What started as technical selling pressure on gold prices early on Friday turned into a rout as the precious metal lost most of its weekly gains on Friday.

T looks like it’s time for a technical fix

Entering the weekend, many analysts say the market is too late for a healthy correction. He also notes that this could lead to a long-term sustainable rally to all-time highs. The latest Kitco Weekly Gold Survey shows that individual investors continue to hold strongly on gold in the near term. But Wall Street analysts take a more cautious stance. Colin Cieszynski, chief market strategist at SIA Wealth Management, comments:

Gold has had a great breakout lately, but the upside momentum seems to be slowing down a bit. Also, it looks like it’s time for a technical correction with potential support near $2,000 or $1,960.

This indicates the end of the bull trend for the forehead!

Phillip Streible, chief market strategist at Blue Line Futures, says it’s not surprising that gold saw some selling pressure on Friday as the month-long bullish news began to fade. He says markets are getting used to the idea that the Federal Reserve will raise interest rates in May. At the same time, fears that the US banking system would collapse began to subside, reducing safe-haven demand for gold.

cryptocoin.com As you follow, some analysts think that prices may remain under pressure in the near term. However, Streible notes that the market is in a solid uptrend. In this context, the analyst said, “If we close below $1,953. Yes. This indicates that the bullish trend has ended and gold has moved into a neutral position,” he says.

Sales are a corrective pullback for gold

Senior technical analyst Jim Wyckoff says that gold remains bullish as it sees selling in gold as a corrective pullback. Wyckoff explains:

A break below the April low of $1,965.90 will begin to indicate a peak in the market, negatively impacting the short-term price uptrend.

Individual strong bullish as Wall Street balances

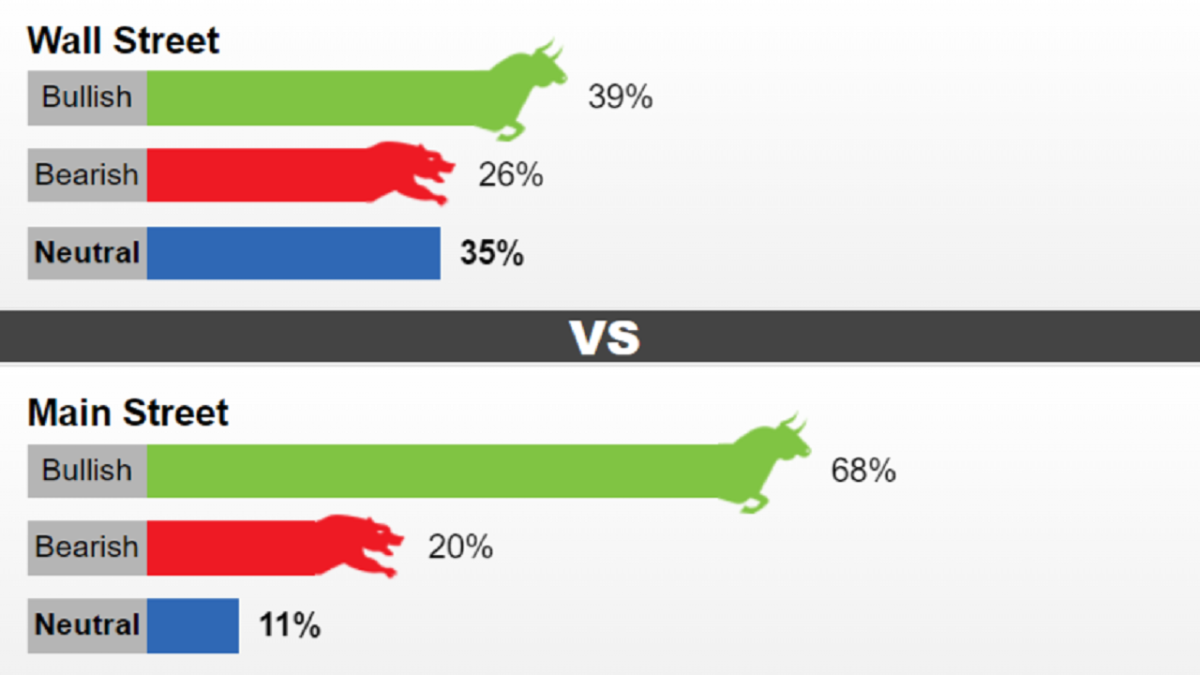

23 Wall Street analysts took part in the Kitco Gold Survey this week. Among respondents, nine analysts (39%) were bullish for gold in the near term. At the same time, six analysts (26%) show a bearish trend for the next week, while eight (35%) think prices will remain flat.

Meanwhile, 1,347 votes were cast in online polls. 930 of the respondents (68%) think that gold will rise next week. Another 278 (20%) said prices will fall, while 156 (11%) said they would remain neutral in the near term.

Despite Friday’s selloff, retail investors expect gold to bounce back to next week’s average target of $2,047. The bullish outlook emerges as gold prices close Friday at $2,08.10 and are roughly neutral compared to Monday’s open. However, before the Easter Long Weekend, prices were down about 1% from Thursday’s close.

Attention! US dollar oversell

Looking at the price action of the coming week, many analysts say that traders and investors should pay attention to the US dollar. On Friday, the US dollar index fell to 100.79, forming a double bottom and hitting a new intraday low for 2023. Darin Newsom, senior market analyst at Barchart.com, says you’d have to be insane to stay bullish on gold. However, he adds that the precious metal is looking a little over the top and selling in US dollars is overkill. Accordingly, Newsom comments:

The contract is in a position to complete a 2-day bearish reversal on its short-term daily chart. While not the most reliable reversal pattern, this will (again) mark the end of the previous short-term 5-wave uptrend. On the other hand, while DXY extends its long-term downtrend below 100.82 February low, it is currently in short-term oversold condition and may see a short-term bounce.

Looking beyond short-term price movements, however, Newsom adds that long-term trends in gold and the dollar remain in place. “None of this changes the long-term trends of gold (up) or the US dollar index (down),” the analyst says.

Marc Chandler, managing director of Bannockburn Global Forex, also says he sees US dollar and bond yields as oversold. “If they go up, gold will lose its position. Although $2,000 offers psychological support, we think the $1,900 region is more important,” explains Chandler.