Gold’s rise to a two-month high at the beginning of the week created a solid bullish mood in the market. However, some analysts are also warning investors about the FED next week. The latest weekly gold survey shows that retail investors expect gold prices to return a striking distance of $2,000 an ounce, even if the Fed is almost guaranteed to raise interest rates another 25 basis points next week. Meanwhile, market analysts are also more cautious, albeit bullish. Here are the details…

Two executives expect bullish gold

Sean Lusk, co-director of commercial hedging at Walsh Trading, said that while supply problems dominate broad commodity markets, the Fed’s inability to control inflation pressures continues its upward trend. However, he added that in the short term, fighting the Fed will not make any money. “Yes, gold prices could drop by $50 next week if the Fed continues its hawkish trend after a rate hike,” Lusk said. “But there is little they can do about inflation. There are a lot of commodities that have nowhere to go but up due to supply problems. There is scarcity of all kinds on a wide range of commodities. Therefore, I think gold should continue to be bought on the lows,” he added.

James Stanley, market strategist at StoneX, said he thinks gold prices will rise until next week’s Fed meeting and then all bets will be off. He added that gold’s impressive ability to hold above $1,950 could lead to a retest of $2,000 an ounce ahead of the Fed. “CPI has moderated well, but core inflation remains quite sticky,” Stanley said. I don’t think they should take it lightly, as the risk of missing the target could be too great. Therefore, I think there is a possibility of a mid-week reversal after the FOMC rate decision,” he said.

What did the gold survey indicate?

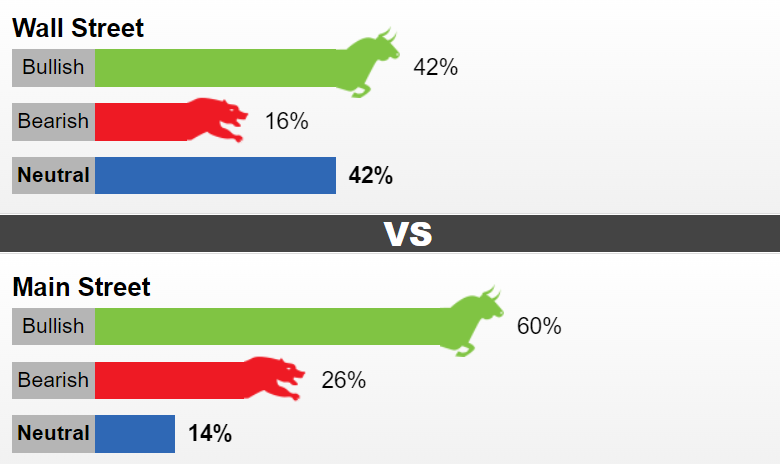

This week, 19 Wall Street analysts took part in the Kitco News Gold Survey. Both the bullish and neutral positions received eight votes in the vote, which ended in a draw. So in total, these options received 42 percent of the vote. At the same time, three analysts, or 16 percent, were down on gold for the week ahead. Meanwhile, 369 votes were cast in online polls. Of these, 221, or 60 percent, think that gold will rise next week. While 95 people or 26 percent said that gold will fall, 53 people or 14 percent stated that they are neutral in the near term.

The latest survey shows that retail investors expect gold prices to retest resistance around $1,980 an ounce by the end of next week. The gold market is aiming to end this week in neutral territory and was roughly unchanged from last week, recently trading around $1,965.80 an ounce. Looking ahead, Wednesday’s monetary policy meeting represents the risk of next week’s most important event. Markets are almost exclusively pricing in a rate hike. Some analysts said the rate hike and hawkish tone will support the US dollar and put pressure on gold.

What is needed for the uptrend?

The strength of the dollar this week has made it difficult at best for gold to find any traction, according to Gary Wagner, founder of TheGoldForecast.com. In addition, Wagner said, “Additionally, a 0.25 percent rate hike is almost certain at the FOMC meeting on Wednesday, June 26. “The combination of the dollar’s continued strength and the interest rate hike will not mean bullish for gold,” he said. While the yellow metal faces some fundamental risks next week, it remains bullish on gold as some analysts managed to hold some critical technical support above $1,950 per ounce.

Michael Moor, creator of Moor Analytics, said the precious metal could gain bullish momentum as prices hold above $1,964.40 per ounce. “Currently we are either in a bullish correction against the downside move at $2,102.2 or we are in a new bull structure. If there is a correction I will be aware of possible depletion areas at 1.998.6-2.001.4, 2.019.2-252 and higher. “If it’s not a fix, they can still remain temporary resistance,” he said.

What are the critical levels?

On the other hand, analyst Christopher Lewis shared his thoughts. Lewis thinks that gold is very volatile right now and it’s hard to hold on for a long-term position. According to the analyst, you therefore need to keep your position size reasonable. The interest rate differential will continue to be the main determinant of what happens in this market, as the US dollar will be extremely sensitive to fluctuations against the euro and other major currencies. As the US dollar falls, this helps the gold market. However, we saw a significant amount of strength to show dollar buying later in the week.

All things being equal, a lot of back-and-forth range-bound trades await. Therefore, long-term traders will need to be very careful with their position sizing. However, a break above the top of the weekly candlestick will be a very strong bullish sign and will prompt traders to be a little more aggressive. It should also be noted that we recently hit a long-held top near the $2,100 levels.