The gold market bounced from a two-year low in the middle of the week. It rose above $1,650 an ounce. However, persistent bearish sentiment could limit gains next week, according to a survey. Here are the expectations of Wall Street analysts and individual investors regarding the precious metal…

Expectations about the Fed’s rate hike have changed

For the third week in a row, Wall Street analysts are seeing a strong drop in gold prices in the near-term. At the same time, the bearish trend has a slight advantage among individual investors. The gold market was trying to close the week with heavy losses. cryptocoin.com As we have also reported, the changing interest rate expectations on Friday provided a new upward momentum in the precious metal. According to the Wall Street Journal, some members of the Fed are considering slowing the pace of rate hikes after November as volatility and uncertainty dominate financial markets.

According to the CME FedWatch Tool, markets are still predicting interest rates to rise above 5 percent in early 2023. Phillip Streible, chief market strategist at Blue Line Futures, said that while the Fed has slowed rate hikes through the end of the year, this means rising inflation has not changed. Rising interest rates will continue to support the US dollar near 20-year highs. Therefore, he added that he is neutral on gold in the short term.

Gold survey dominates decline

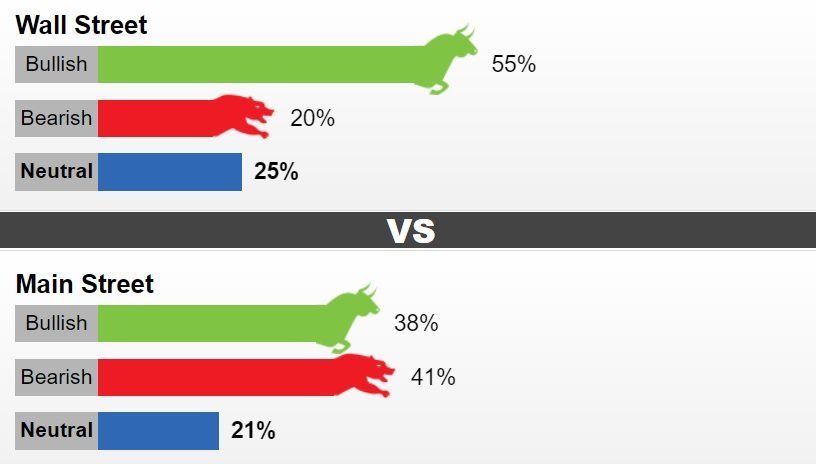

20 market professionals took part in Kitco’s Wall Street survey this week. Eleven analysts, or 55 percent of respondents, said there would be a drop in gold next week. Four analysts, or 20 percent of respondents, indicated that they were on the rise for the precious metal. Finally, five analysts said they are neutral on precious metals in the near term.

There was also a decline in the online survey, in which individual investors participated. 473 participants participated in the online surveys. A total of 180 people, or 38 percent of the respondents, suggested that gold would rise. 192 people, or 41 percent, predicted that gold would fall. The remaining 101, or 21 percent, called for a sideways market. The gold market ended the week in slightly positive territory. December gold futures were last traded at $1,656.40, up 0.5 percent from Friday.

The price change in gold will come with the dollar

Forexlive.com chief currency strategist Adam Button argues that gold looks attractive in the long run. However, he said the next week is bearish due to the actions of the FED supporting the US dollar. According to the analyst, buyers are “waiting in the bushes, just ready to buy gold”. According to the analyst, your best bet is to wait for a better moment to buy gold. Saxo Bank’s commodities strategy Ole Hansen said he is neutral on gold as interest rates will continue to rise. Hansen used the following statements:

The highest rate expectations have not yet been met. A weaker dollar will be needed to replace the sentiment in gold. Until that happens, investors are playing gold in either a bearish or neutral stance. I prefer neutral.

There are also those on the rise for gold

However, as rising bond yields continue to hurt the global economy, some analysts are still bullish on gold. Adrian Day, Head of Asset Management, said he was optimistic about gold as global central bank monetary policies led to a serious recession. Day used the following statements:

Contrary to the British Treasury Secretary’s assertion that the system is working well, the situation is still fragile, as evidenced by the Bank of England’s market intervention. We will see more incidents like this. In such an environment, gold should flourish.