In the wake of FTX’s bankruptcy, the largest centralized exchanges are sharing evidence of reserve to regain investor confidence. Here are the altcoins/tokens in Bitfinex, OKX and Kraken’s basket…

Bitfinex releases altcoin reserves after FTX bankruptcy

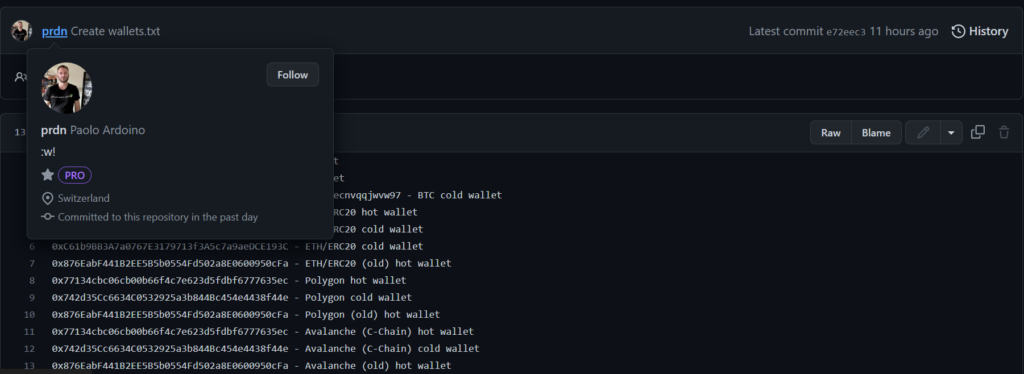

This year’s collapse of Terra (LUNA), 3AC, Celsius, Voyager, and then FTX has once again highlighted the need for exchanges and businesses’ reserves to be transparent. Amid the ongoing fear and uncertainty among investors, Bitfinex is posting proof of its reserves. CEO Paolo Ardoino shared the list of major Bitfinex wallets, which was last updated on November 11.

According to the GitHub proof of reserve provided by Ardoino, the exchange currently has a total of 135 cold and hot wallets. The largest portion of the exchange’s reserves consist of Bitcoin and Ethereum:

- 204 thousand 339 (204338.17967717) Bitcoin (BTC)

- 2018 thousand (2018.5) L-BTC

- 1,000 BTC on the Lightning Network

- 1 million 225 thousand (1,225,600) 600 Ethereum (ETH)

OKX’s altcoin reserves

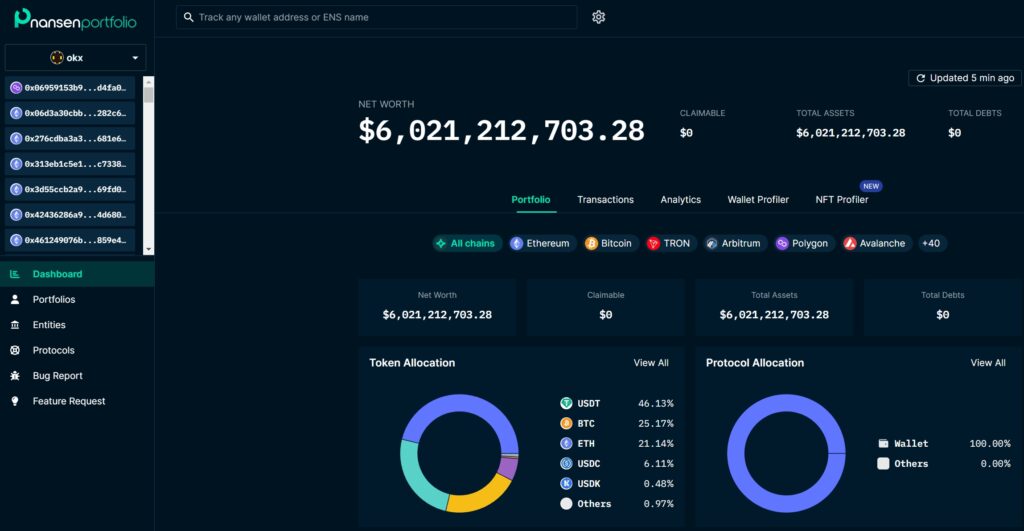

Like Binance and Bitfinex, OKX has also released some of its reserves on social media. The Seychelles-based crypto exchange reports that there are $6 billion in reserves in cold wallets. The distribution of the 6 billion dollar reserve of OKX provided through Nansen is as follows:

- Tether (USDT) – 46.13%

- Bitcoin (BTC) – 25.15%

- Ethereum (ETH) – 21.07%

- USD Coin (USDC) – 6.19%

- USDK (USDK) – 0.48%

- Others – 0.97%

Kraken’s reserves

The US-based cryptocurrency exchange offered its reserves to the public by including altcoins such as XRP and ADA in an update on August 11th. Kraken’s reserves are as follows:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- USD Coin (USDC)

- Ripple (XRP)

- Cardano (ADA)

- Polkadot (DOT)

cryptocoin.com As you follow, FTX, which has filed for Chapter 11 bankruptcy, and Alameda Research, which has ceased operations, hold a total of around 120 million USDC tokens. Meanwhile, problems emerged at cold wallet provider Ledger in early November, when FTX plunged into a liquidity crisis.

Ledger experienced a temporary server outage

In the midst of the FTX bloodbath, massive withdrawal demand has emerged on crypto exchanges. As a result, hardware-based cryptocurrency wallet provider Ledger experienced a temporary server outage. “After the FTX quake, there is a huge exit from exchanges to Ledger security and self-sovereign solutions,” Ledger CTO Charles Guillemet reasoned, explaining that the systems were back up and running shortly thereafter.

Meanwhile, following the liquidity crisis and rumors of the acquisition of cryptocurrency exchange FTX, Binance CEO Changpeng Zhao has announced that he will be launching a reserve monitoring system soon. This system will enable the verification of cryptocurrencies in companies or exchanges.

All crypto exchanges should do merkle-tree proof-of-reserves.

Banks run on fractional reserves.

Crypto exchanges should not.@Binance will start to do proof-of-reserves soon. Full transparency.— CZ 🔶 Binance (@cz_binance) November 8, 2022

CEO Changpeng Zhao shared Binance’s current reserves on Twitter on November 10.