Gold prices climbed to a one-month high on Friday and rallied above a weak US dollar. That seems to have set the nugget on track for its third consecutive weekly gain. We have compiled the market comments and analyzes of analysts for our readers.

Matt Simpson: A move towards $1,900 is possible for gold

Spot gold price hit $1,873.9, its highest level since May 9, at the time of writing. At the time of writing, it was down 0.2% to $1,864.50. However, gold prices are up about 0.8% so far this week. U.S. gold futures were down 0.26% at $1,866.5.

As the dollar moves down, making dollar-priced bullion more attractive to offshore buyers, City Index senior market analyst Matt Simpson

We think it has seen a significant drop near $1,828 and a move towards $1,900 is possible once the bullish momentum returns.

“Large speculators and managed funds increased their net long gold purchases”

Gold prices, decline in dollar and US special It rose more than 1% on Thursday, supported by data showing employment rose less than expected last month.

As investors see the yellow metal as a safe haven, signs of economic crisis may be supportive of gold demand. Matt Simpson continues with his assessment:

Also, major speculators and managed funds increased their net long gold positions last week for the first week of the six-week series, indicating support at lower levels in this case.

Wang Tao: A break above $1,879 could open the door to the upside

By the way Cryptokoin.com , the two politicians announced on Thursday. The Federal Reserve will continue to tighten its monetary policy beyond the half-point rate hike expected at each of its next two meetings.

As it is known, higher short-term US interest rates increase the opportunity cost of holding non-interest bearing gold. According to Reuters technical analyst Wang Tao, spot gold price could test the resistance at $1,879, a break above it could lead to a gain of $1,892.

Pablo Piovano: Gold faces strong resistance near $1,870

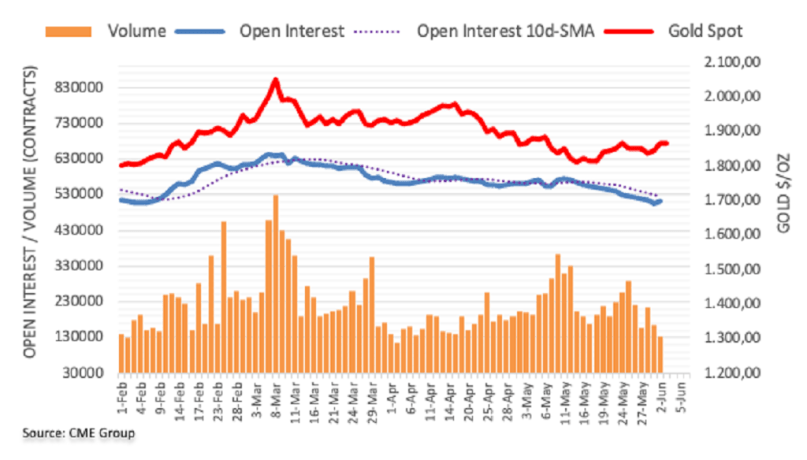

CME Group’s latest data for gold futures markets, short position since May 12 He noted that it has increased for the first time and the increase is currently about 5.7 thousand contracts. Instead, volume contracted for the second consecutive session, this time to around 30.4k contracts.

According to market analyst Pablo Piovano, the strong rally of gold on Thursday was behind the rising open interest rate and opens the door to more gains in the very near term. Against this, the precious metal is facing stiff resistance near $1,870.