Bitcoin (BTC) witnessed a brutal crash last week with the collapse of the Terra ecosystem. Since then, it has been fluctuating around $30,000 and the death cross theme that could trigger a new wave has taken place.

Bitcoin (BTC) has reached 3-day death cross, can more drops come?

An important red mark on the technical charts is Bitcoin crossing a 3-day red chart. The last two times this has happened, the BTC price has corrected by an astonishing 50%. If Bitcoin repeats this performance, $15,000 could be next. Popular crypto analyst Lark Davis writes:

Interesting observation about the Bitcoin 3-day death cross. The last two times, the bottom was reached 6 days and 10 days after death cross. Did we hit the low a day before this time passed? Or another accident? Latency indicator, past performance does not show the future.

Amid the recent market correction, there is a massive BTC inflow on the exchanges. As on-chain data provider Glassnode explained:

Number of Bitcoin Addresses Posted to Exchanges (7d MA) reached 7,918,940, a 4-year high, on May 13, 2021, a previous 4-year high It was observed with a level of 7,903,512.

Further, the RSI chart shows that Bitcoin has never been oversold at this point. Therefore, investors may want to wait a little longer before placing chips.

BTC accumulation continues

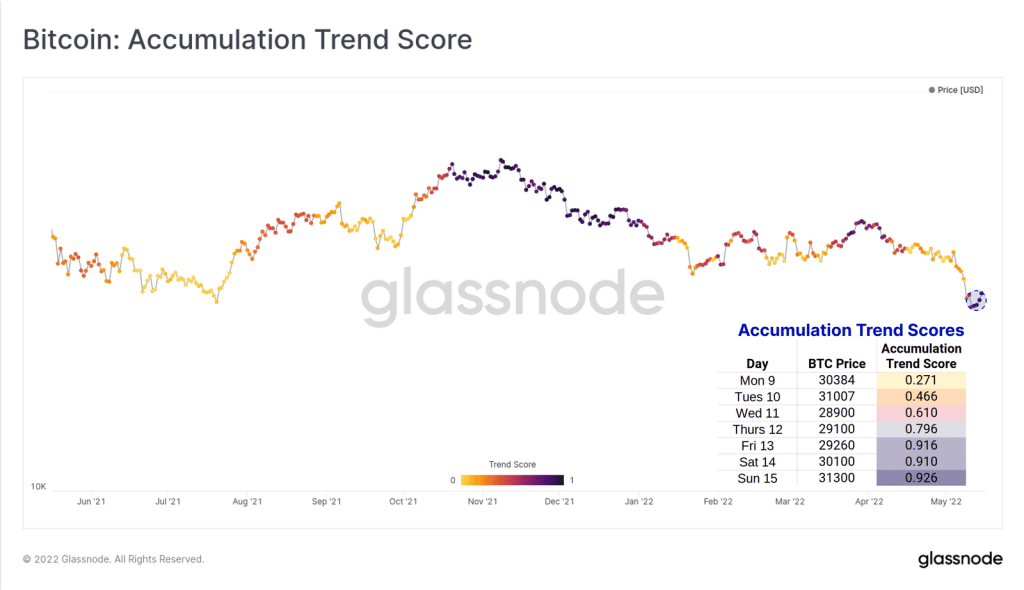

Kriptokoin.com Glassnode reported that BTC accumulation continued during last week’s major price correction. Glassnode data presented an accumulation trend score approaching 1. On-chain data provider writes:

On Thursday, May 12, at market low, the Accumulation Trend Score reversed from very weak values below 0.3 to above 0.796. Supporting Bitcoin price’s return to $30,000, the Score returned above 0.9 for the remainder of the week, indicating strong buy-side activity.

However, Glassnode explains that small investors with balances of less than 1 BTC are the biggest accumulators. However, investors holding 100 BTC to 10,000 BTC showed an overall weakness in net accumulation.