Gold price rallied to its highest level in more than a week on Monday, aided by the weaker dollar. Elsewhere, higher US Treasury yields continue to cap gains in dollar-priced bullion.

Jeffrey Halley: Jury still undecided on gold price

Spot gold was up 0.67% at $1,858 at the time of writing. Prices reached their highest level since May 12 at $1,865.34 on the day. U.S. gold futures rose 0.80% to $1,856.8. Jeffrey Halley, senior analyst at OANDA, comments:

The jury is still undecided on whether gold has weathered the storm in the medium-term or has simply recovered in response to the continued pullback of the US dollar.

“I need to see gold hold its last gains before I move higher”

Dollar index (DXY), investors maintain selling pressure, It fell as the dollar cut bets on more gains from rising US interest rates and hopeful that the relaxation of lockdowns in China could help global growth and exporters’ currencies. A weaker dollar makes bullion more attractive to offshore buyers. Jeffrey Halley says:

I need to see gold hold its last gains against dollar strength amid dollar weakness, before I move higher structurally.

ANZ Bank: These could still be boosters for gold!

As you can follow from Cryptokoin.com news, St. Louis Federal Reserve Chairman James Bullard reiterated last week that the US central bank should raise interest rates to 3.5% this year to more quickly contain high inflation.

The zero-yielding yellow metal becomes less attractive to investors when US interest rates are raised. However, it is seen as a safe haven asset during economic crises. In a note, ANZ Bank economists underline the following:

A worsening macro-economic outlook with high inflation may still be supportive for the gold price. The increased risk of underperformance in equity markets has increased the risk diversification appeal of gold.

“There has been no significant safe-haven inflow to the bottom”

ANZ Bank economists, however, believe that a sale in financial markets can result in significant amounts It states that it failed to pull safe-haven streams towards the bottom. Economists point out the following:

The gold price briefly fell below $1,800 amid rising yields and the appreciation of the US dollar. An aggressive Federal Reserve rate hike and concerns over economic growth caused the US dollar to hit a multi-year high.

“Another test of 200-day SMA is likely for gold price”

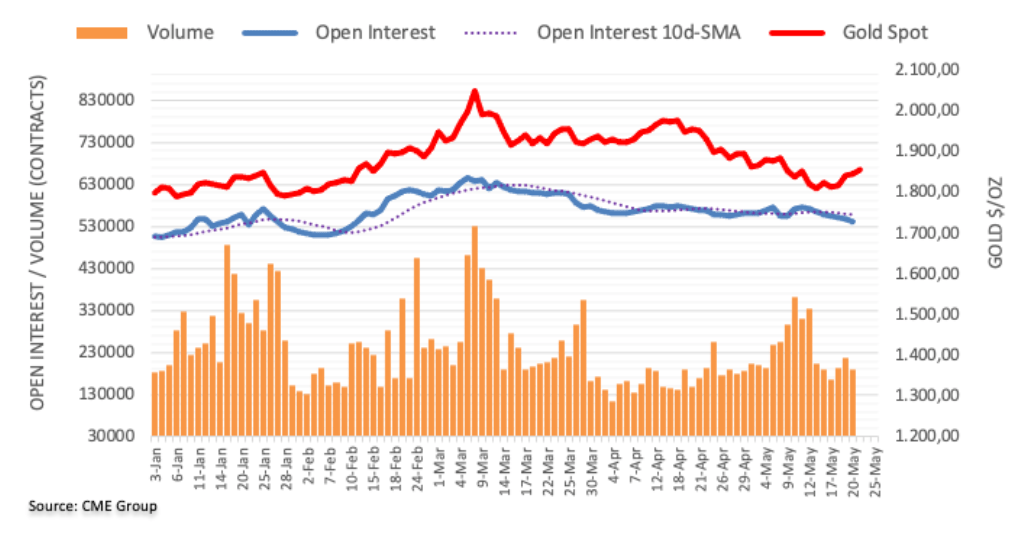

Given CME Group’s advanced data for gold futures markets, open interest broadened its downtrend and narrowed to about 61,000 contracts on Friday. Volume reversed two consecutive daily gains along the same lines, dropping nearly 29.6k contracts.

Market analyst Pablo Piovano states that the increase in gold prices on Friday was accompanied by the contraction in open interest and volume, which indicates that short closing behind the daily gains. However, the continuation of the uptrend does not look favourable in the very near term with a potential visit to the 200-day SMA around $1,835 on the cards.