Gold prices fell on Wednesday as the US dollar appreciated slightly, as investors are considering the possibility the Federal Reserve will raise interest rates once again in May. Analysts interpret the market and analyze the technical outlook of gold.

for gold the possibility of some relaxation is still on the table

Spot gold was down 1.72% at $1,970 at press time. U.S. gold futures fell 1.84% to $2,001. Meanwhile, the dollar index (DXY) rose 0.34%, making gold less available to buyers of other currencies. Yeap Jun Rong, a market analyst at IG, evaluates the latest developments as follows:

Prospects are already priced for a 25 basis point gain, leaving most of the focus on whether to signal a rate pause later. Given the recent rally and overextended technical conditions, this could provide an anchor for gold prices. However, the possibility of some easing in gold prices may still be on the table once the Fed’s rate outlook is confirmed.

Investors focus on comments from Fed officials

cryptocoin.com As you follow, the CME FedWatch tool shows the probability of a 25 basis point increase as 86.6% in May, while interest rate cuts are expected in the second half of the year. Louis Fed President James Bullard said on Tuesday that the Fed should continue to raise rates in light of recent data showing that inflation is persistent. But Atlanta Fed President Raphael Bostic noted that one more increase “must be enough” before stepping back to “see how our policy is progressing in the economy.”

Investors are trying to gauge whether the potential rate hike in May will be the last before the Fed takes a break, and is focusing on further comments from Fed officials this week before the May meeting enters a blackout from April 22.

Gold technical analysis: It remains on the bears’ radar

Technical analyst Anil Panchal evaluates the technical outlook of gold as follows. Gold bears the brunt of the US dollar’s recovery, falling below $2,000 to around $1,973 after renewing an intraday low of $1,969 in Europe early Wednesday.

Recent weakness in gold price marks another U-turn from the 200 Hourly Moving Average (HMA), which joins the bearish MACD signals to guide the gold bears towards the two-week ascending support line near $1,980. However, the RSI (14) line is oversold so it seems less likely for the price to cross $1,980. If this happens, it could push the gold price towards the monthly low of around $1,949.

Gold price hourly chart

Gold price hourly chartMeanwhile, the two-day ascending trendline, the previous support around $1,999, is limiting the sudden recovery of gold price. Following this, the 200-HMA level around $2,010 might push gold buyers. First of all, gold price remains on the bears’ radar unless it stays below the pre-April 03 support line, no later than $2,040.

Yellow metal faces consolidation in the near term

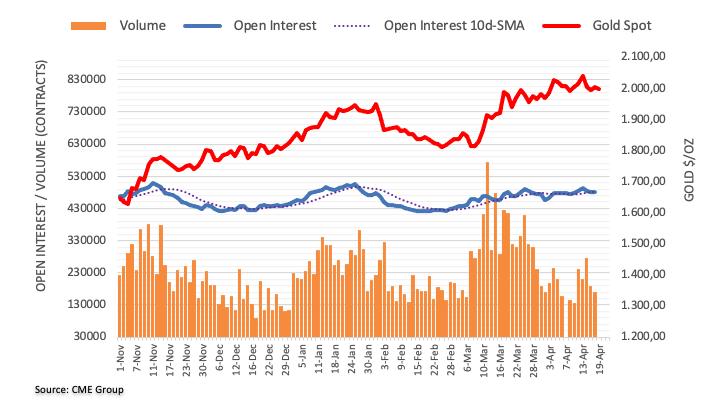

According to preliminary data from CME Group, the number of short positions in the gold futures markets increased by just 300 contracts on Tuesday, after falling for two consecutive days. Volume, on the other hand, contracted by more than 105,000 contracts in the second session in a row.

Market analyst Pablo Piovano states that the rise in gold prices on Tuesday was driven by a small increase in the number of short positions and a sharp decrease in volume. According to the analyst, this has opened the door to some consolidation in the very near term. So far, the $2050 region continues to limit bullish attempts from time to time, while the $1,980 region has held the downside so far.