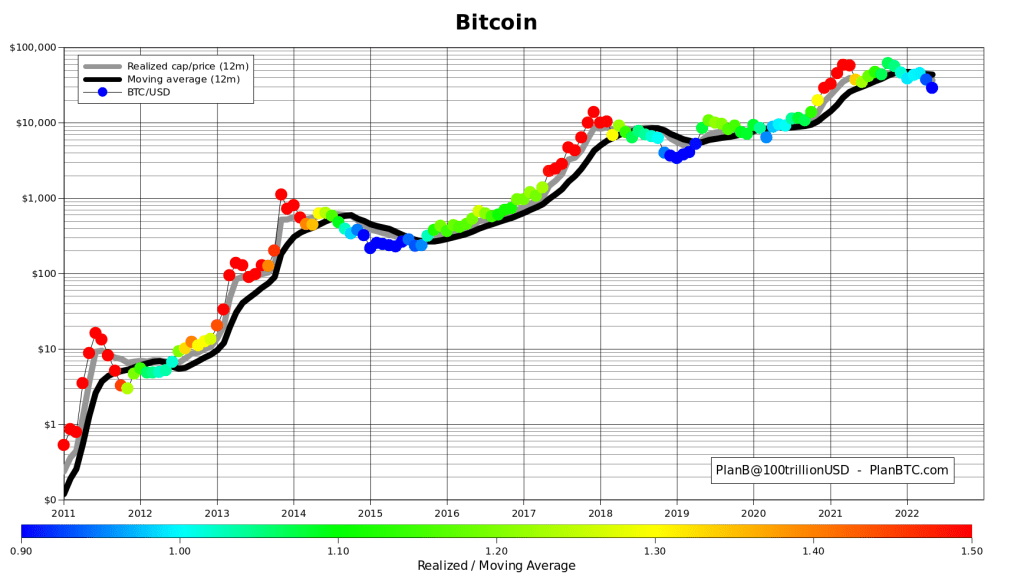

Until the major correction we saw in May-June, PlanB’s S2F model had correctly predicted Bitcoin’s trajectory. The notorious stock-to-flow model (S2F), which accurately predicts Bitcoin price movements, predicts $72,000 this week. On the other hand, a Twitter analyst said that BTC will bottom at $ 17,600.

Bitcoin targets $72,000 this week, according to S2F model

Earlier, a Fidelity analyst explained why S2F is no longer true and will not be in the future. S2F’s main source of forecasting is the scarcity of the asset, which alone cannot determine the price, especially in modern markets.

To see better results with Bitcoin, it is necessary to consider scarcity. Unfortunately, it is nearly impossible to accurately calculate the technology adoption rate, even if we compare it to similar technologies like mobile devices or the internet in the future.

The current divergence from the price pattern is one of the largest the market has seen in asset history. This suggests that the stock flow can no longer be used to determine the future price levels of Bitcoin.

Lack of purchasing power in Bitcoin

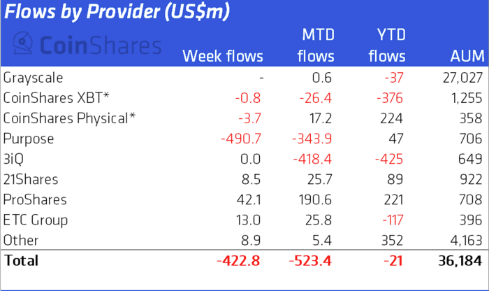

The reason S2F’s price prediction is unlikely to come true is because individual investors alone cannot keep the price of digital gold as high as the model suggests. cryptocoin.comAs you follow, institutional investors sold nearly $500 million worth of BTC after the collapse of the cryptocurrency market.

It is not yet clear when institutional investors will return to the cryptocurrency market, especially after Ethereum’s fiasco that caused a massive liquidation and margin call in the lending and lending market. Companies like 3AC, Celsius and many foundations had to cease operations after Ether fell below $900. Meanwhile, a popular Twitter analyst is pinpointing the bottom $20,000 from the middle of all those sales.

Crypto analyst warns collapse is imminent

In a recent strategy session, “Cheds” said that Bitcoin is still in a macro downtrend. The analyst also adds that BTC’s recent rally to the lows of $17,600 will face an abrupt end. In his YouTube post he says:

I’m looking at the daily chart. This looks like a bear sequel. I can draw a bear pennant. I can draw a bear flag. I can draw a rising wedge. It feels like a little relief rally so far. There is the volume [downtrend], the standard volume trend, so this channel is one to two days away. One to two days until [BTC] takes action.

Recently, Cheds said that breaking the bearish pennant or ascending wedge will set new 2022 lows:

If the trend continues, the structure can be seen as a bear pennant or flag rising wedge with movement measured in the low teens.

Earlier this month, Cheds said that Bitcoin is in a “strong position” to bottom at $12,000. Bitcoin is trading at $20,708.08 at the time of writing.