The price of gold is traded around $ 1,800 around the resistance. So, will this recovery continue or will it pause? Analyst Jordan Roy-Bryne presents its prediction by examining graphs for valuable metale. Kriptokoin.comWe are examining as…

Analyst gave resistance and support levels for gold price

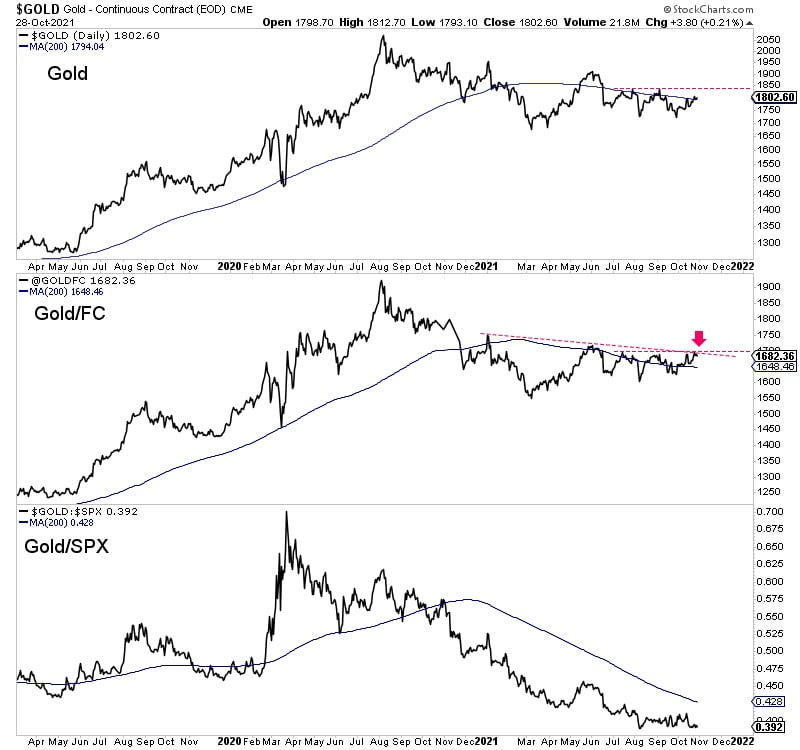

Gold, Vaneck Gold Miners ETF, HUI and Vanck Junior Gold Miners ETF, along with 200 -day moving averages, the analyst, since the beginning of summer, the tendency to decline gold shares, the gold follows a horizontal course, he says. On the other hand, gold continued to wrestle with 200 -day moving average ($ 1,794), and gold shares rose to the 200 -day moving average. Analyst says that the lock resistance level for daily and weekly graphics is $ 1,835.

For short -term appearance clues, the analyst who browses several indicators draws the gold against foreign currencies (Gold/YP) and stock market in the following graph. Gold/YP tends to lead the gold at significant turning points. The YP has performed better than gold in the past few months, but there is no significant difference in the analyst yet. Gold remains incredibly weak against the stock market. According to the analyst, this should change if the precious metal will be over $ 1,835.

Analyst: 2016-2019 levels need to be paid attention

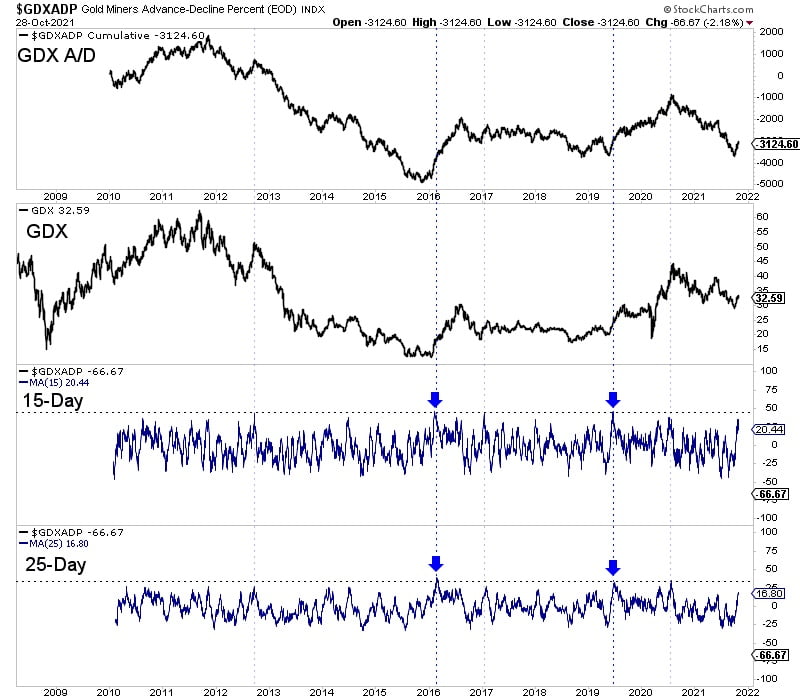

As the next step, the analyst, who draws attention to the progress-thinking graph, says this is a reliable indicator for any market group. Analyst, in order to measure a “potential“ width pressure ”, we draw this with a 15-day and 25-day progress-firing line. A width pressure occurs when a market passes from power to power.

Width occurs following the bottoms, but sometimes it may occur at market summits. Roy-Bryne says that the 15-day and 25-day decline and increases after 2016 and 2019 bottoms should be considered. According to the analyst, if the GDX may show a significant power for one or two weeks, 15 and 25 -day indicators may give a large move signal that can be the proof of an important footpoint.

Currently, the analyst says that evidence that precious metals will overcome past resistance is lacking, he says there is no positive separation. He says that the market will reveal the basics of the rise in a slightly way, but argues that the next major movement in the sector will not start without increasing the federal reserve interest rates.