Gold prices and other precious metals fell on Friday and investors flocked to the dollar with bets that the US Federal Reserve will stick to aggressive rate hikes.

“Gold holds up relatively well compared to industrial precious metals”

The dollar is rising as things look potentially negative in the US, according to Bart Melek, head of commodities strategies at TD Securities. and this is damaging the gold. The strategist also states that the market is aware of the possibility of seeing very aggressive rate hikes.

As you can follow on Cryptokoin.com news, the rival safe-haven dollar has climbed to fresh 20-year highs and sold gold to other currency holders due to concerns that tighter monetary policies will harm the global economy to rein in rising inflation. It made it less attractive. Bart Melek makes the following assessment:

However, gold prices hold up relatively better compared to industrial precious metals. However, demand may suffer in a recessionary environment.

“Downward pressure on gold prices continues”

TD Securities economists expect the yellow metal to remain under downward pressure. Strategists interpret the current situation as follows:

A liquidity gap is pulling all assets down and causing gold to be wasted, challenging its safe-haven status, despite the violent rally in Treasuries.

Strategists note that significant sales inflows continue to put pressure on the yellow metal at a time when liquidity is scarce, with CTA trend followers joining the liquidation party. According to strategists, gold prices are struggling to sustain the bull market period that defined the uptrend in the yellow metal under the pressure of this selling flow. Finally, the strategists underline the following points:

For now, the trend line has remained despite the strong CPI report as turbulence in risk assets triggered Treasury bonds. But gold continued to see a significant amount of indifferent positions, which could put pressure on prices, while short traders’ positions began to rise from near-record lows.

Pablo Piovano: Gold prices now looking at $1,800

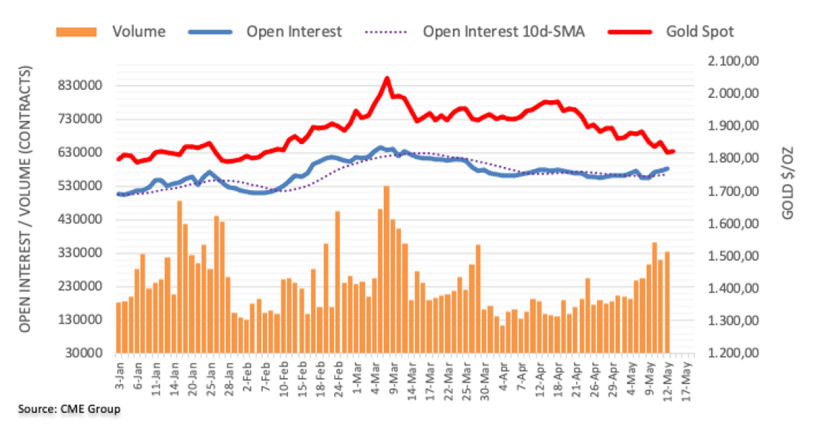

CME Group’s latest data for gold futures markets shows that the short position has been around this time for the third consecutive session on Thursday. It pointed to an increase of 6.2 thousand contracts. Along the same lines, volume partially reversed the previous decline, with nearly 23.5K contracts rising.

According to the analyst, the significant drop in gold prices on Thursday was behind the rising open interest and volume, suggesting that the extra decline in cards continues in the very near term. However, the analyst states that the next critical support is at the $1,800 level.