Gold price continues to move between $1,800 and $1,850. Under the influence of opposing forces, the yellow metal has yet to emerge from the range trade. In this context, TD Securities strategists note that gold is pulling in two directions. Senior analyst Edward Moya, on the other hand, sees gold below $1,800 as unlikely.

“Below $1,800 seems less likely for gold price”

Some analysts say the Fed fears a recession. On the other hand, recession fears are likely to provide shelter demand for gold. Edward Moya, senior market analyst at Oanda, comments in the market update:

Wall Street will likely be inclined to expect more rate hikes from the ECB. This will weaken the dollar. It will also lead to weak growth outlook, which will trigger the safe-haven buying of gold. For now, the gold price is still stuck in a wide trading range. However, a drop below $1,800 seems less likely as the top of the dollar may be in place.

TDS: Gold pulls in two directions

cryptocoin.com As you can follow, central bank governors spoke at the European Central Bank’s (ECB) Sintra conference. However, gold is unlikely to break out of the last trading range, according to the TD Securities strategists’ report. Strategists comment:

Fed Chairman Jerome Powell spoke on a panel at the ECB’s Sintra conference. However, gold markets are set to remain firmly locked in the last trading range. A hawkish Fed regime clashes with recession fears. That’s why the yellow metal is pulled in two directions.

“Golden beetles sniff out a potential stagflationary outcome”

After all, the US5-30s curve already points to a high probability of recession in the next twelve months, according to strategists. Therefore, the Fed walk cycle tends to be associated with increased recession risks. However, strategists say the Fed’s ability to control inflation is limited given the supply-side disruption. In this regard, they note that this walking cycle differs from recent historical analogues. From this, strategists come to the following conclusion:

Golden beetles sniff out a potential stagflationary outcome associated with lower growth. However, central banks faced a credibility crisis due to persistent inflation. For this reason, it should be taken into account that they can continue to increase interest rates for a longer period of time than they will. In this scenario, pricing for a Fed pivot will be less associated with the likelihood of a recession than in previous periods.

Pablo Piovano: Gold price now targets $1,800

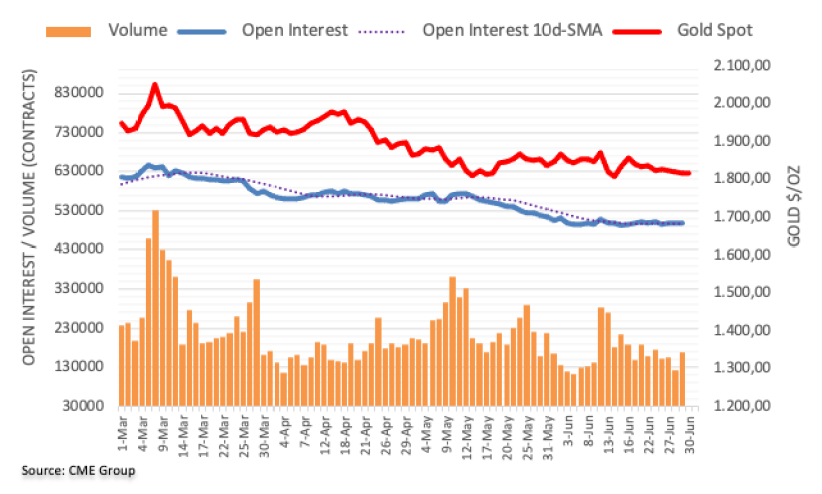

CME Group’s latest data for gold futures markets noted that open interest rose by nearly 2.2k contracts on Wednesday. Along the same lines, volume increased by approximately 45.6k contracts. Accordingly, he carried the irregular performance to another session.

According to market analyst Pablo Piovano, the gold price remained on the defensive amid rising open interest and volume on Thursday. Against this, the analyst says that the yellow metal has now shifted its focus to key support in the $1,800 region.