Analysts look at historical data to predict future levels of Bitcoin price. According to Inmortal, which likens Solana’s current situation to Ethereum 2012 levels, if history repeats, SOL could bottom out at $20. Technical levels for Bitcoin, Ethereum and Solana…

What levels does Bitcoin point to in the coming months?

A closely followed crypto analyst, Inmortal maps out what he believes Bitcoin (BTC) and Solana (SOL) will perform for the rest of the year. In its latest analysis, Inmortal told its 179,200 Twitter followers that over the next six months, Bitcoin will fluctuate widely:

You’ll be bored to death for the rest of the year. Panic sales may come in the $25,000-27,000 region.

People will get FOMO at $38,000.

In the short term, Inmortal predicts Bitcoin will recover towards its critical resistance at $32,500. For this, the analyst shared the chart below.

Analyst watches these levels on Solana

SOL, according to Inmortal, before ETH drops 95% and 70 It follows Ethereum’s market structure from July 2017 to January 2021, where it reached 1,400 before bottoming out around the dollar. You can follow the graphs below for comparison. Looking at the chart of

Inmortal, the crypto analyst predicts that SOL will bottom at $20 by the end of this year before starting a new bull market. In the short term, however, Inmortal says it’s bullish on SOL as the altcoin is in huge decline from ATH:

I’m buying more SOL here. After -86% of ATH level, this is the opportunity of a lifetime for me.

Based on Inmortal’s chart, SOL posted a bullish divergence on the daily chart suggesting the possibility of a short-term trend reversal.

As Bitcoin moves forward in June, how can it perform in the coming weeks

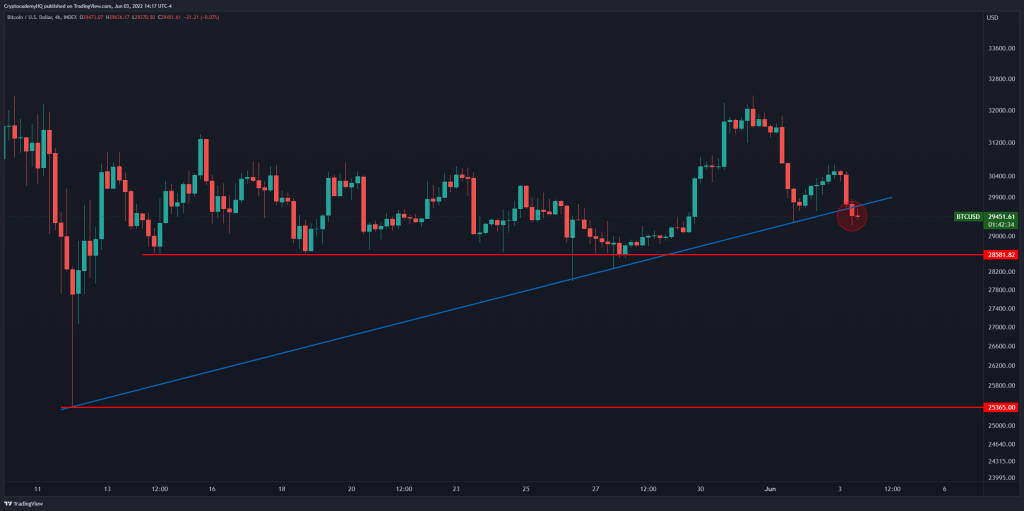

Another popular analyst, Justin Bennett, is looking forward to seeing Bitcoin as BTC is currently following the June 2021 price action. He predicts what moves may be made in the coming weeks. Analyst Bennett told his 100,900 Twitter followers that Bitcoin is at risk of revisiting the 2022 low of $26,910 as the bulls struggle to maintain BTC’s short-term diagonal support:

BTC on a four-hour close basis in May It is trading below the trendline at $29,700. The next line of defense for the bulls is $28,600. Below that, and we’re likely looking at a sweep of May lows.

According to Justin Bennett, Bitcoin’s current price action resembles the market structure of June 2021, when BTC also swept the bottom before starting a recovery. Sharing the chart below, the analyst says:

It may not play out exactly the same, but so far BTC is posing well for June 2021.

Bennett says if Bitcoin follows the June 2021 scenario, BTC will likely hit 2022 lows:

Probably $24,000 to $25,000 somewhere. But I doubt the cycle is low.

After recording a new year low, the crypto strategist predicts a rally for Bitcoin but stresses that BTC is unlikely to start a new bull market:

A relief to a lower macro high rally more likely, but I doubt it will last that long.

Looking at Bennett’s chart, the relief rally could push BTC up to $35,000 in July.