The sentiment in the gold market improved as the precious metal managed to hold the critical support above $1,700 even as the US dollar rallied to a 20-year high.

“It is possible for gold prices to rise, but…”

Gold is likely to rise next week. However, analysts say investors should not expect to see a significant breakout as the Federal Reserve will continue to aggressively raise interest rates. Markets currently see an 88% chance for the Fed to raise the Fed Funds rate another 75 basis points on Sept. 21. Sean Lusk, co-director of commercial hedging with Walsh Trading comments:

Weaker economic data next week is likely to put pressure on the US dollar. This could increase gold prices. But the data won’t stop the Fed from raising interest rates. This will ultimately support bond yields and the US dollar. Gold is likely to climb to $1,760 next week. But that won’t change the fact that it’s stuck.

“The rise in gold is not the start of a new bull trend”

Marc Chandler, managing director of Bannockburn Global Forex, says he sees any rally in gold as a short-term correction to the current downtrend. Chandler explains his views as follows:

I expect a little more bounce underneath. What I’m looking at is the soft headline CPI and the market hesitant to raise 75 basis points from the Fed later this month. However, I think this can be a bit confusing in the sense that headline inflation will still rise and the core rate may rise. Increases are corrective in nature. So, it is not the start of a new bull trend.

What do the gold survey results show?

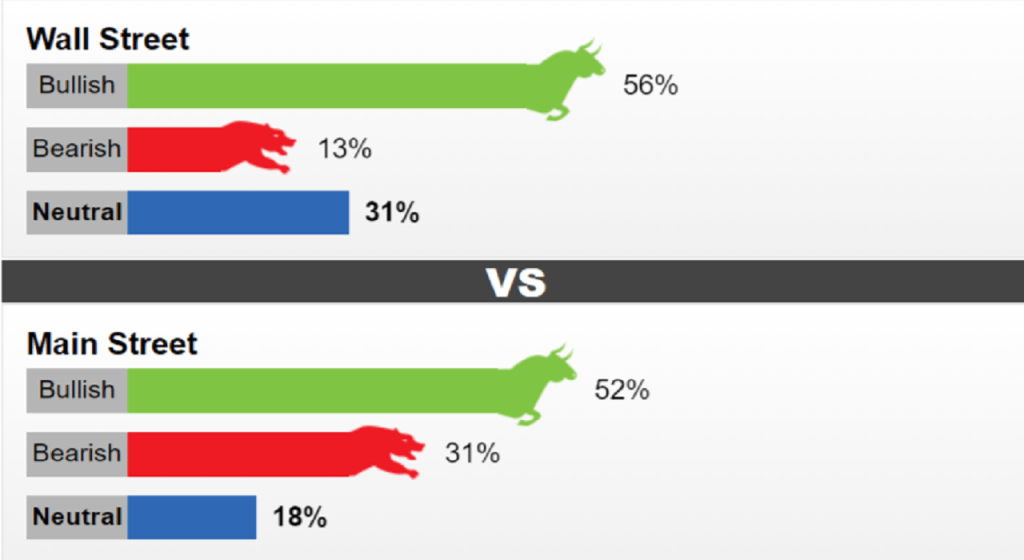

This week, a total of 16 market experts voted in Kitco News’ Wall Street poll. Nine analysts (56%) said they were optimistic about gold next week. Two analysts (13%) declared that they are in a bearish trend. Five analysts (31%) noted that they were neutral on precious metals.

On the individual side, 495 respondents voted in online polls. A total of 255 voters (52%) predict that gold will rise. 153 respondents (31%) predict that gold will fall. The remaining 87 voters (18%) expect a flat market.

Optimism among Main Street investors has improved significantly after bear sentiment hit several-year highs last week. The renewed short-term confidence comes as gold prices trade relatively unchanged for the week, ending a three-week streak of losses.

“I see gold without a trend”

According to DailyFX senior market analyst Chris Vecchio, there is a challenging environment for gold. Despite this, the analyst says that the bulls are confident that the precious metal has probably managed to establish a solid support base around $1,700. In this context, the analyst makes the following comment:

It will take something substantial for prices to dip below $1,680. However, gold is still caught between the struggle and the pull of real returns and inflation. That’s why I see gold without a trend.

The end of the negative correlation between gold and the dollar?

cryptocoin.com As you can follow, the US dollar has risen above the highest level of the last 20 years. However, it was unable to sustain its gains on it. He then closed the week with a negative note. Many analysts say that this is why they are seeing a rise in gold. Equiti Capital’s market strategist David Madden notes that gold remains neutral above $1,700. But the strategist says it does show some resistive strength that might help draw some attention. The analyst explains his views as follows:

This is likely to be the beginning of the end of the strong negative correlation between gold and the US dollar. However, I am still optimistic about the US dollar. Because the Fed is in a better position to instill confidence in the currency than the Bank of England or the ECB.