Bitcoin price is about to test the critical 200-week moving average line as support. Technical analysts such as Michaël van de Poppe and Skew argue that the region will lead to dynamism.

Analysts expect “pretty big move” for Bitcoin price

Data from TradingView shows that the BTC price is down 0.5% on the day to approach $26,500. The latest US macroeconomic data has led to a decline in all markets, including cryptocurrencies.

In his current analysis, popular crypto analyst Michaël van de Poppe said, “Individual investors are showing such extreme bearish bias in Bitcoin and crypto that it is almost insane.” Poppe attributed the negative sentiment to the bankruptcy of FTX, which caused widespread collapse in 2022.

Retail is so extremely bearish on #Bitcoin and #Crypto, it's almost insane.

People are stuck in the 2022 mindset.

— Michaël van de Poppe (@CryptoMichNL) May 27, 2023

“Big moves are coming” at $26,000

Elsewhere, popular trader Skew points out Bitcoin’s strong reaction near $26,000. There are more important trendline challenges developing right now, according to the analyst.

In his analysis of the 4-hour BTC/USD chart yesterday, Skew said, “Price is trying to regain the 100D MA after a nice rise from the 200W MA. The price is currently fixed between the 4-hour EMAs and 1-day EMAs,” he said. The crypto analyst, for $26,000, said, “I expect a pretty big move soon. I think the break will happen here,” he said.

Skew later reported that the “foam” on exchanges and open interest in Binance exceeding $300 million had been cleared.

$BTC Binance Open Interest

Price is hovering around previous breakdown & majority of the OI has been cleared out-12K BTC ($320.9M)

a lot less froth in the market meaning whichever way spot moves, probably wouldn't fade it pic.twitter.com/dgb9OW2GnB

— Skew Δ (@52kskew) May 27, 2023

The technical analyst isn’t the only one who wants a marked change in BTC price behavior next. This week, Glassnoda analyst Checkmate predicted “big moves are coming.” A later overview of some key on-chain metrics showed BTC/USD at a “decision point.”

Bitcoin price is still in the “consolidation” phase

On the other hand, Rekt Capital stated that additional strength is still needed to turn the tide in favor of the bulls.

Referring to the 1-day chart, “BTC is still in the middle of the red downtrend channel. It consolidates here with the red resistance area above the critical one to beat if sentiment is to change decisively in the short term.”

This chart also showed a bearish head-and-shoulder pattern. Something Rekt Capital has previously warned will result in a longer-term bearish phase, including a trip towards $20,000.

Glassnode reports 14% of investors are at a loss

The on-chain analytics firm says that BTC’s drop from $30,900 has put another 2.71 million Bitcoins in the loss zone. This accounts for about 14% of the total BTC circulating supply. According to the analytics firm, the latest drop has increased the total supply of Bitcoin at loss from 3.96 million BTC to 6.67 million.

The -14.6% drop from the local top of $30,900 pushed 2.71 million BTC towards our current spot price of $26,400, equivalent to 14% of the circulating supply. This brings the total supply up 68.4% from 3.96 million to 6.67 million BTC over the period in question.

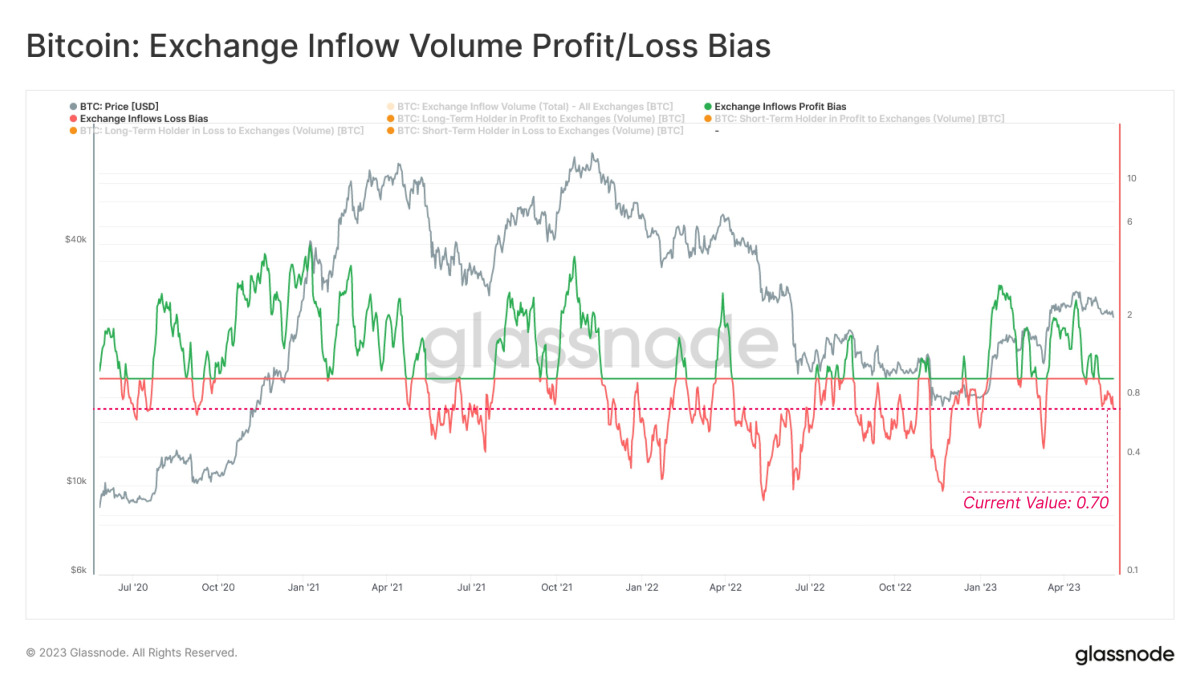

Glassnode also realizes that more of the Bitcoin flowing into cryptocurrency exchanges is at a loss based on the profit/loss ratio comparing the number of losing coins with the profitable ones. According to the analysis:

When evaluating the profit/loss ratio (bias) of the Bitcoin volume invested in the exchanges, we note that the current negative trend is 0.7, indicating that cryptocurrencies are flowing into the exchanges at a loss.

According to the analytics firm, Bitcoin’s short-term holders (STH) were responsible for most of the BTC flow to exchanges recently. Meanwhile, cryptocoin.comAs we have quoted, Michaël van de Poppe’s latest statements point to the increasing hesitancy among investors.