this week has been tough for gold. According to the CME FedWatch Tool, markets have almost completely priced in a 75 basis point move at the end of this month.

According to some analysts, the Fed’s aggressive stance pushed the US dollar to a 20-year high. This alone forced gold prices to test long-term support at $1,730. While there is a significant bearish sentiment in the market, some analysts say they expect a bounce in the near term. Michael Moor, founder of Moor Analytics, comments:

Gold is generally in a bearish trend. But below it is approaching significant possible extinction levels. It is possible that this will trigger a bullish retracement/trend as well. We have entered the bottom of multiple bearish formations. But we’re probably on the last structural stretch from the highs down.

“Gold is likely to continue struggling against the US dollar”

Colin Cieszynski, chief market strategist at SIA Wealth Management, says he sees the potential for at least a short-term bounce in gold. The strategist explains it this way:

The recent decline in gold was mainly driven by a rally in the technically overextended US dollar. The RSI for gold is oversold. Therefore, gold is likely to make a short-term bounce. However, a lot of capital is moving to the US looking for a defensive haven. Therefore, gold may continue to struggle against the US dollar.

Cieszynski adds that while gold may struggle against the US dollar, it remains strong against other major global currencies.

What do the gold survey results show?

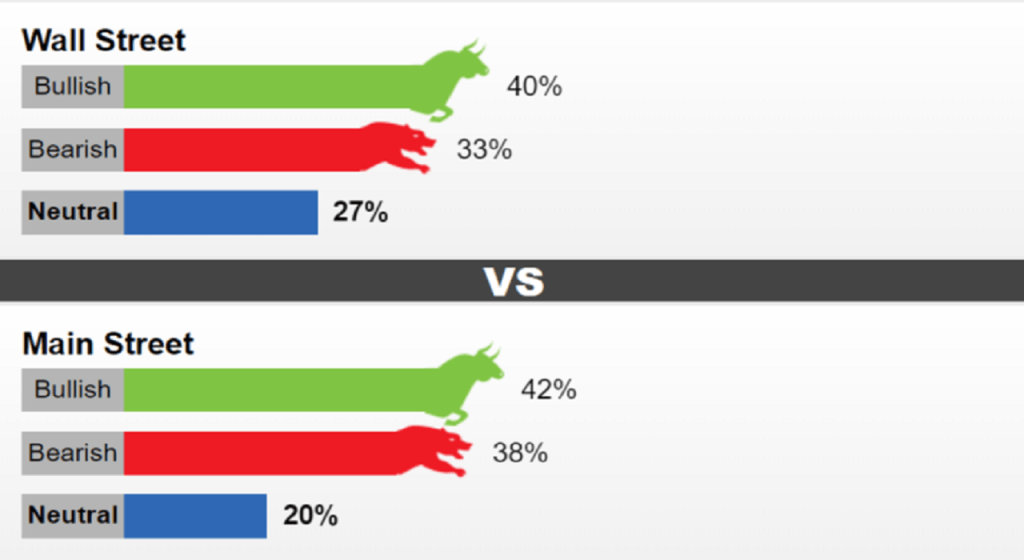

This week, 15 Wall Street analysts took part in Kitco News’ gold survey. Among respondents, six analysts, or 40%, are optimistic about gold in the near term. At the same time, five analysts, or 33%, are bearish against gold. All four analysts, or 27%, remained neutral on the precious metal next week.

Meanwhile, 484 votes were cast in online Main Street polls. Of these, 204, or 42%, expect gold to rise next week. 183 or 38% predict it will be lower. The remaining 97 voters, or 20%, remained neutral in the near term. Sentiment among individual investors remains low. However, the participation rate is also low. This is an indication that the precious metal is receiving little attention in this volatile environment.

“Big picture for yellow metal still in decline”

While there is a chance for gold to move lower in the near term, some analysts say there is still solid support in the market. Phillip Streible, chief market strategist at Blue Line Futures, notes that the sell-off can be viewed as a capitulation move, as a large number of unregistered longs have left the market. In this context, the strategist comments:

A lot of fat has been cut this week. We don’t think there are that many sellers in the market. I do not foresee that prices will drop much below $ 1,700.

However, other analysts are significantly bearish even if there is a break in selling pressure. Michael Moor draws attention to the following levels:

The big picture for gold is still bearish. However, I am having a hard time going back. I’m looking for $1,650. This will also be the neckline of a large double top that goes back to $1,200.

Is it possible for gold to regain its shine?

For many analysts, the market needs to see a change in US monetary policy if gold is to regain its shine. cryptocoin.com As you can follow, the 75 basis point move of the Fed in July seems certain. Therefore, the Fed’s stance continues to be a rough headwind for gold.

Some analysts and economists note that the latest jobs report, which showed the economy created 372,000 jobs last month, solidified the rate cut. Also, the market sees hope that the Fed can make a soft landing as it continues to raise interest rates.