Some cryptocurrency analysts have revealed their expectations for various altcoin projects. Raul Pal praised Ethereum, while InvestAnswers said he was bullish on Solana. Analyst Sahana Vibhute cited bullish expectations for BNB, LINK and LTC. Here are the details…

Goldman Sachs executive drew attention to the leading altcoin ETH

Former Goldman Sachs executive Raoul Pal said that Ethereum (ETH) is on a rally path as the macroeconomic environment becomes more conducive to crypto. In a new YouTube update, Pal tells Real Vision Finance subscribers that ETH will surpass $2,000 as global growth weakens and inflation trends come down. Pal used the following statements:

Obviously, better-than-expected inflation figures came from the US. This is what I expected – inflation is rolling. Now, it’s still very high, but the problem is that commodity prices are falling. So prices should start to drop. This calmed the bond market. It has given further relief to the crypto markets, relief to the stock markets. I think that’s the big signal. The next signal I’m looking for is that global growth is falling, and that will be confirmed in numbers to come maybe next week or the next.

In the short term, Pal says the crypto could face minor corrections. Ultimately, however, the CEO of Real Vision predicts that ETH will burst at $2,000 with huge psychological resistance.

InvestAnswers rises in Solana

A popular crypto analyst says that smart contract platform Solana (SOL) is bullish while making a call that Bitcoin (BTC) has passed the low point of the bear market. In a new YouTube video, anonymous server InvestAnswers tells its 443,000 subscribers that current metrics show Ethereum (ETH) rival Solana is undervalued. The analyst used the following statements:

When I compare Solana to Ethereum, it should technically be much higher on a relative value basis. And again, we’re just looking at data here. We look at quantity, we look at metrics, we measure everything. This is how we make decisions. Nothing about emotions, how people feel, or what kind of religion or tribe they belong to. We’re just looking at data.

In Bitcoin, the analyst says the influx of money from institutions and the “world’s smartest capital allocators” show that Bitcoin has already crossed the bottom of the last bear market. The host says he is 80-90 percent sure that BTC will not revisit its recent lows.

Expectations in this direction in 3 altcoins

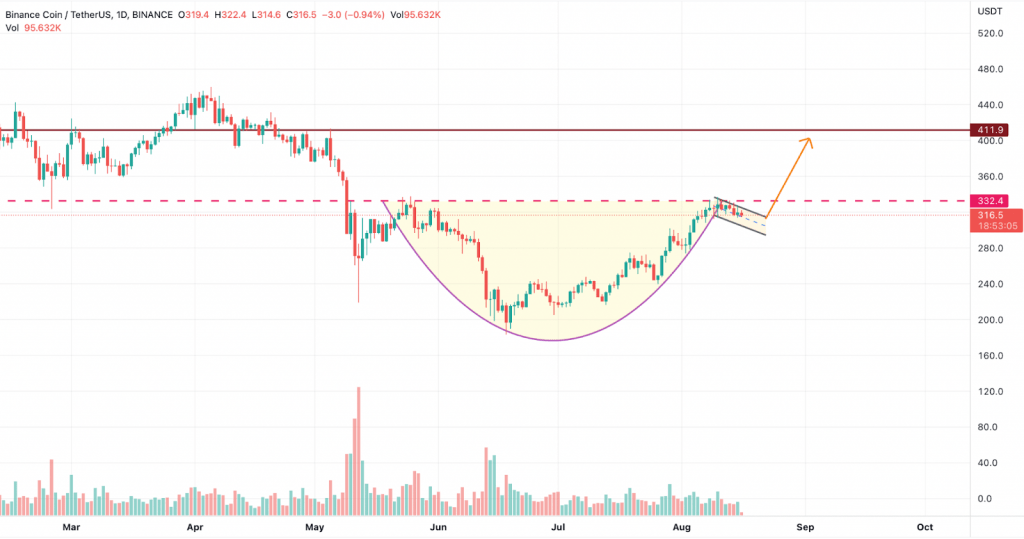

Finally, Sahana Vibhute shared her expectations for BNB Coin (BNB), Chainlink (LINK) and Litecoin (LTC). According to the analyst, Binance Coin is following the predefined path that leads the asset to fly high to reach the first target at the earliest. The bullish momentum may be blocked to some extent as selling pressure builds up. Therefore, after a short consolidation, the uptrend could be triggered that could push the price above $400 this month. Also, a steep rise could not only regain above $300, it could also bounce back above $400 before the end of the month.

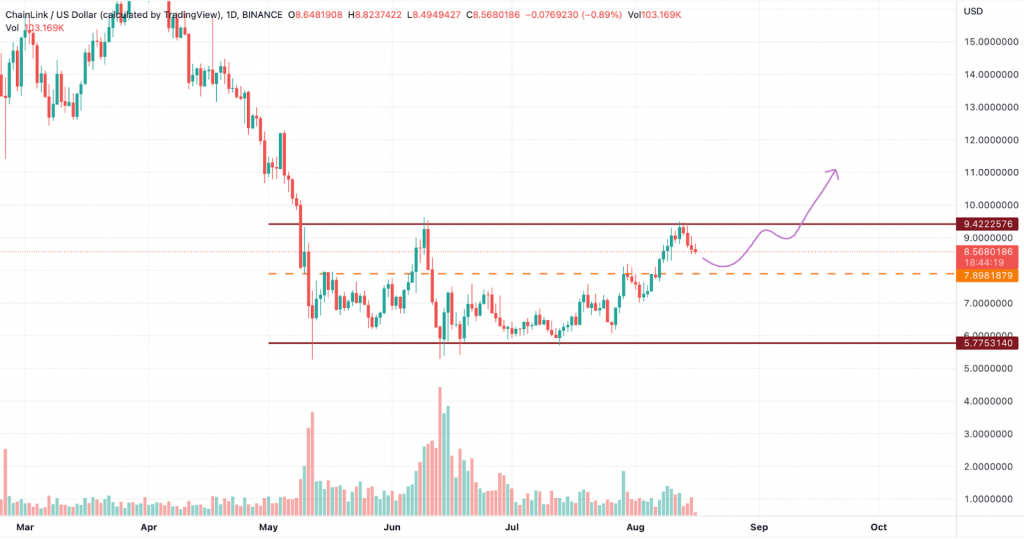

On the other hand, Chainlink showed sharp strength, according to the analyst. It has gone above 50% since the start of monthly trading. A recent rejection of the upper resistance at $0.43 could push the price down. LINK price was rejected for the second time at the same resistance. The trend has reversed significantly which could put significant bearish pressure on the asset. Therefore, the probability of a minor decline arises for a drop below $8 and initially near $9.5 and then back to the resistance at $10.

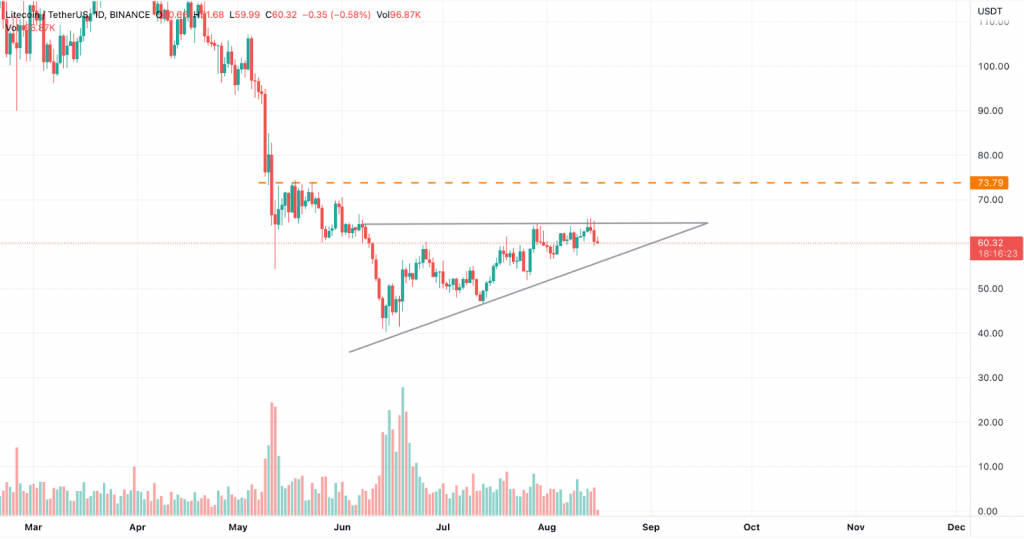

Litecoin price, on the other hand, maintained a quiet trend with an attempt at a less steep recovery. However, despite the price dropping multiple times, the trend continued to rise. Therefore, the possibility of a rise above $75 arises. As mentioned earlier, the trend is up inside an ascending triangle that is expected to remain until the end of the current trading month. Currently, sellers are in the dominance and therefore a significant pullback could push the price back just below $60 and backfire.