Gold price remains under pressure as the US dollar tries to catch a bid. Meanwhile, the Federal Reserve comes this week in critical for gold. According to market analyst Ross J Burland, the golden bears are moving, but higher highs are calling us. Market analyst Dhwani Mehta says gold bulls are looking higher. We have compiled analysts’ evaluations and forecasts for our readers.

“Gold price is on the verge of a major correction”

Data on Friday showed US business activity contracted in July for the first time in nearly two years. Also, the US Composite PMI Output Index fell much more than expected this month to 47.5. The previous month’s data was at 52.3. This showed that the US is likely to enter a recession. However, the dollar found support from safe-haven flows late Friday. Investors opted to exit equities amid some weak earnings reports. Ross J Burland comments:

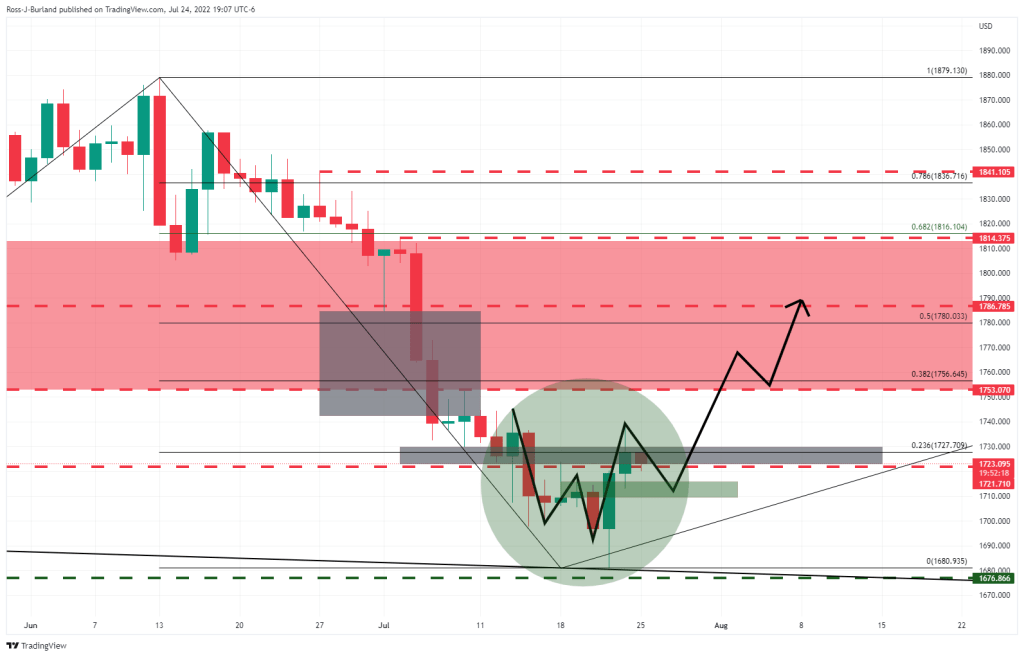

The gold price may be on the verge of a major correction. The Fed meeting will be decisive in this regard. Gold eased a significant price imbalance on the weekly chart ahead of the FOMC.

“We haven’t seen a capitulation under it yet!”

cryptocoin.com As you follow, the markets expect a 75 basis point increase from the Fed. In doing so, the Fed will shift its policy stance to a longer-term neutral position, according to the analyst. TD Securities analysts also predict that Chairman Powell will leave the door open for additional rate hikes of 75 basis points. There is some upside potential in gold prices. However, analysts, looking through a positional lens, comment:

The huge position held by the average trader is still almost twice its typical size. This indicates that a significant amount of pain will reverberate in the gold markets as prices fall. We haven’t seen a capitulation under it yet. This is a sign that the last rally will eventually face a price wall.

Meanwhile, according to Ross J Burland, the daily chart’s W-form is pulling the price of gold to the neckline around $1,700 for the rest of the bulls’ commitments ahead of a full rise in the coming days.

Important levels to watch for gold price

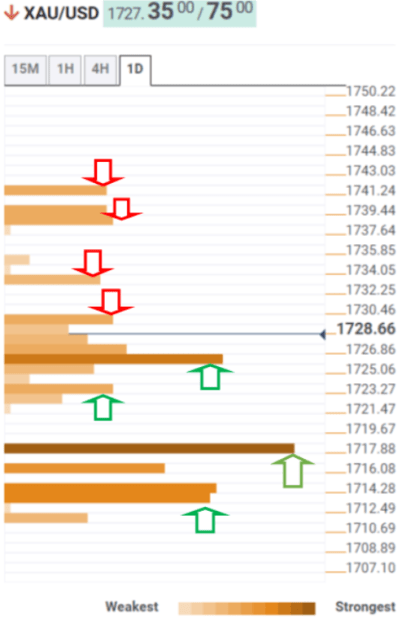

Market analyst Dhwani Mehta analyzes the indicators of the Technic Confluence Detector (TCD) he uses as follows. TCD shows that the price of gold is following a sustained move above the one-day Fibonacci 38.2% at $1,730. The next upside target is at $1,733, one-day Fibonacci 23.6%. The previous day’s high of $1,739 is likely to limit gold’s recovery.

Further higher, the bulls will challenge the one-day R1 pivot point as it goes from $1,741 to $1,750. However, this level is a psychological barrier. Alternatively, buyers remain hopeful as long as the Fibonacci 23.6% one-week support at $1,726 is defended.

The bears will then attack the critical Fibonacci 61.8% one-day support at $1,722. Fibonacci 38.2% one-week and one-day SMA10 convergence at $1,718 will come to the rescue of buyers. Also, SMA5, Friday’s low at $1,713 for one day, will be the pass-through for gold sellers.

Technic Confluence Detector

Technic Confluence Detector