The gold market entered the weekend trying to hold on to $2,000. However, the strong neutral mood in the market suggests that gold is in no rush to go anywhere anytime soon.

Gold will likely continue to pull back

Meanwhile, the Federal Reserve is poised to raise interest rates another 25 basis points. The threat of high inflation to spread throughout the economy is effective in this. In the latest Kitco Weekly Gold Survey, most analysts say gold prices may continue to struggle into the next week as the Fed is expected to reiterate its hawkish stance. Adrian Day, Head of Asset Management, comments:

The Federal Reserve’s meeting next week will determine the short-term direction of gold. However, the risk remains on the downside. Gold will likely continue to pull back from its early April high of $2,040 amid concerns about tighter monetary policy. This came after exaggerated optimism about the Fed’s return in March.

Gold’s biggest short-term challenge

So far, markets have almost completely priced in a 25 basis point hike next week. But analysts say gold will be vulnerable to any direction that signals further rate hikes this year or that the central bank will continue its aggressive policies longer than expected. The CME FedWatch Tool shows that markets started pricing a 25bps increase in June. He also points out that he postponed the rate cut expectations until after the summer. Ole Hansen, head of commodity strategy at Saxo Bank, comments:

The biggest challenge that gold will face in the short term is to what extent the rate cuts are reflected in the price. Given the current strong correlation between gold and the December 23 SOFR contract, we will be watching SOFR futures and futures spreads like a hawk.

Neutral tone dominates the gold survey

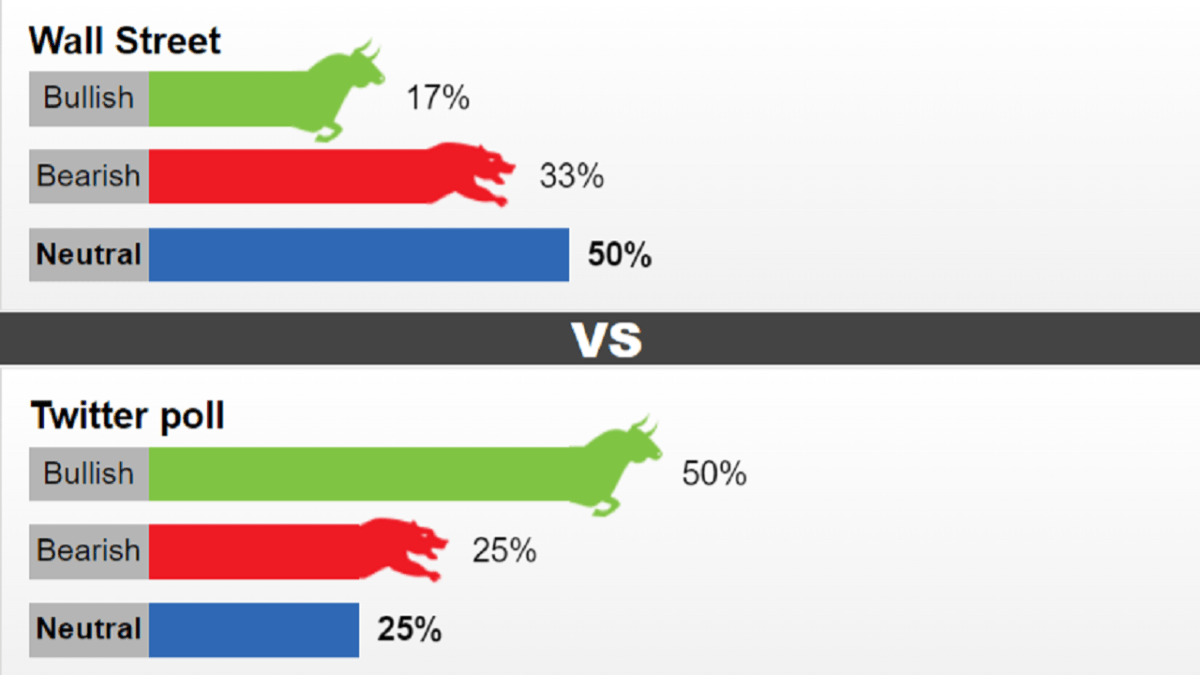

18 Wall Street analysts voted in the Kitco Gold Poll this week. Among respondents, three analysts (17%) were bullish for gold in the near term. At the same time, six analysts (33%) showed a bearish bias for the next week. Nine analysts (50%) think that prices will remain flat.

This is the second week in a row that investors have taken a neutral stance on gold. In the past two weeks, gold prices have been trading in a range between $1,980 and $1,930. A poll on Twitter shows that the majority of retail investors remain bullish on gold in the near term. This week, 160 respondents voted in the Twitter poll. Of these, 80 (50%) think that gold will rise next week. At the same time, the bearish and neutral positions each received 40 votes, or 25%.

This is a buying opportunity!

While there is a solid neutral trend in the market, many analysts state that gold remains in an uptrend as it holds the line high. Phillip Streible, chief market strategist at Blue Line Futures, says recent price movements show that gold investors are extremely comfortable at the $2,000 level. In other words, he notes that any significant price drop can be seen as a buying opportunity.

Streible points out that gold has more to gain upside with a dove stance to Chairman Jerome Powell’s statement and comments, compared to the selling risks from a more hawkish stance. In this context, the strategist said, “I think any dip towards $1,950 will be bought. This is a buying opportunity,” he says.

This discussion will push gold prices beyond $2,450

Some analysts point out that even if the Fed continues to raise interest rates, it only increases the risk of the central bank pushing the economy into a recession. Analysts say that this push and pull in the global economy is driving gold’s neutral price action. Looking beyond US monetary policies, Richard Baker, creator of the Eureka Gold Miner’s Report, says the ongoing debt ceiling debate poses significant economic risk and could support gold prices. Based on this, Baker makes the following statement:

History may not repeat itself, but it looks like it will repeat itself in the next few months. The ‘debt limit raising debate’ will push gold prices to $2,450 or beyond. It should not be forgotten that the downgrade of the US debt rating and failure to default brought gold prices to record levels in 2011. The perception of not being able to manage was the catalyst.

cryptocoin.com Earlier last week, the Republican-led House of Representatives passed a bill raising the debt ceiling and envisioning drastic spending cuts. However, the US Senate, which is controlled by Democrats, said the law was “dead on arrival”.