Gold prices fell to their lowest levels in more than two years. The gold market, testing critical support levels, could be in trouble. What do the survey results show and what do analysts think about it?

Inflation stubborn, Fed aggressive, gold prices upside down

Alongside the decline in gold, sentiment among Wall Street analysts and individual investors has been on the decline. This highlights the risks of low prices in the near term. Markets are reacting to the Federal Reserve’s aggressive monetary policy to cool stubbornly high inflation. Therefore, last week’s sell-off of gold is a continuation of the trend that started in early March.

Markets almost completely digested a 75 bps gain next week following the Federal Reserve’s monetary policy meeting. However, surprisingly durable inflation in August prompted markets to price in with a slight chance for 100 bps movement. cryptocoin.com As you follow, rising hawkish expectations are supporting the US dollar near 20-year highs. That pushed 10-year bond yields to 3.5%, their highest level since April 2011.

“We will probably see more weakness in the near term”

In this environment, many analysts say that a lot of technical damage has been done to gold prices. They also note that it will be difficult for the precious metal to find any bullish momentum in the near term. Adrian Day, head of Asset Management, commented:

Gold sales were exaggerated. But assets often do not recover quickly from such declines. Therefore, we will likely see more weakness in the near term.

What do the gold prices survey results show?

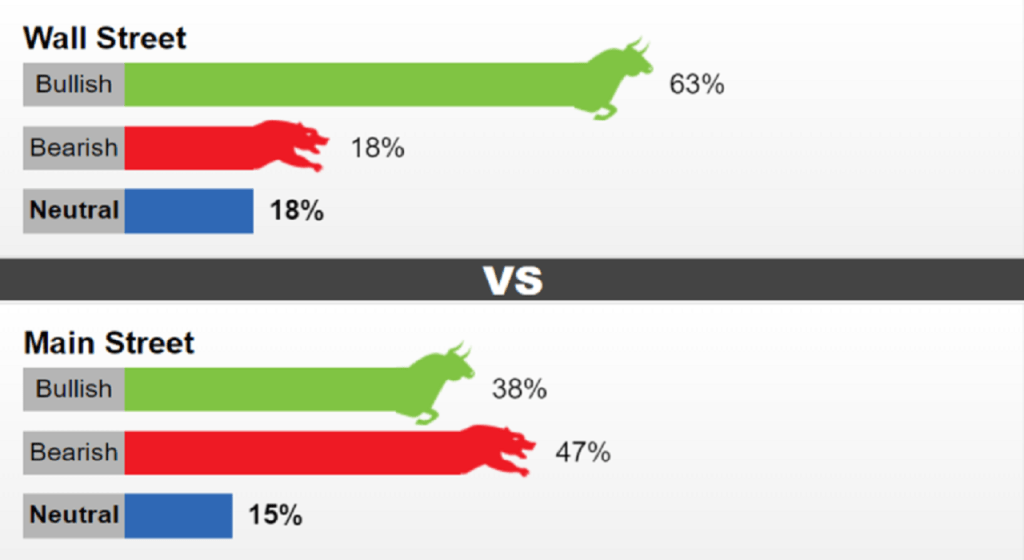

This week, a total of 22 market professionals took part in Kitco’s Wall Street survey. 14 analysts (63%) said gold will decline next week. At the same time, 4 analysts (18%) were bullish or neutral on gold in the short term.

On the individual side, 1,045 respondents voted in the online poll. A total of 395 voters (38%) predict that gold will rise. 489 (47%) of respondents predict that gold will fall. The remaining 161 voters (15%) expect a sideways movement. The bearish sentiment came as the gold price slumped to a two-year low at $1,661.90. The precious metal was last traded at $1,674.30, down nearly 2.7% from last Friday.

“The three-year bull trend for gold prices is coming to an end!”

Sensitivity is clearly in decline. However, many analysts point out that $1,675 represents an important support level. The question on that: How much is it possible for gold prices to drop? According to analysts, a drop below this level will mark the end of gold’s three-year bull trend.

Some analysts see an initial support near $1,650. However, SIA Wealth Management Inc’s chief market strategist, Colin Cieszynski, notes that up to $1,550 gold has little support.

“Gold acts as a risk asset”

Marc Chandler, managing director of Bannockburn Global Forex, says the next gold price target is $1,615 to $1,650. He also states that he does not rule out the possibility that prices will drop to $1,500 next year.

The Fed is unlikely to raise interest rates by 1% next week. However, markets expect to take more aggressive steps for the rest of the year. Chandler notes that markets now predict the terminal rate for the Fed Funds rate to be 4.50%. In this context, the analyst says:

Risk assets are coming out. Gold acts as a risk asset and should be treated as such. Forget the safe haven and inflation hedge narratives.

There are also optimists about gold prices.

However, not everyone is on a downward trend when it comes to gold. Saxo Bank’s head of commodities strategy, Ole Hansen, notes that closing the week above $1,680 for gold will likely signal a strong movement building in the market. Hansen adds that the Fed’s move to raise interest rates by 75 basis points may provide some relief below. In addition, the analyst comments:

I also wonder how much further stocks have to go before stagflation starts to get some attention.

Michael Moor, founder of Moor Analytics, says gold sales are likely to reach the point of exhaustion. However, he adds that it needs to see a solid close above $1,687.