Gold prices try to end their four-week streak of losses after support drops below $1,800 an ounce. Therefore, the bullish sentiment in the gold market is starting to rise. Here are the thoughts of analysts and individual investors for the market next week…

What happened in the markets this week?

The latest results from the Kitco Weekly Gold Survey show that Wall Street analysts and retail investors alike are holding solid bullish momentum on the precious metal next week. Not only has gold gained technical momentum after falling into the oversold territory, analysts say its safe-haven appeal is shining once again. As we reported on Kriptokoin.com , gold’s rally this week came as US stock markets finished in negative territory for the seventh week in a row. On Wednesday, the S&P fell 4 percent to see its worst one-day sale since June 2020, when the global COVID-19 pandemic first rocked markets.

Blue Line Futures chief market strategist Phillip Streible said gold is bullish as investors seek to hedge against further financial market weakness. He added that in the current environment, he sees gold and the US dollar acting together as safe-haven assets. “Equity market conditions could still get much worse,” he said. “There are signs that economic conditions in the US are starting to deteriorate,” he said. U.S. stock markets worsen as rising inflation pressures weigh on corporate earnings. At the same time, rising interest rates are tightening financial market conditions.

Investors hopeful for gold next week

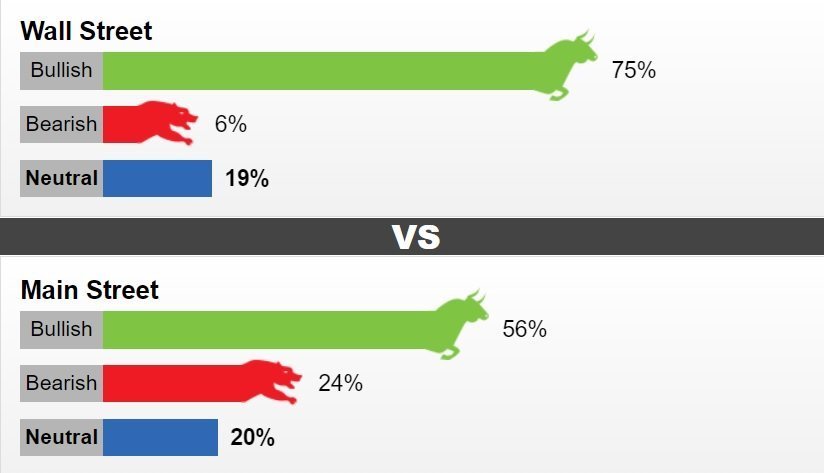

16 Wall Street analysts surveyed gold this week. Of the participants, 12 analysts, or 75, predict that gold prices will rise next week. While one analyst was bearish against gold in the short term, three analysts, 19 percent, were neutral on prices. Meanwhile, 1,003 votes were cast in online Main Street polls. Of these, 558, or 56 percent, expect gold to rise next week. 243 respondents, or 24% of respondents, thought lower levels would be seen, while 202 respondents remained neutral in the near term.

The bullish sentiment comes as gold prices close the week with an increase of about 2 percent. Gold futures for June delivery were last traded at $1,840.50 an ounce. Many analysts think gold prices will attempt to break through the initial resistance at $1,850 an ounce as the US dollar lost some momentum after trading near its 20-year high. The US dollar index closed the week down 1.4 percent. At the same time, bond yields fell further after hitting a three-year high of over 3 percent two weeks ago.

Sprott CEO: Gold needs to bounce

Colin Cieszynski, chief market strategist at SIA Wealth Management, said: “The recent US dollar rally seems to be declining , gold technically appears to be recovering. “There is a lot of financial market uncertainty and volatility in the market,” he said. Sprott Inc CEO Peter Grosskopf said that gold should bounce higher in the near term as the downtrend approaches extremes, adding:

Gold was getting pretty pale, so I can safely say that when the sentiment turns up, the price should rise. Gold continues to do its job and is once again seen as a major hedging asset.

Adrian Day, chief of Asset Management, Adrian Day is concerned about the precious metals as market volatility rises amid rising inflation or rising risks that the US economy, pushed there by a policy error by the Federal Reserve, will plunge into recession. He said he was optimistic. “It’s becoming increasingly clear that the Fed cannot lower inflation without causing a recession. The Fed will not be able to move forward as an economy,” he added.

Some analysts expect bearish gold

However, not all analysts are optimistic about the precious metal in the near term. Equiti Capital market analyst David Madden said he expects the US dollar to keep gold prices on the line. While he said gold prices could drop next week, Madden said he saw a bottom around $1,800 an ounce. He added that market volatility and further equity weakness will continue to support gold prices as a safe-haven asset. He added that Europe and the UK are closer to inflation-induced recessions than the US and used the following statements:

I don’t think the US dollar has peaked yet. The 50 basis point gains will continue to come and will continue to support the US dollar. You have to put your money somewhere and right now it’s in US dollars.