Two famous analysts shared their latest comments for the largest cryptocurrency by market cap. Analysts pointed to some cycles when announcing the dates for the uptrend for Bitcoin (BTC). Here are the details…

TechDev: Bitcoin no longer cares about halving cycles

A popular crypto analyst says that Bitcoin (BTC) will challenge all traditional theories about market cycles next year. The analyst known as TechDev tells his 402,000 Twitter followers that he will challenge the traditional belief that BTC’s price cycles are driven by halving cycles. . cryptocoin.com As we have also reported, alving cycles are four-year intervals in which the block rewards of Bitcoin miners are halved. Many investors believe that this process plays a role in putting pressure on the price.

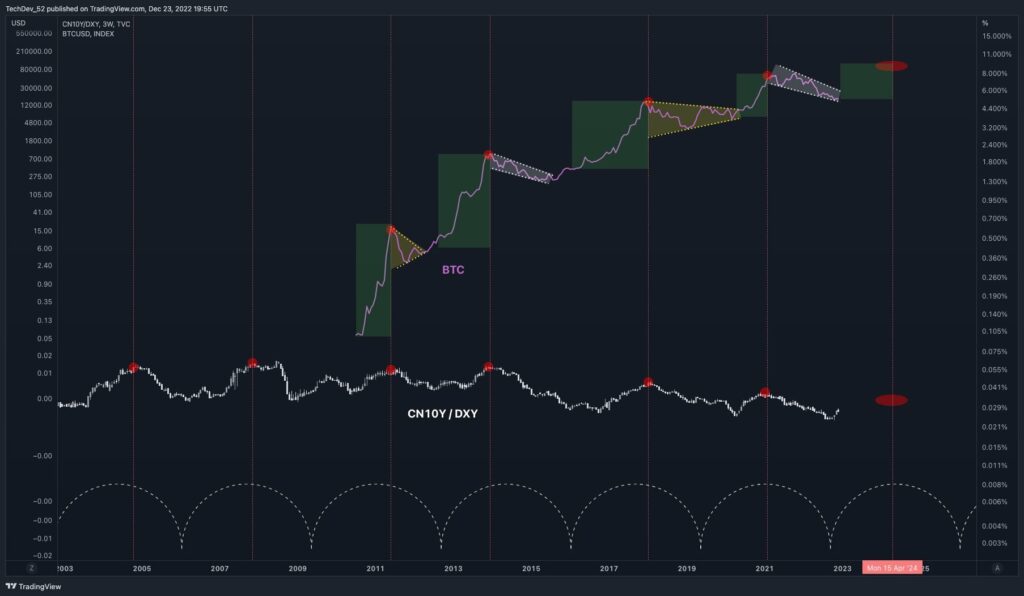

However, TechDev thinks that BTC will largely ignore the next halving, which is likely to happen in mid-2024. He predicts that this will replace the coin early next year. TechDev predicts that a bounce in Bitcoin next year will coincide with the weakening of the US dollar, which it pegs against China’s ten-year bonds to depict a global liquidity cycle.

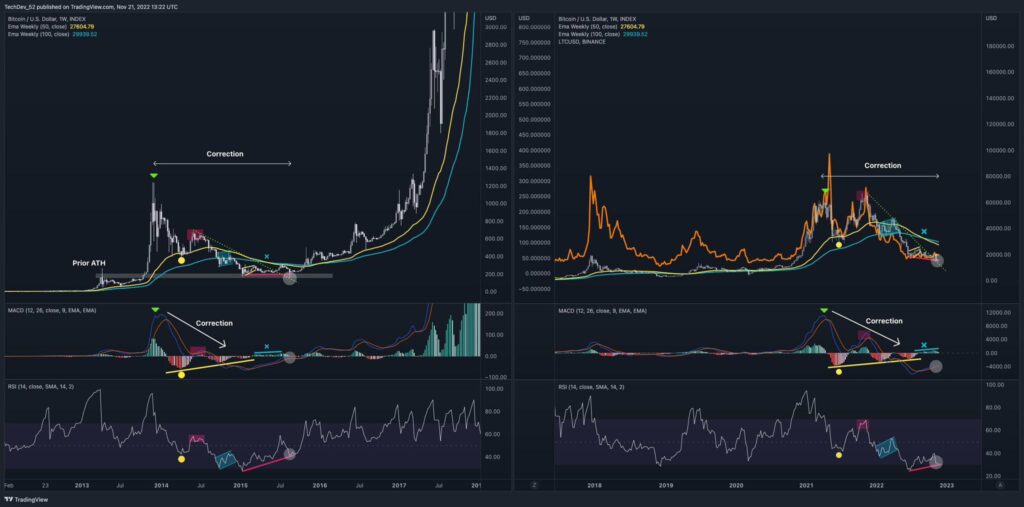

Was the actual peak recorded in “April 2021”?

The analyst also says that the bear market is deeper than many think, suggesting that Bitcoin reached its peak in April 2021 instead of November. It therefore implies that the market is closer to a reversal. He uses Litecoin (LTC) as an example for the anomaly seen in Bitcoin, which recorded a lower high in November. The analyst used the following statements:

BTC, I think, ‘peaked’ in April 2021. The structure of LTC (orange) is easier for most people to digest. Parabolic top makes November ’21 a lower high. The majority still do not seem to understand that corrective waves can make new highs. In the past they were part of the majority.

Rekt Capital: The bear market is coming to an end

On the other hand, statements came from crypto expert Rekt Capital. The analyst has set a date for the conclusion of the Bitcoin (BTC) bear market. Rekt Capital reported on Twitter yesterday that Bitcoin has historically found its absolute bottom price about 365 days after the previous bull market peak. According to the analyst, given that it has been nearly 400 days since BTC reached $69,000 today, the bulls may be ready to take action at any time.

It's been ~400 days since the #BTC Bull Market peak at $69000

Which means that this Bear Market is getting closer and closer to ending

Historically, $BTC Bear Markets find their absolute bottom price approximately 365 days after the previous Bull Market peak#Crypto #Bitcoin

— Rekt Capital (@rektcapital) December 23, 2022

Also, based on a BTC chart, Rekt Capital argued that the coin is still below the $17,150 resistance price and a monthly close below $17,150 will likely confirm the resistance level further, which will send Bitcoin back to the $15,400 lows.

Another analyst points to Bitcoin halving

Combining the data, Kyledoops claimed that buying BTC about a year before a Bitcoin halving always gives investors maximum opportunity. Every halving event is followed by a significant increase in Bitcoin price. Given that the next Bitcoin halving will occur in 2024, about 1.5 years from now, the chart analyst argued that bottoming Bitcoin now provides the ultimate prospect.

2/10) Observations of Cycle 1

Buying around 1 year prior to the halvening event (marked with orange vertical dashed line) provided max opportunity

(Green vertical dashed line) is when the first halvening occurred & price went parabolic.

It took 52 weeks from halvening 1 to ATH pic.twitter.com/IRdHhOzPia— Kyledoops (@kyledoops) November 25, 2022