Bitcoin price has returned to 2020 levels this year with the blow of FTX after Terra. After a year full of bankruptcies, now all eyes are on 2023. Are we at the end of a bear market, could February be a game changer? Let’s take a look at what analysts are saying.

Could February 2023 be a game changer for Bitcoin?

Bitcoin price had already dropped significantly in 2022 before FTX’s sudden bankruptcy last month. While investors expected a recovery throughout the year, BTC remained under pressure despite all efforts. Now all hope is in January, when we will move to a new page. However, as crypto analyst Daan Crypto noted, the first months of the year have historically closed lower for Bitcoin. The analyst, backing his claim with data, states that since 2013, 60% of January months have resulted in negative returns. The positive news is that February is usually ‘green’…

Historically, January isn't the best month for #Bitcoin with 60% of the months since 2013 ending up with a negative return.

We can also see how the percentage change on average in January is quite large. Both up and down.

Will January bring some volatility back into the market? pic.twitter.com/RmFJ86DtNq

— Daan Crypto Trades (@DaanCrypto) December 28, 2022

In his analysis, Daan Crypto mentions that February is BTC’s best ‘return’ month. “Besides that, February was one of the best paying months for BTC. Keep in mind that these data are not a reliable indicator for future returns,” he says. As for the analyst’s current Bitcoin price forecast, he said all eyes are on the $16.9-17,000 region, which has been rejecting prices for a while. cryptocoin.comAs you follow, BTC spent the month of December below this region.

$BTC Back in the "Christmas Range" between ~$16.7-16.9K.

The idea/feeling I had of a weak breakdown being a fake out seems to be accurate for now.

Eyes on the 16.9-17K area from here which has been rejecting price for some time now. https://t.co/UjXwIW9GyW pic.twitter.com/g4tbXbKr3l

— Daan Crypto Trades (@DaanCrypto) December 28, 2022

What does on-chain data say about BTC?

While Bitcoin is consolidating, another crypto analyst Ali Martinez suggested that the direction of the trend could be determined by a move between $16,000 and $17,000. According to on-chain data from IntoTheBlock, there are two major supply barriers at 16,600 and 17,000, respectively. Here 1.46 million addresses hold 915,000 and 730,000 Bitcoins, respectively.

#Bitcoin sits between two significant supply walls. One at $16,600 where 1.46 million addresses hold 915K #BTC and the other one at $17,000 where 1.27 million addresses hold 730K $BTC.

A sustained move outside of this area will likely determine the direction of the trend. pic.twitter.com/oGNdbcPV0k

— Ali (@ali_charts) December 26, 2022

Two key resistance levels to break for the rally

Crypto analyst Michaël van de Poppe, who updated his analysis on this issue, says that the $ 17,400 and $ 17,700 levels are critical. Here’s what they said in their latest YouTube post:

If we move up we are looking at a situation where there are some important resistances that we can focus on; Of course, we caught this resistance at $17,400 and we have another resistance near $17,700. If these two are broken, the upward acceleration can accelerate.

The analyst also warns that if Bitcoin drops below $16,600, the scenario could disrupt the market overall. This line represents bullish support, which helps protect the price from a possible collapse. Elsewhere, crypto analyst Jim Wycoff noted that Bitcoin will likely end the year on a volatile path as both bulls and bears are showing insufficient strength:

Price continues to move sideways and fluctuating. Neither the bulls nor the bears have a short-term technical advantage, suggesting that the same sideways move will continue in the short-term. Look for more active positions as the new year begins.

“Bitcoin is preparing for a big and unexpected leap in 2023”

According to the predictions of TechDev, one of the popular Twitter analysts, Bitcoin may start to make up for all its losses in 2022 next year. In a new analysis, TechDev says market sales in 2021 started in the second quarter of the year, not the November peak:

We start with the total value of the altcoin market, where I see the market divided into a cyclical set of regions, Correction > Accumulation > Markup. The chart below shows why I believe we are saving and what I can expect next. It also serves as further evidence of the correction starting in Q2 2021, breaking the local RSI uptrend like the previous correction.

RSI stands for “relative strength index” that analyzes Bitcoin’s candle oscillation over 14 periods. TechDev says the broader market structure mimics late 2016/early 2017.

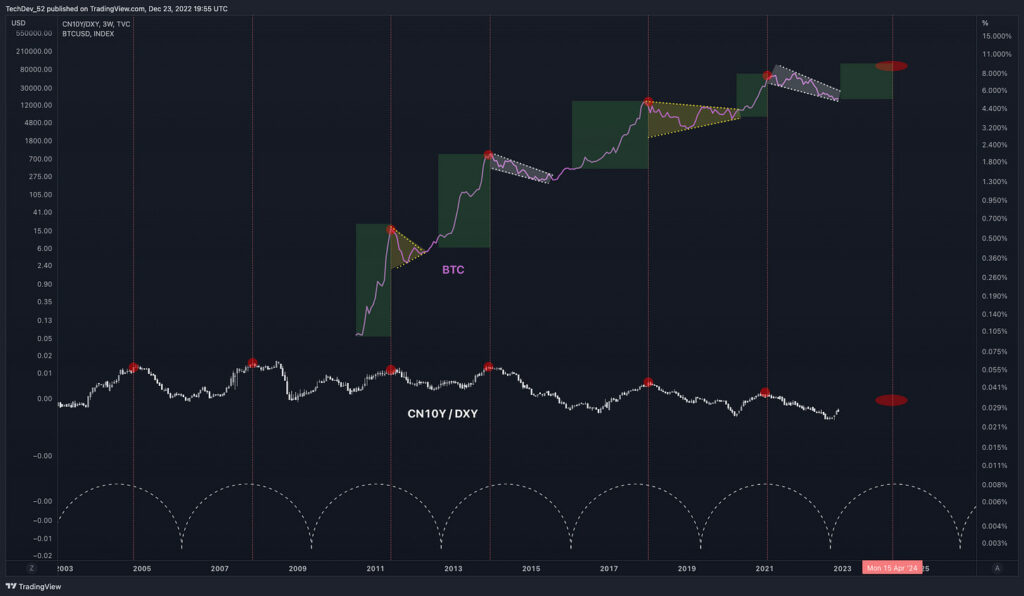

He also adds that Bitcoin tends to follow the global liquidity “cycle.” TechDev thinks this cycle is illustrated by charting the Chinese 10-year bond yield (CN10Y) against the US dollar index (DXY).

Finally, the analyst says the chart’s local tops have “fallen steadily along the trendline” since 2014:

His next hit can predict the next Bitcoin/crypto peak. Cyclical timing over the last 20 years suggests that this could be between late 2023 and mid 2024.