Gold price is making a modest gain to end its three-week streak of losses. According to some, the strong bullish sentiment in the market could push prices to $2,000 next week. Meanwhile, a gold survey shows that both Wall Street analysts and retail investors are in a solid uptrend on gold in the near term. Here are the details…

What happened in the market last week?

Broad-based uptrend cryptocoin.com As we have also reported, the US Department of Labor announced that 339,000 jobs were created last month, following the strong employment data, as gold saw some selling pressure on Friday. But some analysts said that despite the hawkish employment numbers, gold’s new momentum has room for further advancement. Golden weekend, without hitting $2,000. However, analysts said the bounce from the two-month low would provide some bullish momentum in the near term. For example, James Stanley, senior market strategist at Forex.com, used the following statements:

There is an uptrend line connecting last Friday’s and this Tuesday’s lows. I think it’s in the bulls’ court and it’s up to them to lose for now.

At the same time, with prices expected to rise next week, analysts do not expect to see a major breakout to all-time highs. For example, Colin Cieszynski, chief market strategist at SIA Wealth Management Inc, states that gold will not set a record. He states that the weakening US dollar should support gold next week. But he says he doesn’t think prices will go above $2,000 an ounce. The analyst pointed to the “reduction of tensions in the political and banking system”. He mentioned that these show that if there is a bounce for gold, it may be moderate. However, he underlined that $2,000 remains an important psychological barrier.

What does the weekly survey show for the gold price?

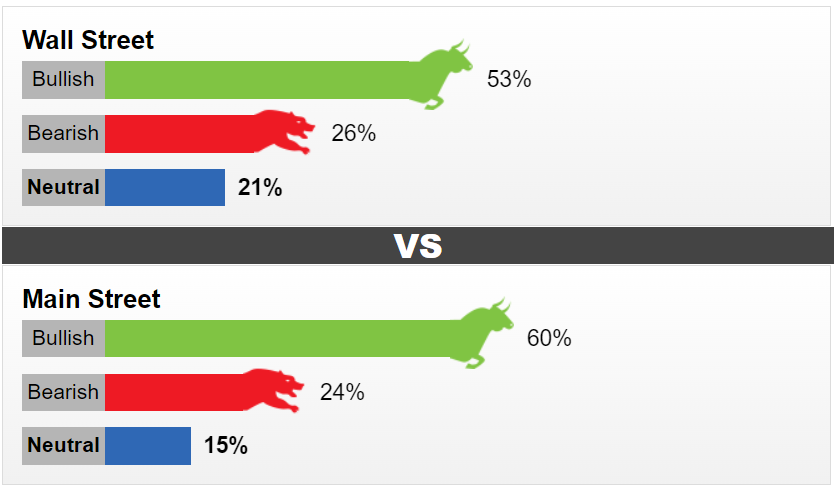

This week, 19 Wall Street analysts took part in the Kitco News Gold Survey. Among the respondents, ten analysts, or 53 percent; He was bullish for gold in the near term. At the same time, five analysts, or 26 percent; It showed a bearish trend for the next week. Finally, four analysts, or 21 percent; He thinks that prices will remain flat. Meanwhile, 509 votes were cast in online polls. 307 of them, or 60 percent, think that gold will rise next week. 124 people, or 24 percent, predict that prices will fall. Then, 78 people, or 15 percent, stated that they would remain neutral in the near term.

In other words, individual investors as well as Wall Street analysts do not expect gold prices to reach record levels anytime soon. The survey shows that individual investors are expecting prices of around $1,997 for gold next week. According to many analysts, the main driving force for gold remains the Fed’s monetary policy stance. Expectations continue that the FED will pause its aggressive monetary policy stance at its meeting two weeks later. At the same time, economists warn that a recession will not signal the end of the tightening cycle.

$2,070, a major resistance level

Some analysts say that better-than-expected job gains last month supported the Fed’s aggressive stance. However, other analysts have pointed out that cracks are beginning to appear in the labor market when looking beyond the numbers. The unemployment rate in the US rose to 3.7 percent, the highest level in the last seven months. Adam Button, chief currency strategist at Forexlive.com, said:

I believe it will become increasingly clear that the Fed funding rate has peaked, and that this will be a boost for gold. Still, the $2070 level remains as a major resistance and it will be difficult to overshoot until this level is broken.