The gold price briefly dropped below $1,800. However, it quickly rebounded and was up 1.4% to $1,841.65 at time of writing today. Experienced analysts evaluate the future of gold.

ANZ: Gold to stabilize at $1,820

ANZ Bank economists expect gold to stabilize around $1,820. Economists assess

Aggressive monetary tightening, rising yields and a stronger dollar are key drivers for the gold price. Concerns about global economic growth fueled by persistent inflation and rising geopolitical risks should somewhat shield the yellow metal. We expect the price to find a bottom at the current $1,820 level with upside potential of $1,950.

TDS: Yellow metal may be damaged more

As you can follow from cryptokoin.com news Wednesday On the day, gold failed to hold the bull market trendline around $1,830. Strategists at this floating TD Securities see more downside potential for the yellow metal. Strategists explain their views as follows:

While Powell expressed his willingness to move interest rates beyond neutral to rein in inflation, although he may seem deaf about economic concerns, the data released are mostly still solid.

TDS strategists continue to see more downside potential for gold as bearish momentum strengthens among the precious metals complex and broad macro liquidations are also weighing on them. Strategists comment:

ETF holdings are down for the ninth consecutive day, while positioning analytics still discuss the potential for additional pain for gold bugs.

Pablo Piovano: Gold stays limited to 200-day SMA

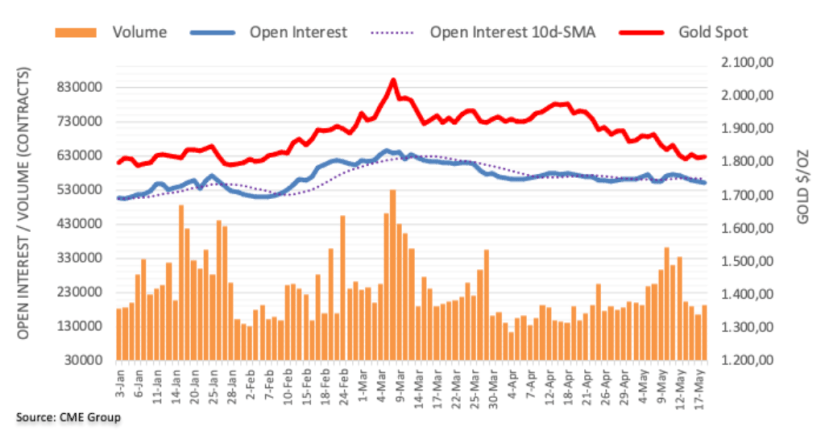

Given CME Group’s advanced data for gold futures markets, open interest this time around 4 It narrowed for another session with .5k contracts. Instead, volume reversed three consecutive daily pullbacks, raising nearly 26.4k contracts.

The analyst states that gold prices entered a fruitless session on Wednesday on the backdrop of declining open interest rates. Meanwhile, further consolidation in the yellow metal remains in the cards, while bullish attempts remain capped by the 200-day SMA around $1,837.