2 widely followed crypto analysts shared altcoin projects that they see great potential in their latest Youtube posts. Coin Bureau analyst Guy says Lido Finance can finally manage Ethereum. Let’s take a look at the analysts’ expectations, without the precision of the estimates.

Analysts identify high-potential altcoin projects

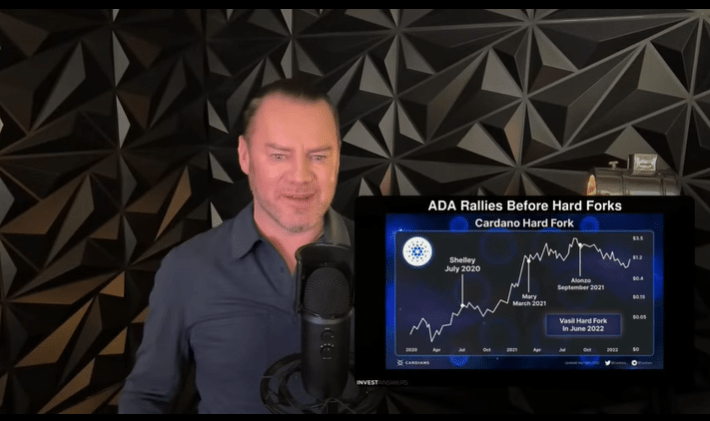

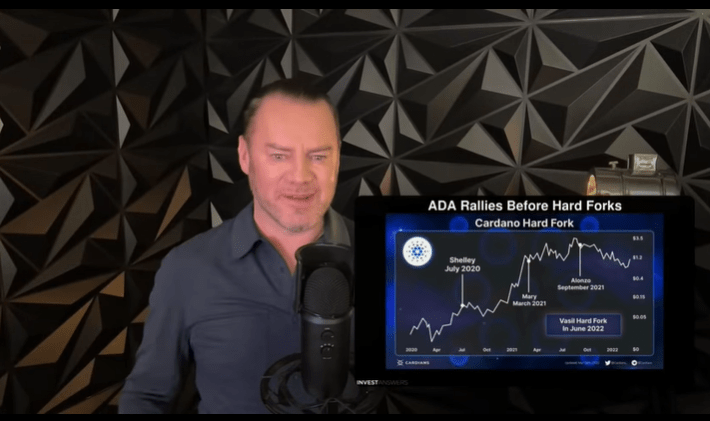

In a new video, analyst at financial education YouTube channel InvestAnswers, the release of the Vasil hard fork this month highlights ADA’s current rally. says:

It is always collected before hard forks. It’s pretty clear that the current boost is due to the Vasil hard fork, which is supposedly the future of many great things: much more scalability in terms of TPS [transactions per second], much more smart contract functionality, much more DeFi capabilities, etc.

Discussing in part of the post how the letter fork could affect ADA price, the analyst says that network upgrades have historically been bullish for ADA:

If you look at the past, July You can see the Shelley hard fork in 2020. This was a big move until the hard fork, as the latest Alonzo update saw DeFi crypto rise by about 135% and hit the ATH level of $2.96.

What levels do investors expect in the ADA price?

Cardano rose to $0.63 on June 1 and hit its highest level since dropping to $0.42 in May. The analyst says that the altcoin project may not have broken its previous highs, but the price action shows that ADA is splitting from other altcoins. Analyst interprets this situation as follows:

We are currently around $0.65, something like this, so it hasn’t shattered, but diverges and becomes uncorrelated with other altcoins. To Cardano/Ethereum pair (ADA/ETH), Cardano/Bitcoin pair (ADA/BTC), etc. If you look, it’s really exploding, so we’re going to watch this very carefully. As we have seen in the analysis of

Kriptokoin.com , Cardano briefly outperformed XRP by market capitalization in the last rally, before returning to the seventh-ranked position. left. At the time of writing, it is trading at $0.5462, down 5%.

An altcoin could dominate Ethereum

According to Coin Bureau analyst, “Guy” is the next analyst to update the altcoin analysis and is the host of the popular Youtube channel Coin Bureau. The analyst tells his two million YouTube subscribers that the liquid staking protocol Lido Finance could eventually become the de facto governance protocol for Ethereum:

Lido Finance allows you to stake PoS cryptocurrencies without having to lock them in, meaning you can trade freely while staking them. You can do. The short explanation of how this works is that when you stake your cryptocurrency through Lido Finance, the protocol gives you a tradable token that acts as a kind of receipt for the crypto you stake.

Lido Finance’s native cryptocurrency Lido DAO (LDO) is an ERC-20 token released in January 2021 with a max supply of one billion. LDO can be used to vote and participate in the protocol’s DAO. According to Analyst Guy, Lido DAO could essentially start to rule Ethereum due to the high demand for liquid staking. The analyst explains why:

This is because if 100% of the ETH staked on the Beacon Chain is done through Lido Finance, the Lido DAO will have an incredible amount of impact on Ethereum itself. The Lido Finance team believes this is inevitable due to the demand for liquid staking. Consider that current estimates see the protocol holding 50% of all staked ETH in the coming months.

Etherscan shows that Lido Finance accounts for over 32% of all ETH stored on the Beacon Chain, which is considered the backbone of Ethereum’s PoS consensus mechanism.