As the markets try to recover after the hard sell, a popular crypto analyst is examining the charts of 4 altcoin projects he sees as potential. Another crypto analyst explains why he believes Solana (SOL) is still the top Ethereum (ETH) competitor.

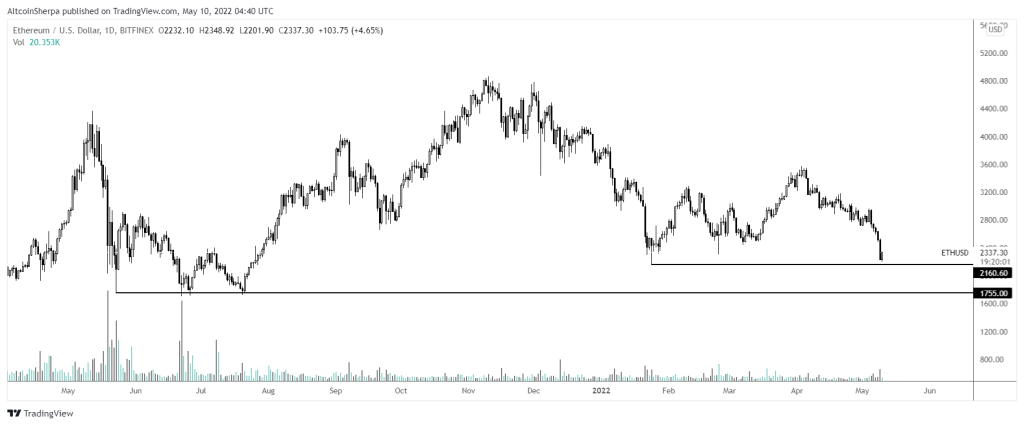

First of all, there is the leading altcoin Ethereum

The pseudonymous analyst known as Altcoin Sherpa said that leading smart contract platform Ethereum (ETH) is already at its highest in January in the $2,100 range. says it has dropped to lows:

Interesting observation for Ethereum, it’s at a January low; Something that Bitcoin (BTC) has already cracked. While BTC is closer to May lows, ETH is still well above these levels.

Source: Altcoin Sherpa / Twitter

Source: Altcoin Sherpa / Twitter Ethereum rebounded from today’s low to $2,334 after hitting $2,170 on the day.

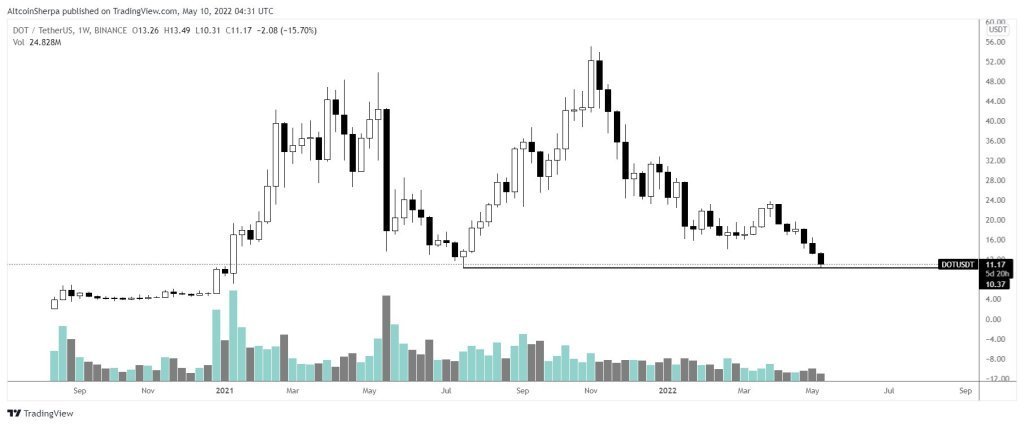

Analyst continues with Polkadot

The analyst then looks at cross-chain interoperability protocol Polkadot (DOT), setting an entry level target of less than $6:

$6 if this level is lost. At least it looks like a good long scalp.

Source: Altcoin Sherpa / Twitter

Source: Altcoin Sherpa / Twitter Polkadot was trading above $16 a week ago but dropped below $11 before recovering a bit. The DOT was currently trading at $10.08, down 12.47% in the last 24 hours.

The next altcoin Avalanche (AVAX)

The graphics guru then moves on to the Tier-1 smart contract platform Avalanche (AVAX). This altcoin was also above $ 68 on May 5, and a few days later it made a big dive below $ 42. Altcoin Sherpa now wants to get in:

Looks like a good buy. 1W old all-time highs reached.

Source: Altcoin Sherpa / Twitter

Source: Altcoin Sherpa / Twitter Avalanche was changing hands at $34.75 at the time of writing, losing 25.11% on a daily basis.

Analyst focuses on Cosmos (ATOM)

Altcoin Sherpa then evaluates the scalability and interoperability ecosystem Cosmos (ATOM), if Bitcoin (BTC) also fluctuates 10 focuses on crypto asset capitulating at dollar level:

If BTC suffers another drop, it seems possible to drop below $10 in the coming weeks. But this area should provide some support.

Source: Altcoin Sherpa / Twitter

Source: Altcoin Sherpa / Twitter Cosmos also moved in line with the crypto market today and rallied a bit after hitting $9.75. However, at the time of writing, it was trading at $11.85, depreciating 16% on a daily basis.

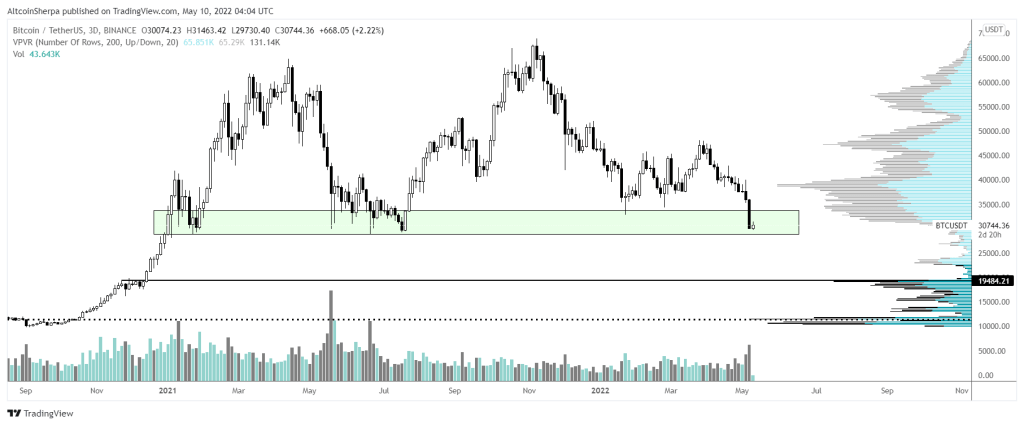

Altcoin Sherpa finally looks at leading crypto

The analyst wraps up his tweet storm by highlighting the current support range for Bitcoin between $30,000 and $35,000.

This remains a support area for now, I’m starting to fill out some offers. There’s too much uncertainty with the macro to assume it’s bottoming out yet. From a stand-alone (technical analysis) standpoint, the next level would be around $23,000 followed by $20,000 by volume profile.

Source: Altcoin Sherpa / Twitter

Source: Altcoin Sherpa / Twitter BTC has lost about 25% over the past week, giving up $40,000 or even dropping below $30,000 during the day. At press time, Bitcoin is up 1.50% in the last 24 hours and is worth $31,424.

What are the advantages of Solana over Ethereum?

InvestAnswers anonymous server says the ‘Day One Thesis’ is SOL’s Ethereum hedge as it sees Solana as the only potential ‘ETH killer’. The analyst states that SOL has less than 1/12th of the market cap of ETH but “does a lot.” The analyst also summarizes Solana’s potential advantages over Ethereum:

Solana’s strength and the reason I still love it is because it has the largest selection of DApps of any Blockchain out there. They have an exponential take. Fast, inexpensive, scalable. Despite the interruption.

Analyst points out that Solana’s cuts are a potential problem. As Kriptokoin.com also reported, Solana suffered a network outage in late April when the project’s mainnet beta cluster “stopped producing blocks as a result of stalled consensus,” according to Solana Labs.

Analyst also states that Solana has higher inflation than Ethereum. The analyst states that the greater size of Ethereum’s advantages is its earlier launch date and higher adoption rate. He says that Ethereum also has the most validators and is more decentralized and deals with less regulatory risk.