Wall Street analysts and Main Street investors see potential for higher prices next week, according to the latest Gold Survey. The new bullish sentiment comes as gold prices end the week with a 2% gain by testing a critical resistance point. December gold futures were last traded at $1,783.30.

“Gold is now closed to races”

Daniel Pavilonis, senior commodity broker at RJO Futures, says he sees an excellent setup that will lead to higher prices for bullion in the near term. He noted that the jump in gold came as sentiment dropped significantly. Pavilonis also says higher prices will create a short-term nuisance as bears leave the market. However, it basically means that a less hawkish Fed will support higher prices for the remainder of the year.

cryptocoin.com Jerome Powell said that more aggressive tightening is possible. However, he added that the central bank will remain dependent on data. He also noted that at some point the Federal Reserve will need to slow the pace of tightening as the economy feels the impact of rising interest rates. Pavilonis comments:

The Fed is signaling that interest rates will not be as hawkish as before. Yellow metal is now closed to races.

Bulls strong in gold survey results

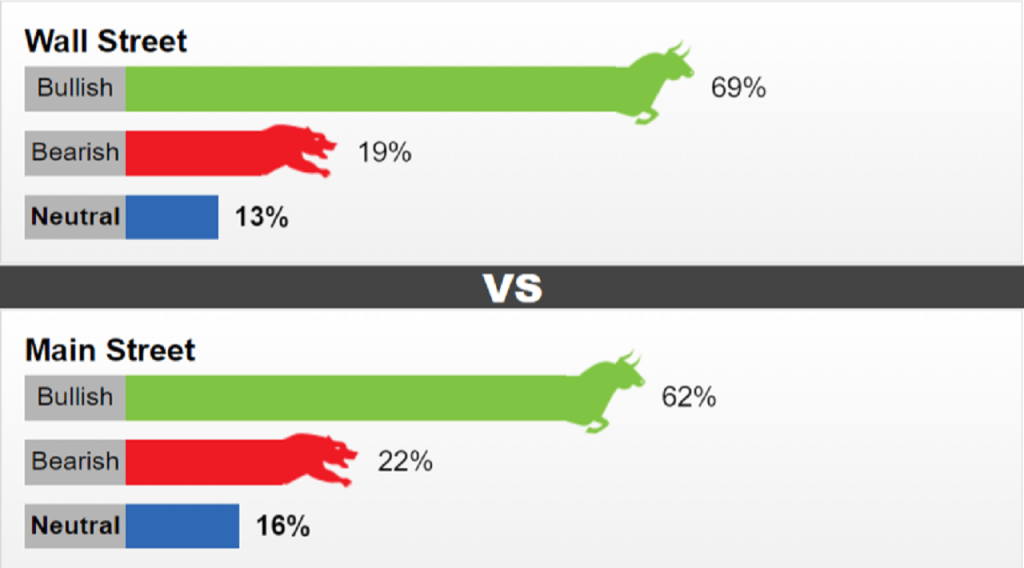

This week, 16 Wall Street analysts took part in Kitco News’ gold survey. Among respondents, 11 analysts (69%) were bullish on gold in the short term. At the same time, three analysts (19%) were bearish on gold. Two analysts (13%) voted neutral this week.

Meanwhile, respondents cast 1,543 votes in online Main Street polls. Of these, 961 (62%) forecast gold to rise next week. Another 334 (22%) voters predict it will be lower. Of the panelists, 248 voters (16%) remained neutral in the near term.

“Plenty of places to go up from here”

Forexlive chief currency strategist Adam Button also says gold is in a bullish trend in the near term. The strategist makes the following assessment:

The subtle change from the Fed was all that was needed. The yellow metal found support at $1,680. There’s plenty of room to climb up from here.

There are also pessimists on gold.

However, not all analysts are optimistic about the precious metal. So, next week does not see a sustainable rally. On Friday, TD Securities analysts said in a note that they had entered a tactical short for gold as the market appeared to be overbought.

Blue Line Futures chief market strategist Phillip Streible says gold could hit $1,800. However, he adds that he would like to make a profit at that level. He adds that the markets may be a little early in their expectations that the Fed will change direction. On Friday, the US Department of Commerce’s core Personal Consumption Spending Price Index showed inflation close to a 40-year high of 4.8%. Streible predicts:

If inflation stays warm, the Federal Reserve will continue to raise interest rates aggressively. This will limit the rise of gold.

“It is possible for gold to consolidate”

Marc Chandler says he is neutral on gold for the next week after two weeks of positive price action. He adds that investors should pay attention to Friday’s nonfarm payrolls report. In this context, the analyst makes the following statement:

About 250,000 people are expected. It will be quite robust compared to before the pandemic. The 10-year yield has dropped to about 2.65% after peaking close to 3.50%. I suspect before the job report. It may not be much lower. Gold combined back-to-back weekly gains for the first time since May. However, it is now possible for gold to consolidate.