While both retail investors and Wall Street analysts expect prices to be higher next week, gold’s ability to hold the ground above $1,800 and recover towards the $1,850 resistance is creating healthy optimism in the market.

“The market has stopped hating gold, but…”

Ole Hansen, head of commodities strategy at Saxo Bank, says gold is not only seeing new momentum, but that momentum is also coming amid US bond yields continuing to rise. This week, the US 10-year Treasury yield climbed over 4% to its highest level since November. At the same time, US two-year yields are approaching 5%.

But Hansen notes that break-even rates continue to rise as well, and inflation remains a major concern. In this context, the analyst says, “Gold may still do well if investors think inflation will be adjusted higher, even as nominal bond yields continue to rise.” Hansen notes that the bullish action of gold pushed prices back above the 21-day moving average. While the analyst says that prices could rise, he thinks gold is still stuck in a wider consolidation pattern. In this regard, he makes the following statement:

Gold prices really need to rise above $1,885 or even $1,900 before seeing any fresh bullish interest from investors. The market has stopped hating gold, but it won’t go up until investors start loving it.

The bulls are ahead of the gold survey!

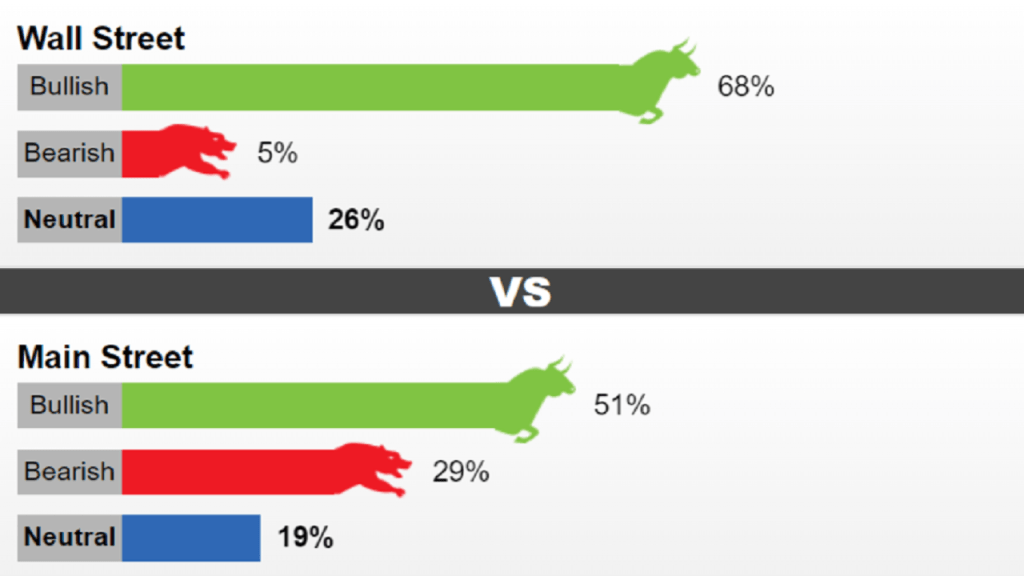

This week, 19 Wall Street analysts took part in the Kitco Gold Survey. Among the participants, 13 analysts (68%) expect gold to rise in the near term. At the same time, one analyst (5%) was bearish for the next week and five (26%) predicted prices will move sideways.

Meanwhile, 495 votes were cast in the online polls. Of these, 254 (51%) expect gold to rise next week. Another 145 (29%) said it would be lower, while 96 voters (19%) remained neutral in the near term. The mood on Main Street has changed significantly from last week as retail investors gravitate towards the downside, expecting prices to drop to $1,800.

The shift in sentiment came as the gold market ended its five-week streak of losses. As you follow on Kriptokoin.com, gold was last traded at $ 1,856, an increase of approximately 2.5% compared to last Friday.

“The problem with gold is that initial purchase interest has run out”

Michael Moor, founder of MoorAnalytics.com, says gold prices hit the exhaustion level last week with $1,810 on the downside. He adds that if prices can stay above $1,838, gold could see an uptrend that continues for days.

Darin Newsom, senior technical analyst at Barchart.com, also predicts solid technical momentum for gold next week. He also adds that he sees potential weakness in the US dollar. According to the analyst, this provides a tailwind for the precious metal. Accordingly, the analyst makes the following statement:

The problem with gold is that it may run out of initial buying interest and go into Wave 2 selling (Elliott Wave uptrend with 5 waves). This is a possibility, but the initial upside target will remain at $1,874.30.

“This is my next target for gold!”

Marc Chandler, managing director of Bannockburn Global Forex, sees the February correction of gold as a buying opportunity. He adds that he sees room for prices to move higher in the near term. In this context, Chandler makes the following assessment:

The strategy I suggested last week was to buy the pullback towards $1800. Gold finished the week by testing the $1850 zone. My next target is $1865 followed by $1882. Momentum indicators are rising and I was expecting employment data to confirm that January was a bit of luck.

“So I am relatively neutral on gold!”

ABC Bullion global chief executive Nicholas Frappell says the central bank is relatively neutral on gold next week as hawk comments could limit any short-term rally. Frappell thinks most of the last shorts have been made.

Nicholas Frappell adds that investors will hesitate to place heavy bets ahead of February’s nonfarm payrolls data next week. As you know, despite the growing threat of recession, the US labor market has shown resilient strength.