The US jobs report showed that unemployment rose in August. This was taken as a sign that the Federal Reserve might slow the pace of rate hikes. After that, gold prices try to hold above the psychological level of $1,700. Analysts interpret the market and look at the yellow metal’s technical setup.

“Any comment about 75 bps in interest will keep gold under pressure”

Spot gold was up 0.19% at $1,714.73 at the time of writing. U.S. gold futures were up 0.17% to $1,725.6. Meanwhile, data showed US employers hired more workers than expected in August. After that, gold rebounded its losses on Friday and rose higher. However, moderate wage growth and the unemployment rate rising to 3.7% indicate that the labor market has begun to loosen. Matt Simpson, senior market analyst at City Index, comments:

The Fed meeting is a little over two weeks away. The ‘blackout period’ is fast approaching. So any comments from Fed members this week have the ability to move the needle in Fed policy. Therefore, Traders will follow these conversations closely. Any comment referring to a 75bps increase will likely put gold prices under pressure.

“Yellow metal rises after employment data”

Meanwhile, DXY hit the top of 20 years. Thus, it made gold expensive for holders of other currencies. cryptocoin.com As you follow, the Fed’s next policy meeting will be held on September 20-21. In a note, ANZ underlines:

Gold rose on Friday as more Americans returned to the workforce. Any easing in the tight labor market will help the Fed tame inflation. It will also potentially reduce the need to tighten rates aggressively.

The US Commodity Futures Trading Commission (CFTC) announced on Friday that speculators reduced the net long position of COMEX gold by 9,599 contracts. Thus, positions fell to 20,726 for the week of August 30.

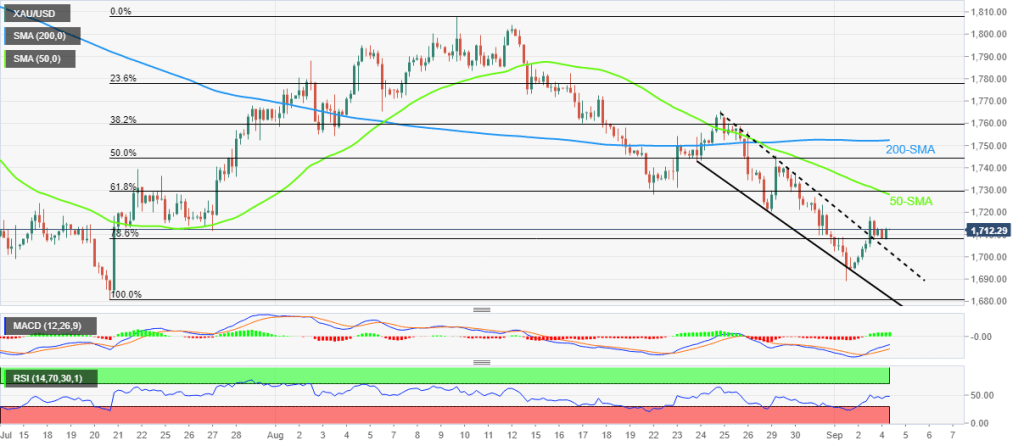

Gold technical analysis

Market analyst Anil Panchal analyzes the technical outlook for gold as follows. A clear break of the eight-day falling wedge is combining the tighter RSI and bullish MACD signals to keep gold buyers hopeful. However, the upward convergence of the 50-SMA and the 61.8% Fibonacci retracement level in the July-August period near $1,729 seems to be a close hurdle for the gold bulls to watch.

Following that, the 200-SMA near $1,753 and $1,766, respectively, and the late-August rally will be important for bullion traders to target. A falling wedge confirmation points to a theoretical target of $1,778. Meanwhile, pullback moves remain harmless until they break beyond the indicated wedge’s resistance line. It currently supports the round figure of $1,700. If the yellow metal price fails to bounce back from the $1,700 support, the bears will hit the yearly low marked around $1,680 in July.