Gold price broke below key short-term support on Monday. The yellow metal’s recent weakness may be linked to the broad strength of the US dollar as the market rushes for risk-safety and hopes the Fed won’t be able to reject 75 basis points (bps) rate hikes for long.

Key developments and data for gold traders

Increasing cases of covid and the resulting quarantines in China, one of the world’s largest gold customers, to weigh the market sentiment Group It participates in the sanctions of Seven (G7) countries against Russia. Fears of escalating economic recession are putting pressure on the gold price, as supply squeezing raises inflation concerns. Market analyst Anil Panchal comments:

Fed Chairman Jerome Powell’s rejection of a 75 basis point (bps) rate hike, Friday’s mostly stronger US jobs report saw the Fed go faster/heavier. Gold failed to keep its buyers happy as it renewed concerns that there was room for tightening. As we reported as

Kriptokoin.com , the US Non-Farm Employment (NFP) exceeded 391k estimates for March to reach 428k when compared to the revised figures for March. . In the same vein, the Unemployment Rate remained unchanged at 3.6%.

Following the data, Minneapolis Fed Chairman and FOMC member Neel Kashkari wrote in a blog post on Medium, “Financial conditions have already returned to near-neutral levels, given that long-term real interest rates have the biggest impact on loan demand. ” commented. The policymaker also said that the nominal neutral interest rate assessment is still around 2.0%. It is worth noting that Louis James Bullard’s Chairman of the Federal Reserve Bank repeated the bullish trend and pushed the Fed to 3.5%.

With hawkish comments from Fed policymakers and stronger US jobs report, Wednesday’s April US Consumer Price Index (CPI) will be crucial for gold traders to watch, with the US dollar hitting a 20-year high. will accelerate its rise.

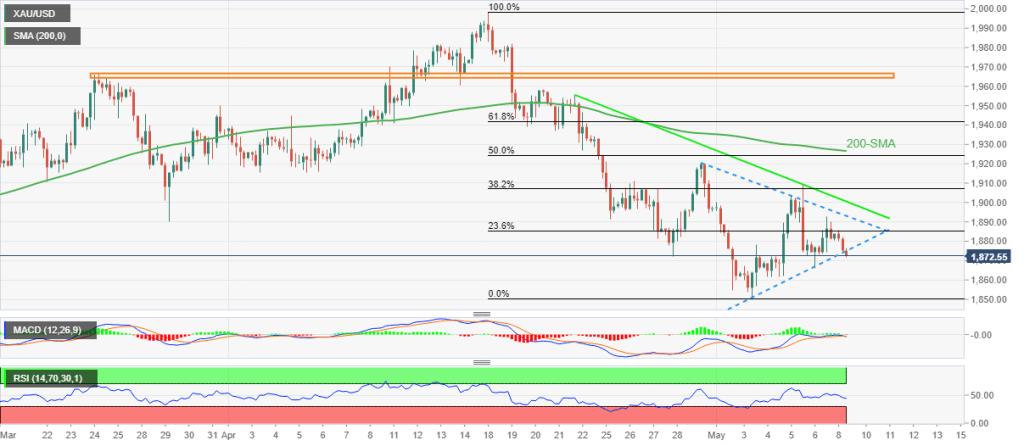

Technical analysis of gold price

Market analyst Anil Panchal said gold broke the bearish trend of the previous week by breaking the one-week symmetrical triangle that was previously between $1,892 and $1,875. states that it has expanded for the fourth time in a row. According to the analyst, precious metal moves are also supported by stable RSI and unobtrusive MACD signals, indicating further weakness.

However, the analyst says that rates act as additional filters to the north as a downward sloping trendline from April 22 against buyers and the 200-SMA around $1,905 and $1,930 respectively. Even if the gold price manages to break the $1,930 barrier, a horizontal area surrounding $1,965 from the end of March will be the key hurdle to watch.

Gold price: Four-hour chart

Gold price: Four-hour chart Meanwhile, a clear downside break of $1,875 becomes necessary for the golden bears to hold the reins. Following that, they won’t hesitate to renew the monthly low currently around $1,850. Still, the analyst reminds that from August 2021, an upward sloping trendline that has so far been close to $1,830 will be a crucial support to follow later on.

“Gold price remains supported by $1,850”

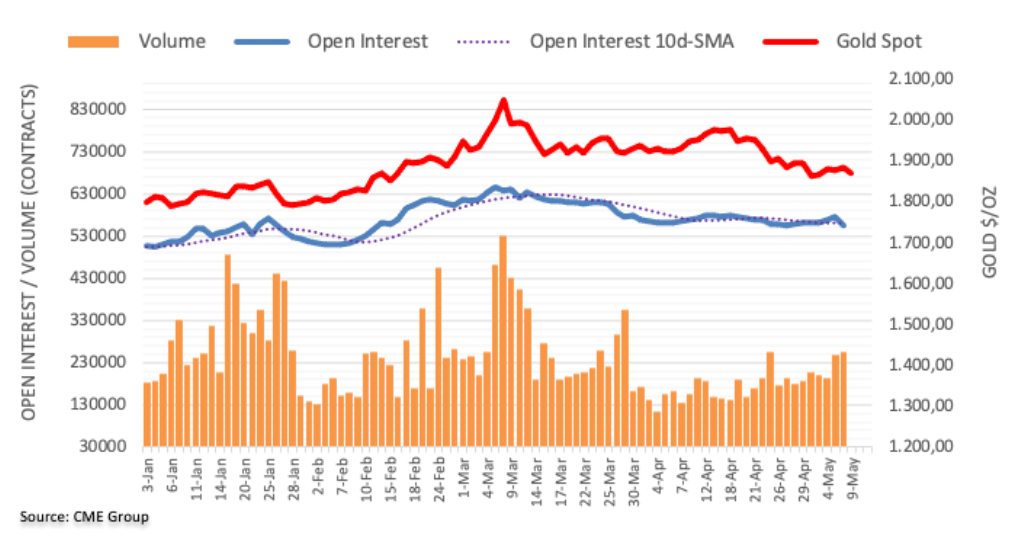

Open interest on gold futures markets reversed three-day gains, according to preliminary data from CME Group and nearly 18.8k contracts shrank on Friday. On the other hand, volume rose for the second consecutive session, this time up by around 4.3K contracts.

According to market analyst Pablo Piovano, Friday’s rise in gold prices was amid waning open interest and hints at the idea that further upside looks somewhat limited, while occasional bearish moves are for now. It is expected to meet some traction near $1,850.