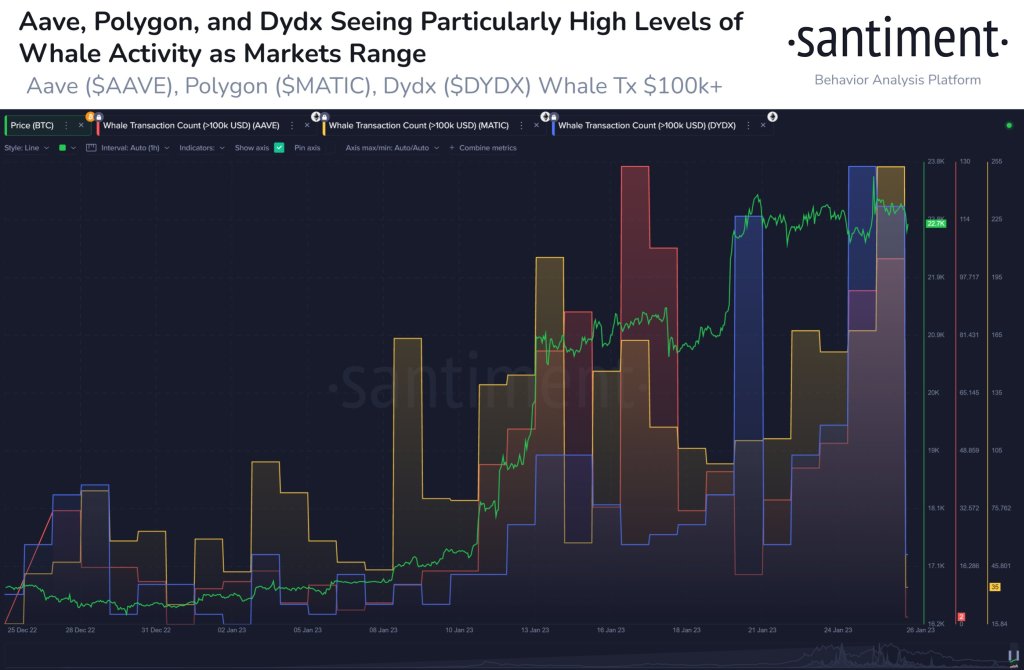

AAVE, MATIC and DYDX witnessed a massive increase in whale transactions in their nets last month. The number of whale transactions on MATIC and DYDX hit the highest level since December alongside double-digit price increases in these two altcoin projects. Experts believe that the growth in interest of major wallet investors in AAVE, MATIC and DYDX should be watched closely.

New Year’s rally from AAVE, MATIC and DYDX

cryptocoin.com As you follow, AAVE, MATIC and DYDX prices rose in January, along with Bitcoin and Ethereum, the cryptocurrencies with large market caps. Experts at crypto intelligence tracker Santiment believe the recent surge in whales’ activity in these networks should be watched closely. Typically, the increase in interest from large wallet investors heralds increased selling pressure and a drop in the asset’s price.

AAVE is the native token of a lending platform built on the Ethereum Blockchain. The altcoin is used to pay transaction fees, participate in management and earn interest on deposited funds. The token witnessed a 56% increase in its price last month.

MATIC is the token of the layer-2 Ethereum scaling solution Polygon. The token is used as collateral for the administration of the platform and for borrowing on the platform. It supports the transfer of a wide variety of other Ethereum-based assets, including cryptocurrencies and NFTs. MATIC price has gained 35% in the last thirty days.

DYDX is a token of a DEX that allows users to trade and lend assets in a fiduciary environment. The token rallied around 95%, witnessing a dramatic increase in its price over a 30-day period.

Three altcoins see rise in whale activity alongside price rally

Interestingly, all three cryptocurrencies have received increased attention from major wallet investors on the network. According to data from crypto intelligence tracker Santiment, large-volume transactions by whales ($100,000) have reached their highest level since December.

Aave, Polygon and Dydx see high whale activity

Aave, Polygon and Dydx see high whale activityExperts at Santiment believe the spike in whales’ activity should be watched closely. Typically, whales start making large profits and sell off their holdings, followed by an increase in selling pressure. This negatively affects the altcoin price and results in a correction.

As seen in the chart above, the increase in Bitcoin price was accompanied by an increase in whale activity. Altcoins followed Bitcoin in the January rally, and whales increased their trading volumes accordingly. Bulls need to be cautiously optimistic when adding AAVE, MATIC and DYDX to their long positions.

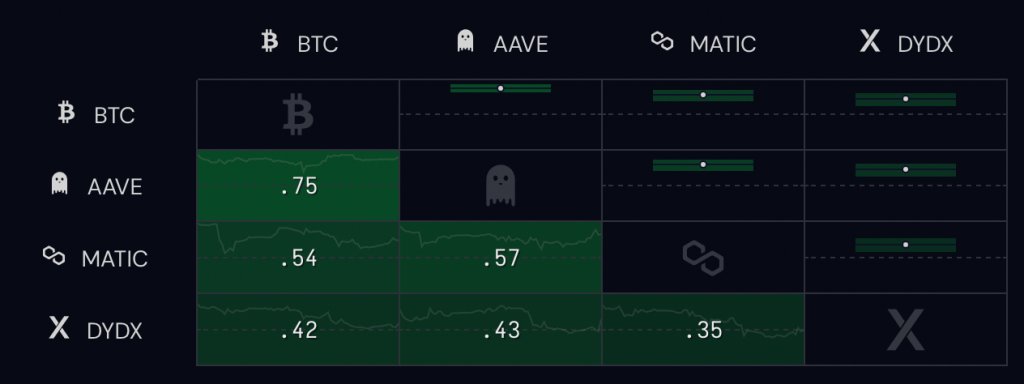

Correlation between BTC and AAVE, MATIC and DYDX

Correlation between BTC and AAVE, MATIC and DYDXA large number of trades typically heralds a correction in an asset and is considered a sell signal. According to analysts, if Bitcoin holds above the $23,000 level and turns it into support, altcoins are likely to follow due to their correlation with the asset.