The gold market is once again stuck in relatively neutral territory. Mixed feelings abound between Wall Street analysts and Main Street investors. Therefore, the forecasts do not point to any breakouts next week.

“Gold price will probably be difficult to recover”

cryptocoin.com As you can follow, the Federal Reserve maintains its aggressive monetary policy stance. Gold continues to struggle for any bullish attention. Fed Chairman Jerome Powell delivered his highly anticipated speech at the central bank symposium in Jackson Hole, Wyoming. Analysts state that gold is facing more headwinds after Powell’s statements.

Jerome Powell wasn’t as hawkish as some analysts expected. However, inflation remains the biggest threat to the economy. For this, Powell noted that interest rates should rise even more. He added that interest rates could stay higher for longer to ensure inflation stays close to the central bank’s 2% target.

Blue Line Futures chief market strategist Phillip Streible says it will likely be difficult for gold to recover as interest rates remain high. “I am not very optimistic about precious metals at the moment as prices are hovering around these key support levels,” the analyst says.

“When expectations start to fall, it is possible for the gold price to rise”

However, other analysts say falling inflation pressures could lead markets to pricing in less aggressive moves from the Federal Reserve. They note that this will weaken the US dollar and support gold prices.

On Friday, the US Department of Commerce said the core Personal Consumption Expenditure Index (PCE) rose 4.6% in July. PCE was 4.8% year-on-year in June. Adam Button, chief currency strategist at Forexlive, comments:

Inflation data was probably more relevant than anything Powell said. Gold is likely to make a good exit as inflation continues to fall. The market is priced too high for a 75 basis point move in September. When these expectations start to fall, it is possible for the gold price to rise.

What do the gold survey results show?

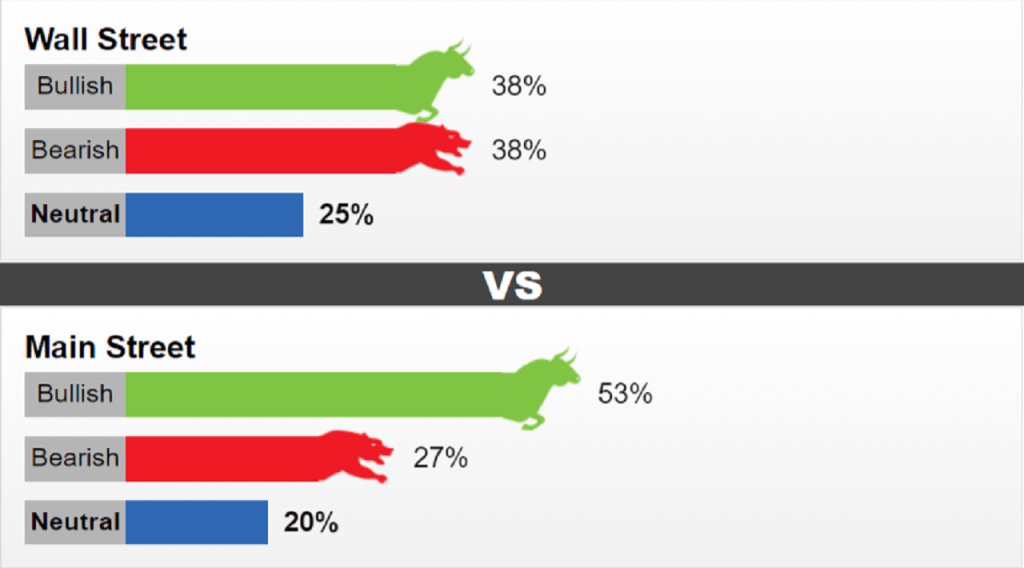

The CME FedWatch Tool shows markets split roughly 50/50 on whether the Fed will raise rates 50 or 75 next month. Along with interest rate expectations, Kitco’s weekly gold survey results are similar. The survey reveals that Wall Street is evenly divided on gold forecasts for next week. Of the 16 analysts who participated, six (38%) predict gold prices will be higher or lower next week. Four analysts (25%) remain neutral on gold in the short term.

However, individual investors remain bullish on the precious metal. This week, respondents cast 561 votes in online polls. According to the survey, 53% of respondents anticipate higher prices. The remaining 27% predicted lower prices, while 20% chose to remain neutral.

“The US Dollar appears to be technically depleted”

Market sentiment has not created a clear path for gold in the near term. However, the most important factor remains US interest rates. Analysts say the Fed will begin to slow the pace of rate hikes if inflation continues to weaken, despite Powell’s latest comments.

The mixed emotion comes as gold prices closed the week down 1.14% on Friday. Colin Cieszynski, chief market strategist at SIA Wealth Management Inc, says Powell’s comments add nothing new to the current outlook. For this reason, he notes that he is optimistic about gold next week. In this context, the analyst makes the following statement:

He didn’t say much that was new and significant enough to push treasury yields or the USD up in the short term. The US dollar looks technically depleted. A correction is needed that removes the recent pressure from gold.

Has the US dollar seen its short-term top?

Darin Newsom, president of Darin Newsom Analysis Inc, says he’s also seeing a short-term top in the US dollar. The analyst makes the following assessment:

The US dollar index appears to have doubled on its weekly chart. This needs to be confirmed with a move below 104.64.