Fed chairman Jerome Powell, ECB’s Lagarde, continues to advocate higher rates in the fight against inflation. Gold price is trading amid cautious optimism on Friday. Accordingly, it is hovering near $1,718 while consolidating the previous day’s losses. According to analysts, the recent rise of the yellow metal may also be linked to a lack of big data.

“The stars align for additional drop in precious metals”

cryptocoin.com As you follow, gold posted significant daily gains on Friday. However, TD Securities strategists expect the yellow metal to move lower. In this context, strategists make the following comment:

Gold prices are flirting with the breakout of a ten-year uptrend around $1,675. At the same time, the stars are aligning for additional drop in precious metals. Gold prices have now accurately captured the expected level of interest rates. However, they do not reflect the consequences of a sustained period of restrictive policy.

“China’s appetite for gold continues to wane”

According to strategists, gold markets are in a highly concentrated and bulging position held by a small number of family offices and proprietary traders, who are increasingly at risk as prices approach pandemic-era entry levels. From this, strategists come to the following conclusion:

We follow the positions of Shanghai gold traders. Data indicate that China’s appetite for gold continues to decline. It also indicates potentially leading to a liquidation gap.

Gold price technical analysis

Market analyst Anil Panchal analyzes the technical outlook for gold as follows. Gold price supports a sustained bounce from a seven-week ascending support line at $1,688. This move is again moving towards the 21-day EMA barrier surrounding $1,730.

The recovery moves are also taking cues from the upcoming bullish crossover of the MACD and the recent recovery in the RSI. In a situation where gold breaks above $1,730, the upper line of the four-month bearish channel stands at the latest around $1,770. It will be very important to watch this.

Alternatively, pullback moves remain unclear until the price stays above the $1,688 support line. Also, the annual low of $1,680 acts as a negative filter. However, if the golden bears continue to break the reins above $1,680, there are chances to witness a gradual southward run towards the $1,600 threshold, which includes the support line of the aforementioned channel.

Pablo Piovano: More consolidation in store

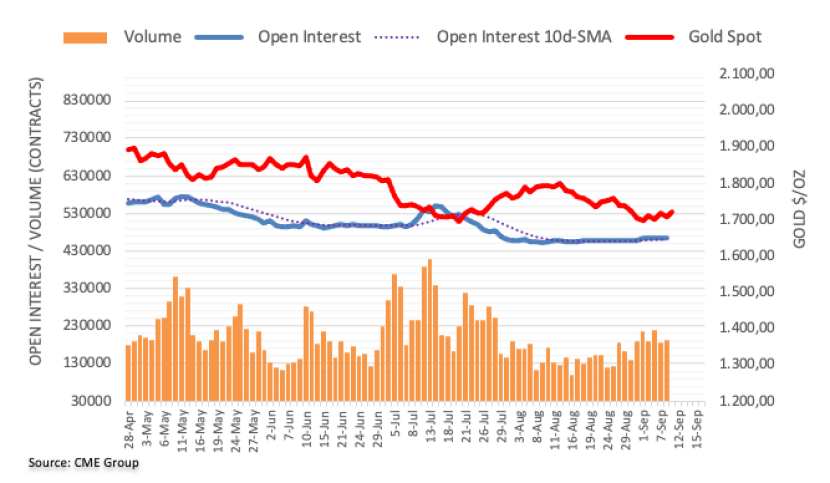

CME Group’s latest data for gold futures markets showed open interest rose 838 contracts on Thursday. It also revealed that it partially reversed the previous day’s decline. Volume followed suit, with nearly 6.6k contracts up.

Gold prices posted modest losses amid the broader multi-session consolidation phase on Thursday. The analyst notes that the daily decline is behind the rising open interest and volume. Also, this indicates further declines are supported by the close target of $1,680, the 2022 low.