The cryptocurrency market has managed to recover the $30 billion it lost in the SEC drama. Most cryptos, including Bitcoin, have recovered over 5% during the day. New analysis from CryptoQuant and DataDash offers 2 different views for BTC in current market conditions.

Nicholas Merten predicts Bitcoin heading for a major correction

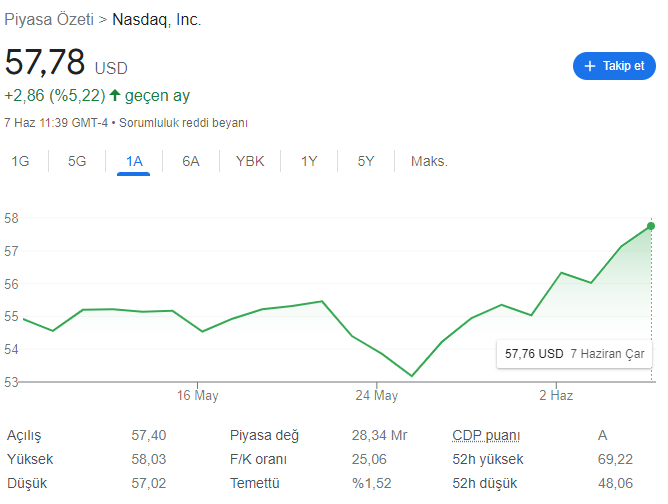

DataDash host Merten is anticipating a major correction for BTC based on a flashing bearish signal. In a new video, he reported that Bitcoin’s performance against the NASDAQ has weakened. The analyst says that this signals a bearish trend for the crypto king.

Merten states that in the short term, big tech is making big gains fueled by the potential of artificial intelligence (AI) technology and outpacing Bitcoin’s price action. The NASDAQ, a broader measure of tech stocks, is vastly outpacing Bitcoin, according to the market analyst.

In his recent video where he evaluated the correlation between NASDAQ and Bitcoin, Merten included the following analysis:

What’s really worrisome lately is tracking the NASDAQ, a broader measure of tech stocks… currently vastly outpacing Bitcoin. Here they continue to churn out more than promises regarding artificial intelligence. This is the big trend right now…

NASDAQ at highest point since April 2022

Merten further talked about the impact of the rise in tech stocks on the cryptocurrency market:

In the long run, we believe we are still in a bear market. To be honest, this price action is starting to challenge that. As we’ve seen the NASDAQ climb from 12,300 to 13,240, we’re starting to see the momentum here pick up considerably over the past few weeks. Again, it’s pushing towards its highest point since April 2022.

Now, can Bitcoin say the same here? Not quite… we’re back to ranges we haven’t seen since June 2022. Essentially, we are steadily getting closer to where we are here in August.

What’s next for Bitcoin?

By comparing Bitcoin to the NASDAQ using the BTC/NDX ratio, Merten says that the crypto king is laying the groundwork for a massive move to the downside as BTC forgoes gains against the NASDAQ during Bitcoin’s recent rally.

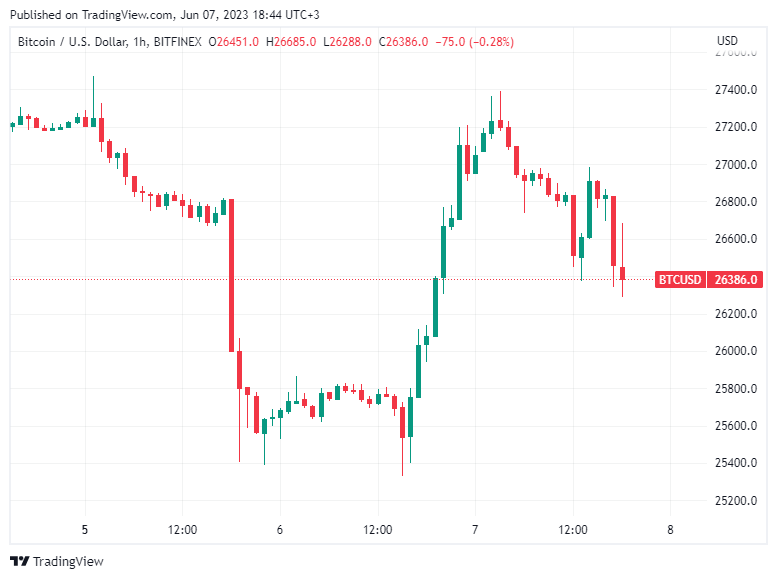

Bitcoin is currently trading at $26,422.62, up 2.5% in the last 24 hours. It gained more than 5% at one point during the day.

CryptoQuant analysis shows $24,000 still valid for BTC

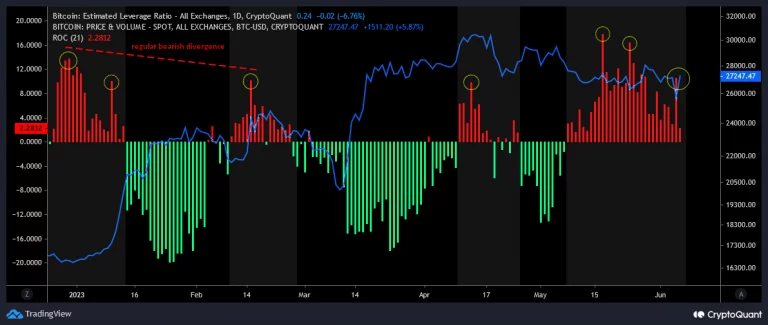

New data from CryptoQuant showed that Bitcoin price could head towards a short-term bearish correction. Based on BTC based Rate of Change (21d): Estimated Leverage Rate, there are indications of leverage overheating. This phenomenon has historically preceded downward corrections in Bitcoin’s price.

The analysis reveals a pattern consistent with previous examples where Bitcoin has experienced a temporary downturn. As such, it leads to speculation that the projected 24,000 target for Bitcoin is still possible.

However, it should be noted that other on-chain indicators also point to a deeper correction potential. Some experts suggest that the price of Bitcoin could drop to the $21,000 to $20,000 range. Factors such as the latest news about the lawsuit against Binance are adding to the FUD environment. This uncertainty will further complicate the situation for a short-term downside correction. cryptocoin.comAs you follow, Binance CEO CZ recently made a statement about Fud news.