The leading cryptocurrency Bitcoin lost its strong support at $ 30 thousand. The positive atmosphere in the market brought by Ripple’s victory could not continue for a long time. Bitcoin price action therefore remains uncertain. Popular analysts in the market share their BTC predictions.

Bitcoin price alert and targets from master analyst

Predicting the May 2021 crypto crash, analyst nicknamed Dave the Wave is making a Bitcoin price warning. Also, the analyst explains his BTC target for the next market cycle. Dave the Wave says that too many people set Bitcoin price targets that follow a flat diagonal resistance and move towards the six-digit numbers. Instead, the analyst uses logarithmic growth curves (LGCs) to map Bitcoin’s potential trajectory. Thus, it depicts decreasing volatility and thus smaller rallies and less dramatic corrections over time. In this context, the analyst makes the following statement:

Pay attention to BTC charts with long-term projected straight lines, channels and parallels that will multiply for price targets in the next bull run. That’s exactly what drove many people astray last time.

Source: Dave the Wave/Twitter

Source: Dave the Wave/TwitterAccording to the analyst’s chart, the LGC model predicts Bitcoin to rise above the $200,000 level before the end of 2026. Dave the Wave also says that despite BTC being “relatively high” after its strong performance so far this year, the crypto king is still in the opportunity zone for long-term investors as it hovers around $30,000. Accordingly, the analyst said, “Yes, the price is relatively high. However, BTC is still in the LGC buy zone for investors,” he says.

High volatility on the horizon for bitcoin price

Famous trader and analyst Michael van de Poppe says that Bitcoin (BTC) is trading in a “key area” that it needs to break. In his post, he predicts that the coin will rise higher if it breaks above $30,308. On the other hand, if it gets rejected at this price point, it is possible for the BTC price to drop drastically.

The crucial area for #Bitcoin to break.

If we do, it's party time and we'll go to highs.

If this is again a fake-out, embrace yourself.

The volatility will be getting there next week. pic.twitter.com/aDIu7BeGEU

— Michaël van de Poppe (@CryptoMichNL) July 23, 2023

Bitcoin whale rate climbs to 90%, investors beware!

The weight of the highest Bitcoin entry transactions is increasing. Usually, when whales accumulate en masse, it is considered a sign of faith. However, this time around, that may not be the case. The connotation changes during bear markets. When this ratio rises above 0.8, it signals a false relief rally. With the current number around 0.9, the landscape becomes more favorable for a mass dump. A recent CryptoQuant analysis thread on Twitter pointed out,

In fact, this inverse correlation was quite evident in the recent past. In mid-June, when that rate dropped, the price started an uptrend. Likewise, even at the beginning of 2023, the price rose when the stock market whale rate fell. So, with the reverse trend at play, current conditions seem ripe for mass dumping. Therefore, with BTC already below $30,000, investors need to be careful.

Source: CryptoQuant

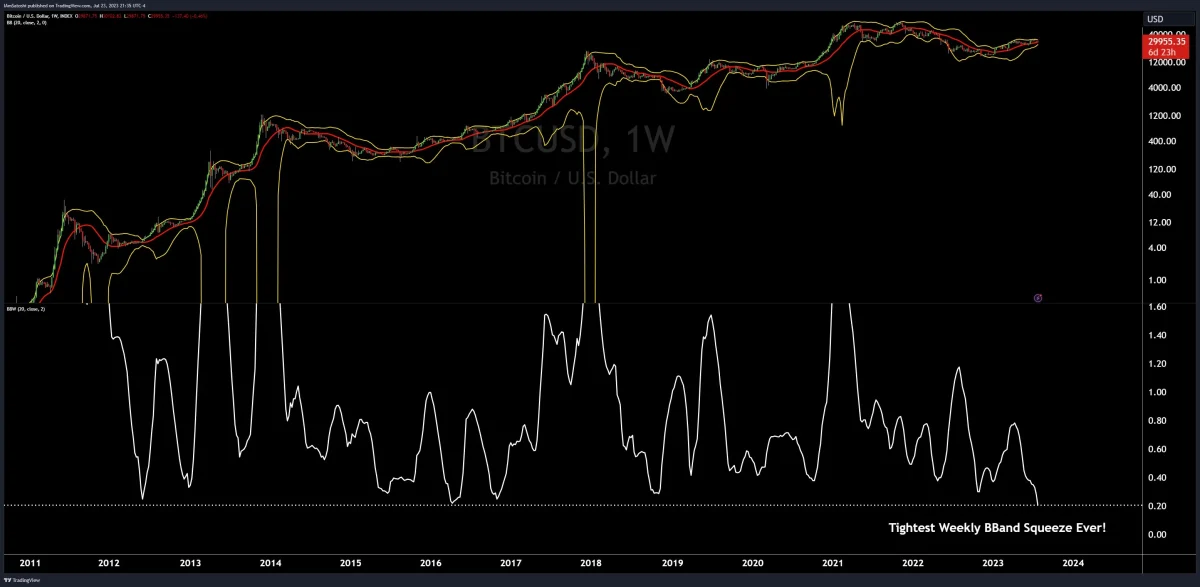

Source: CryptoQuantBitcoin’s Bollinger Bands are tighter than ever

By an important technical measure, Bitcoin’s market volatility is at a historic low with an unusual calm. Renowned cryptocurrency analyst Josh Olszewicz has found that Bitcoin’s Bollinger Bands, a volatility indicator used in technical analysis, are “the tightest [ever] on the weekly timeframe.”

Olszewicz’s observation shows that the price of the cryptocurrency is currently in a limited volatility phase. Interestingly, this ripple contraction isn’t exclusive to Bitcoin. Olszewicz also notes that Ethereum (ETH) is experiencing “the tightest B-Bands ever on a weekly timeframe.” This simultaneous contraction is probably less exciting for traders looking for bigger swings. However, it is possible that it points to a broader market trend.

Bitcoin price action could see beyond $120,000

Standard Chartered analyst Geoff Kendrick says Bitcoin miners have created a virtuous cycle that can push the token price beyond the already bullish predictions. With miners generally selling fewer tokens when the price goes up, the bullish trend that led Kendrick earlier this month to say $120,000 is possible next year represents a 300% increase from current levels. Ask Kendrick, “If higher prices cause miners to sell fewer tokens, driving prices higher, then will even higher prices trigger a positive feedback loop that will push Bitcoin above $120,000?” When asked, he gives the following answer:

Yes. So I think your thinking about this becoming something self-fulfilling is actually a very important driver.

Miners mainly sell Bitcoin to cover their costs. But as the price rises and previous debt struggles in the industry subside, miners are leaving less Bitcoin. Kendrick says that miners also have little reason to sell tokens other than Bitcoin price movements. Part of this is due to the culture surrounding the industry. Also, many miners continue to wait in anticipation that Bitcoin will eventually reach highs.

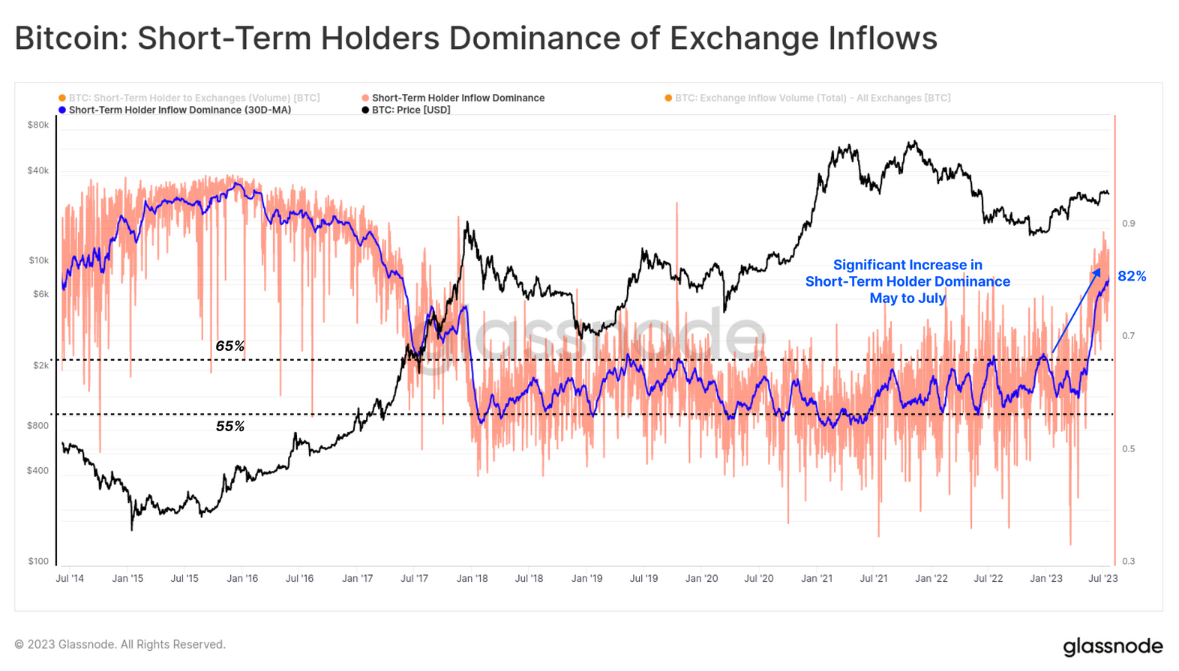

Birth of the whale “short-term owner” of Bitcoin

There has been a shift among Bitcoin investors since the BTC price returned to the $30,000 level. As Glassnode shows, short-term holders (STHs) (traders holding coins for a maximum of 155 days) have become significantly more common. It seems that whales, the largest group of volume investors, also consists of a large number of STHs. Glassnode said, “Short Term Holder Dominance in Entries jumped to 82%. “This rate is well above the long-term range (typically 55% to 65%) over the past five years.” It also evaluates:

From this point of view, we can say that most of the recent trading activities are carried out by Whales who are active (and therefore classified as STH) in the 2023 market.

The dominance of Bitcoin short-term holders in stock market entries. Source: Glassnode

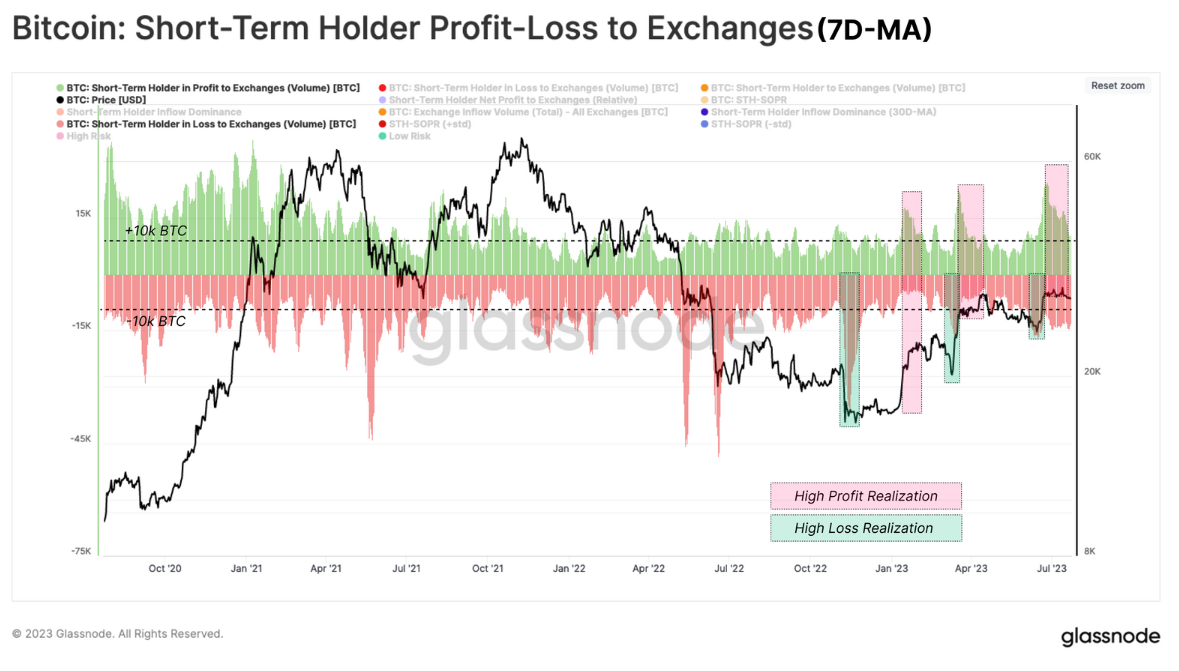

The dominance of Bitcoin short-term holders in stock market entries. Source: GlassnodeInterest in trading short-time movements on BTC/USD was already evident prior to May. Since the collapse of FTX at the end of 2022, speculators have been increasingly eager to take advantage of both upside and downside volatility. The results have been mixed. Realized profits and losses routinely rose in line with volatile price movements. Glassnode continues:

If we look at the Profit/Loss rating realized by the Short Term Holder volume flowing into the exchanges, it turns out that these new investors are trading in local market conditions.

The profit-loss of the Bitcoin short-term holder to the exchanges. Source: Glassnode

The profit-loss of the Bitcoin short-term holder to the exchanges. Source: Glassnode