The gold market is seeing its worst weekly performance in roughly a year. Sentiment among Wall Street analysts and retail investors appears to have dropped, according to the latest weekly gold survey. Here are the details of the survey and expectations…

What are the experts’ expectations for gold? As we have reported as

Kriptokoin.com , precious metal prices not only ended the week with a 3.7 percent loss, but also left behind the week in which they suffered their fourth loss in a row. While the US dollar traded close to the highest level in the last 20 years, the gold market came under significant selling pressure. While some analysts say that gold appears to be oversold, it still faces some challenging factors.

Darin Newsom, president of Darin Newsom, said, “As they say, markets can stay overbought and oversold longer than most of us can stay solvent. Also, Newsom’s Rule 6 tells us that ‘the fundamentals will eventually win’ and the US dollar fundamentals continue to rise.” Marc Chandler, managing director of Bannockburn Global Forex, also noted that momentum indicators appear slightly tense. Still, he doesn’t see momentum changing in the near term. He added that he could see gold prices drop to $1,780 an ounce next week.

Investors in an overall downtrend

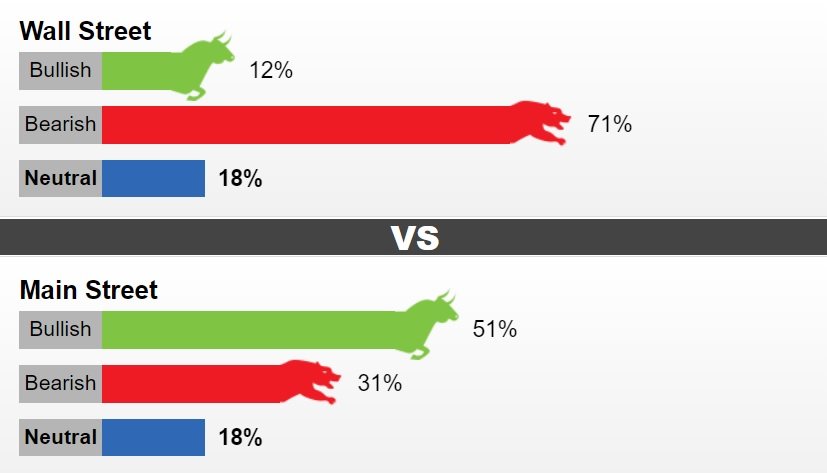

17 Wall Street analysts surveyed Kitco’s gold this week. Among respondents, two analysts, or 12 percent, called for gold to rise next week. At the same time, 12 analysts, or 71 of the respondents, were bearish for gold in the short term. Three analysts, 18 percent, were neutral on prices.

Meanwhile, 932 votes were cast in online Main Street polls. Of these, 481, or 51 percent, think that gold will rise next week. While 286 voters voted 31 percent lower; 165 voters, or 18 percent, remained neutral in the short run. While individual investors continue to be bullish on gold in the short term, sentiment fell sharply from last week’s data, which was up 61 percent.