With the crypto market still under pressure, Bitcoin price continues to drop below the critical $30,000 level. However, PlanB, the inventor of the S2F model, claims that the bear market is almost over. Here are the 2 metrics and price predictions that come out…

Bitcoin (BTC) is trading in the region where it can rise according to historical data

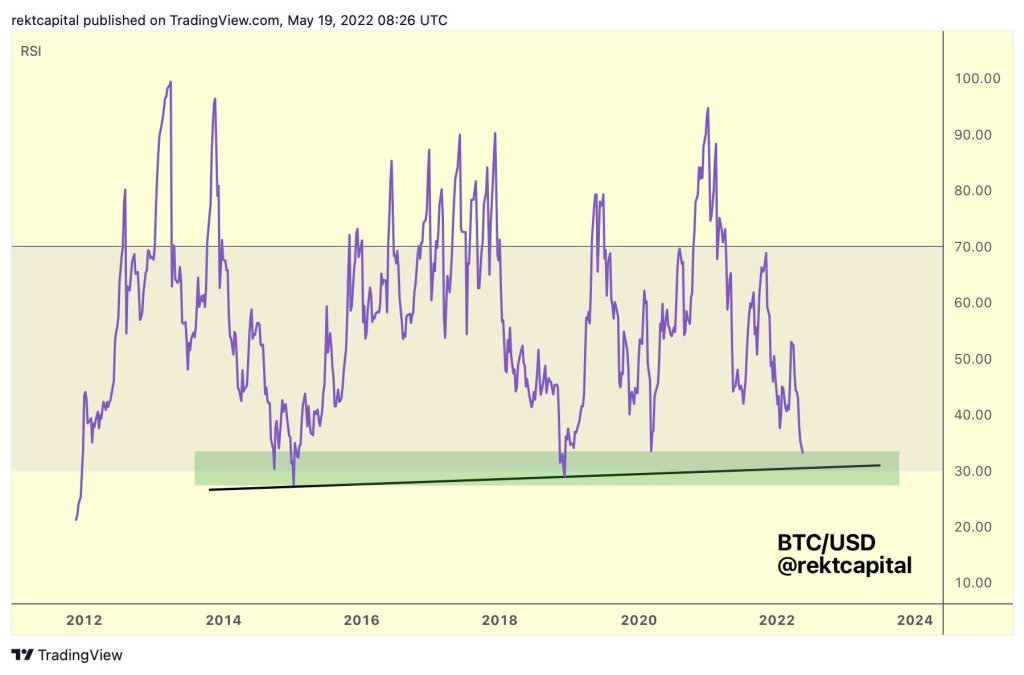

Crypto analyst nicknamed Rekt Capital, in his recent analysis, BTC He says that the RSI data of . However, the RSI levels have hit the bottom of the bear market with a much lower drop in 2015 and 2018. If the RSI levels drop, the black high low could be a reversal point.

The RSI is a momentum indicator that measures recent prices to determine whether it has been oversold or overbought in a given time frame. According to the analyst, in the previous three drops of Bitcoin’s RSI level to the region where it is currently close, a bear market bottom was found, fueling a recovery.

S2F inventor PlanB claims the bear market is almost over

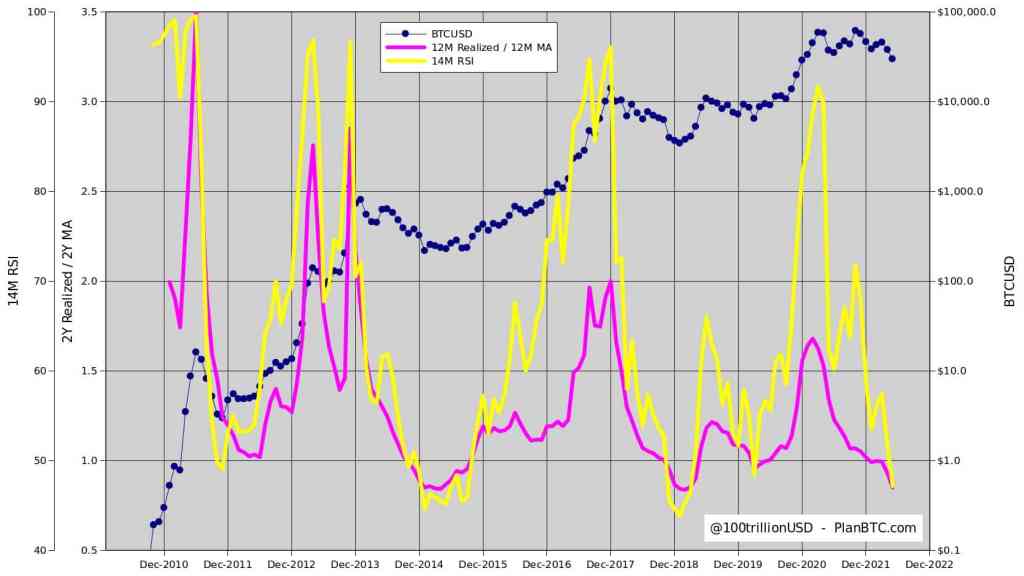

The next analyst, PlanB, is quite optimistic about Bitcoin. The popular on-chain analyst recently said that the BTC price has set a new low for the next bull market. The BTC trend has moved according to PlanB forecasts this week, with the price dropping close to the $28,500 level.

Now, PlanB reports in a tweet that the bear market is almost over and the price should start rising again. He believes that the current levels of RPMA and RSI suggest a bottom for Bitcoin. However, it may be 6-9 months (like 2014 and 2018/19) or 1-2 months (like 2011 and 2020) before we see a jump. Currently, Bitcoin is trading sideways near the $30,000 level. PlanB, whose analysis we shared as

Kriptokoin.com , also shared a correlation between the US stock market and Bitcoin, especially S&P 500 and Bitcoin. Both the stock market and Bitcoin have been down since November 2021. Meanwhile, the S&P 500 is in a bear market as it is down about 20%. Analysts believe that Bitcoin accumulation at the current price could bring more returns to long-term investors.