Crypto analyst Filip L says the Shiba Inu (SHIB) is bearish as profit taking is accelerating among the bulls. According to the analyst, Chainlink (LINK) is at 10% risk of falling under inflated tail risk pressures. The analyst says that Ripple (XRP) traders should only watch these three levels. We have prepared Filip L’s analysis of 3 altcoin projects for our readers.

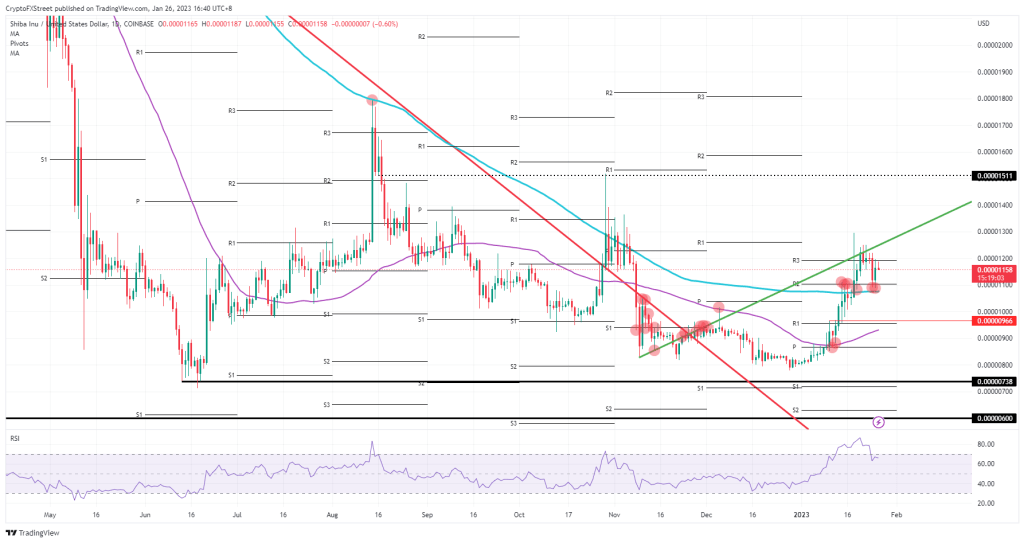

Shiba Inu sees bears crashing the party

SHIB price action is seeing quite a bit of tail risk flare up again as some major events, both monetary and geopolitical, have wreaked havoc on global markets. The balance on the battlefield in Eastern Europe may again shift as Germany and the United States give the official green light to send strategic tanks to Ukraine. This could trigger larger bombings in a tit-for-tat scenario. Russia says this step also increases the risk of nuclear war.

SHIB could see the bulls capitulate due to rising bearish pressure and these tail risks flare up. Price action is supported by R2 and the 200-day Simple Moving Average (SMA) as supportive measures around $0.00001100. US GDP numbers could act as a catalyst if they show contraction. This could push the SHIB tank towards $0.00001000 pretty quickly in search of support after this negative news.

A jump in GDP would be welcomed by markets as a sign that the US economy is still doing well and is holding up fairly well with these rate increases. Traders will adopt the scenario that the Fed has almost finished its march as the economy continues to recover and inflation falls, which means a perfect ‘goldi locks’ scenario emerges. The Shiba Inu will see its buying volume explode on massive demand and rapidly pierce the green ascending trendline towards $0.00001511.

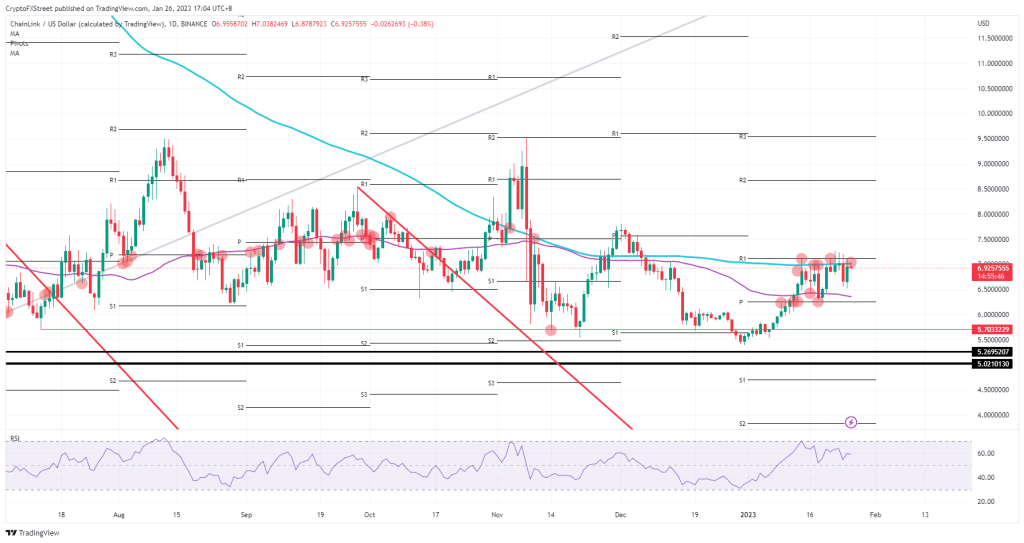

Altcoin risks falling

Chainlink price is trading higher in 2023 and LINK price action has seen the bulls advance on the charts as the risk of a few tails fades a bit into the background. cryptocoin.comAs you can follow, while the markets focused on the decrease in inflation in early January, inflation is still quite high.

Largely traded at a low risk premium for this basket of tail risks, LINK now needs to be repriced. The support at $6.50 looks rather weak and Chainlink price is more likely to need a double layer support at $6.31 with the 55-day Simple Moving Average (SMA) and monthly pivot. Failure to hold this level will end the entire rally and the bulls will hit the $5.27 support.

A good bounce after some economic data this Thursday or Friday will be welcomed by the bulls who have done all the lifting and hard work so far. That means LINK hits above $7.15 after a good US GDP figure this afternoon, or the PCE Deflator falls further on Friday as proof that inflation still continues to drop. This will put the altcoin price back on its way to $9 in February.

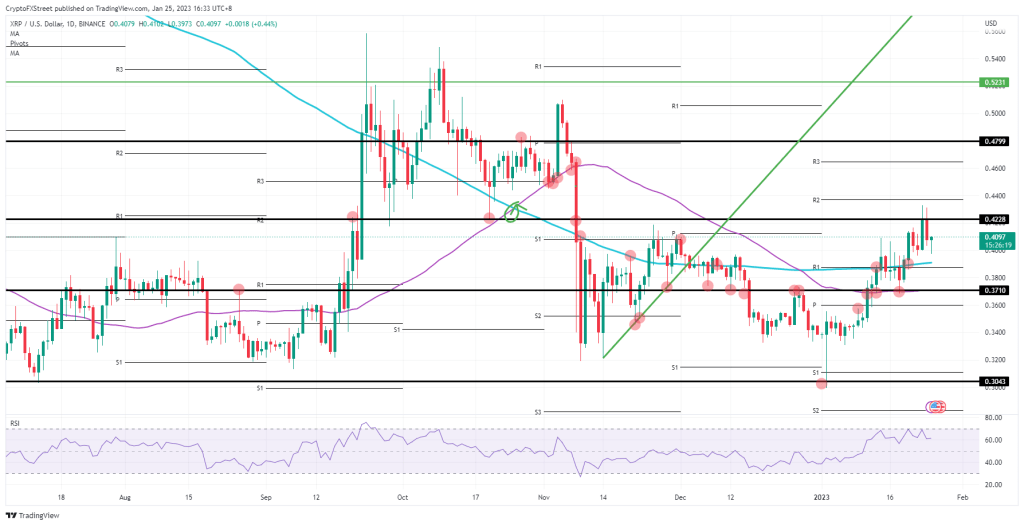

XRP rally inevitable with ample support

Ripple (XRP) price is set to be higher. However, many traders will still have questions about where to enter. Looking at the behavior of XRP in January, it becomes clear that both the 55-day Simple Moving Average (SMA) and the 200-day SMA are the two main levels to watch. It is currently trading around $0.3710 and $0.3900 respectively. Traders should enter one of these levels as a single entry point or use the two levels as a benchmarking guide for a descending trade and buy between the marked levels.

The altcoin has a third scenario or interest level at $0.4228. This level was used as a line in the sand for the head-and-shoulder model from fall 2022. Twice this week already, the bears have pierced $0.4228 which could prevent XRP from making a daily close above this level. This bullish pressure will be successful on its third try. Therefore, if the rally continues after seeking support at the two SMAs, be sure to enter the next break with a profit target of $0.4799. This trade yields between 13% and 30%, depending on which scenario is played.

Unfortunately, however, there is downside risk, and that element of risk is time. Some central banks are ready to make their first monetary policy decisions of the year. Only five to six trading days left. This is a very small window to trade, we are certainly seeing risk and tension after a few hawkish comments that dampened the enthusiasm in the markets at the beginning of the year. If it breaks the $0.3710 downside test, expect to see the rally relax almost completely, price action back to $0.30 and flirting with several-year lows.