The gold market is ending its second-week positive gains, and while confidence remains strong among Wall Street analysts and retail investors, there is some concern that rising interest rates may restrain precious metal prices in the near term. According to many analysts, the biggest factor driving gold’s new upward momentum is the weakness in the US dollar. The US dollar remains relatively high; however, it fell 3 percent from its high at the beginning of the month. So, what are the expectations for the next week?

What happened this week?

Analysts state that the US dollar depreciated against the euro as the European Central Bank signaled that it might start increasing interest rates in July. “Adjusting nominal variables is appropriate – this includes interest rates, with the inflation outlook shifting significantly higher compared to the pre-pandemic period,” ECB President Christine Lagarde said in a comment published Monday.

SIA Wealth Management’s Chief Market Strategist Colin Cieszynski said, “The US Dollar seems to have peaked for now, clearing a significant hurdle from gold that is already starting to recover. There will be a lot of data coming next week, so the foreign exchange markets may be active,” he said. Forexlive.com Chief Currency Strategist Adam Button said that gold is also in a bullish trend as bond yields and the US dollar weaken.

What are analysts’ expectations for gold?

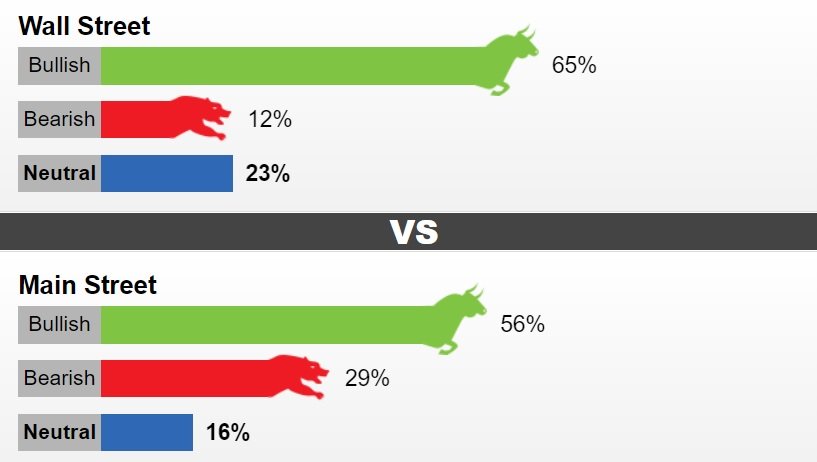

This week, 17 Wall Street analysts took part in Kitco’s gold survey. Of the participants, 11 analysts, or 65 percent, predict that gold prices will rise next week. At the same time, two analysts, or 12 percent, were bearish for gold in the short term, and four analysts, or 23 percent, were neutral on prices. Meanwhile, 570 votes were cast in online Main Street polls of individual investors. Of these, 317, or 56 percent, think that gold will rise next week. While 163, or 29, stated that they had lower expectations, 96 participants, or 16 of them, remained neutral in the near term.

The bullish sentiment comes as gold prices show resistance at $1,850, up roughly 0.5 percent week on week, as we reported on Kriptokoin.com . Gold’s weekly gains came as the latest inflation data showed consumer prices may have peaked. The U.S. Department of Commerce said on Friday that the core Personal Consumption Spending Index, the Fed’s preferred measure of inflation, saw a drop to 4.9 percent from a high of 5.2 percent in March.

Analyst: Every drop is a buying opportunity

But some analysts have said that even if inflation peaks, it won’t drop as quickly. At the same time, the Central Bank will not be able to get ahead of the inflation curve while continuing to raise interest rates. Any dip in gold should be viewed as a buying opportunity in the current environment, said Bob Haberkorn, RJO Futures Senior Market strategist. He added that gold has a ways to go up to $2,000 an ounce by the end of the year as real interest rates remain low. forming. The Fed will not be able to fully address the threat of inflation due to tense stock markets.

Walsh Trading manager Sean Lusk said he expects inflation to remain an issue as energy prices continue to rise. He added that the threat of rising inflation and growing recession fears will make gold an attractive safe-haven asset. Adrian Day, Head of Wealth Management, said that the Fed continues to rise in gold as it is close to testing the limits of monetary policies, and used the following expressions:

On the one hand, the belief in the ability of the FED and other central banks to tame inflation without causing a recession, and on the other There is a war between the armies of reality on the side. Reality will eventually win, and now it’s gaining ground.