This altcoin could experience a drop in user activity as well as ETH price with crypto staking at the SEC’s sight.

This altcoin has seen its worst performance of the year

Ethereum’s native token ETH saw its worst daily performance of the year when the United States Securities and Exchange Commission (SEC) stopped Kraken, a cryptocurrency exchange, from offering crypto staking services.

On February 9, Kraken agreed to pay $30 million to settle an allegation that the SEC broke securities rules by offering crypto staking services to US retail investors.

In particular, the news drove the prices of many proof-of-stake (PoS) blockchain project tokens down. Ethereum, which switched to a staking-based protocol in September 2022, also suffered.

On February 9, the price of ETH dropped nearly 6.5% to $1,525, the biggest single-day drop since December 16 of last year.

Will Ethereum staking survive SEC pressure?

The SEC’s crackdown on crypto staking begins as it awaits the launch of Ethereum’s major network upgrade, dubbed Shanghai, in March. The update will eventually allow Ether validators, entities that have locked around $25.6 billion worth of ETH tokens in Ethereum’s PoS smart contract, to withdraw their holdings alongside return rewards.

As a result, numerous analysts, including Bitwise Asset Management’s chief investment officer Matt Hougan, see Shanghai as a bullish event for Ether. But doubts are being raised about the future of crypto staking in the US, as Brian Armstrong, CEO of the Coinbase crypto exchange, fears that the SEC will ban staking for retail investors in the future.

1/ We're hearing rumors that the SEC would like to get rid of crypto staking in the U.S. for retail customers. I hope that's not the case as I believe it would be a terrible path for the U.S. if that was allowed to happen.

— Brian Armstrong (@brian_armstrong) February 8, 2023

Also, some analysts claim that banning Ether staking services will force users to move away from Ethereum.

Ethereum requires stakers to deposit 32 ETH (~$50,000) into the PoS smart contract to become a validator. As a result, retail investors often use third-party staking services that pool smaller amounts of ETH to enable validator status.

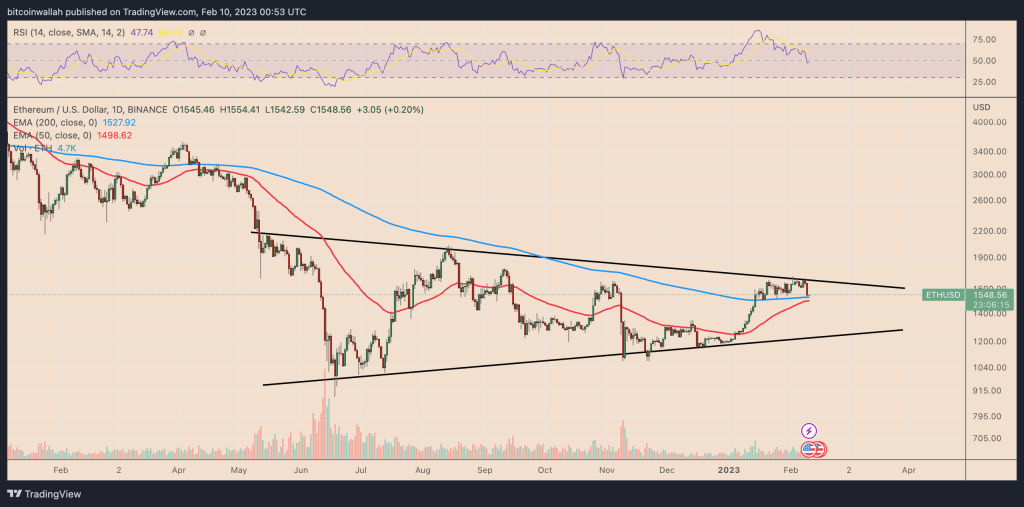

ETH price sees a bearish trend

From a technical standpoint, Ether price is positioning for a possible 20% price correction in February. Especially on the daily chart, ETH price is undergoing a pullback after testing several months of descending trendlines as resistance. It is currently holding the 200-day exponential moving average (200-day EMA; blue wave) near $1,525 as support.

Ether risks falling below the 200-day EMA support wave due to negative market fundamentals. Such a scenario includes the next downside target of $1,200, which coincides with several months of ascending trendline support.

unstable acceleration

Cardano and XRP prices are poised to witness a steep drop below key support levels as the market has experienced unsteady momentum in the last 24 hours.

Additionally, while AI cryptocurrencies have gained attention, the price movements of altcoins have become unusually erratic. This could lead to huge fluctuations in Cardano and XRP prices, which will likely affect traders to turn their attention away.

Cardano price analysis

The ADA price witnessed a downtrend of more than 7% last week as traders did not hesitate to book profits, causing bears to dominate the price chart. However, despite the bearish pullback, Santiment has witnessed strong interest from whale investors as it recorded a surge in transactions valued at $100,000, hitting a new high in 2023. Also, Cardano’s TVL locked in DeFi increased by over 100%, making it strong.

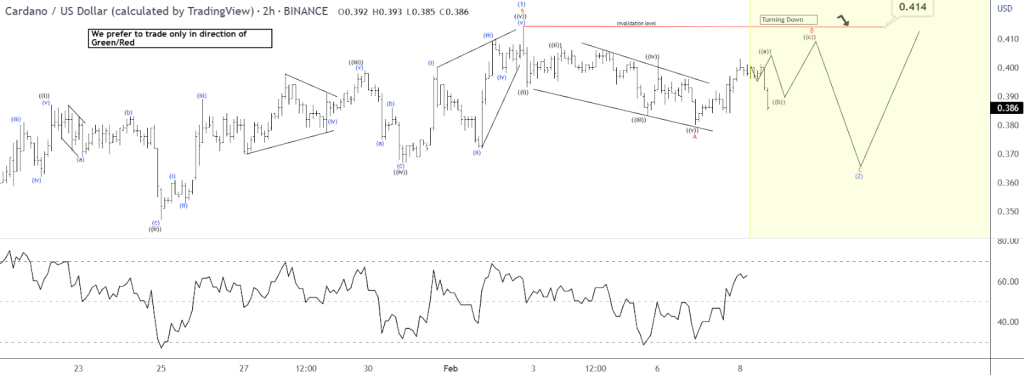

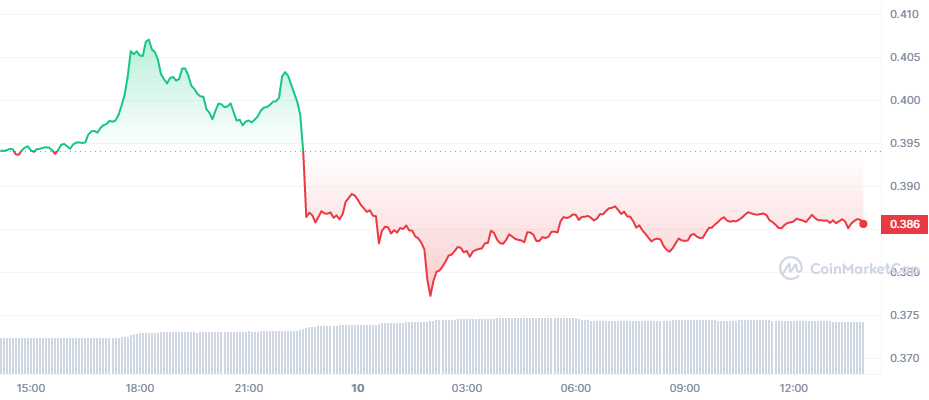

ADA price is up 0.5% to trade at $0.388. Analyzing the daily price chart, ADA price is preparing for a downtrend as shown in the Elliott chart. Cardano may invalidate the bullish rally after falling to $0.414 and a retest at the $0.405 resistance could send the token to $0.365.

Also, the SMA-14 is moving on the verge of the overbought zone and soon this altcoin could see a serious downtrend on its price chart. A break below the EMA-100 trendline will drop the coin to $0.32.

XRP price analysis

As the bears maintain the pressure, XRP continues to face a tough period as the price hovers close to a critical support level. Unfortunately, the high volume of sales activity indicates that it may be too soon to imagine a turning point.

cryptocoin.com According to data, this altcoin is trading at $ 0.397, up 0.7%. If the bears continue to sell with high volume, the token could see a break below the EMA-100 support level at $0.39. A prolonged downtrend in the XRP price chart could witness sustained selling points, bringing the token below $0.365.