Cryptocurrency investments of two large government funds from Canada and Singapore have emerged. Million-dollar funds were investing in the crashing FTX exchange.

Canada’s largest pension fund wipes out $95M of FTX investment

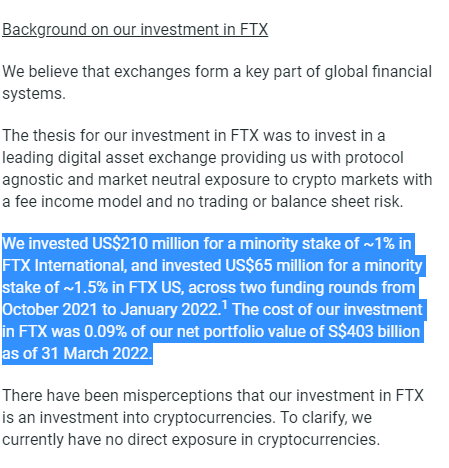

Ontario Teachers, Canada’s largest pension fund, said it will wipe out $95 million in bankrupt crypto exchange FTX, according to a press release on Nov. According to the pension fund, between October 2021 and January 2022, it made two investments in the embattled stock market through the Teachers’ Venture Growth (TVG) platform. His first investment in October 2021 was $75 million, and his second investment was $20 million. The two investments “represented less than 0.05% of their total net assets.

The pension fund said the financial loss from its FTX investment will have minimal impact on its plan. Meanwhile, fund management said it supports regulators’ efforts to review the risks and causes of FTX bankruptcy.

Ontario Teachers joins a growing list of investors who are having their investments wiped out in FTX. Earlier in the week, Singaporean investment firm Temasek announced that it had deleted its $275 million investment in the stock market. cryptocoin.comAs you can see from Genesis, it was added to the bankruptcy series lineup.

Temasek deletes $275 million cryptocurrency investment

The investment firm announced that it conducted an extensive due diligence process on FTX that took 8 months between February and October 2021. The Singapore-owned investment fund said it deleted its $275 million investment in FTX, which went bankrupt on November 17. According to the fund, he had “lost faith in his actions, judgment, and leadership,” in particular FTX founder Sam Bankman-Fried.

Meanwhile, Temasek says it has conducted a comprehensive eight-month due diligence process on FTX. The state-owned fund’s investigations into the crypto exchange’s audited financial statement, regulatory compliance, cybersecurity, and other due diligence efforts did not reveal any red flags. Instead, it showed that the stock market was profitable. The investment firm also reported that it is collecting feedback on the company and its management team from people close to FTX. The press release states:

The thesis of our investment in FTX was to invest in a leading cryptocurrency exchange that gives us protocol-independent and market-independent exposure to crypto markets with a fee income model and no trading or balance sheet risk.

Temasek had no direct investment

The Singaporean company also clarified that it has no direct exposure to any cryptocurrencies. The firm’s blockchain investment activity focuses on cryptocurrency and infrastructure service providers. He added that FTX investment was 0.009% of the $403 billion net portfolio value as of March 31, 2022. Despite the failure of FTX, Temasek wrote:

We continue to recognize the potential of blockchain applications and decentralized technologies to transform industries and create a more connected world. But recent events have shown what we have already described – the birth of the blockchain and crypto market, and there are significant risks as well as countless opportunities.