Bitcoin last halved on May 11, 2020, giving a block reward of 6.25 BTC at that time. After the record global market drop in March 2020, the BTC price was around $8,000 at the last halving event. Now, analysts are pondering how such an event could increase the BTC price to $ 40,000.

If this happens, Bitcoin can reach $ 40,000

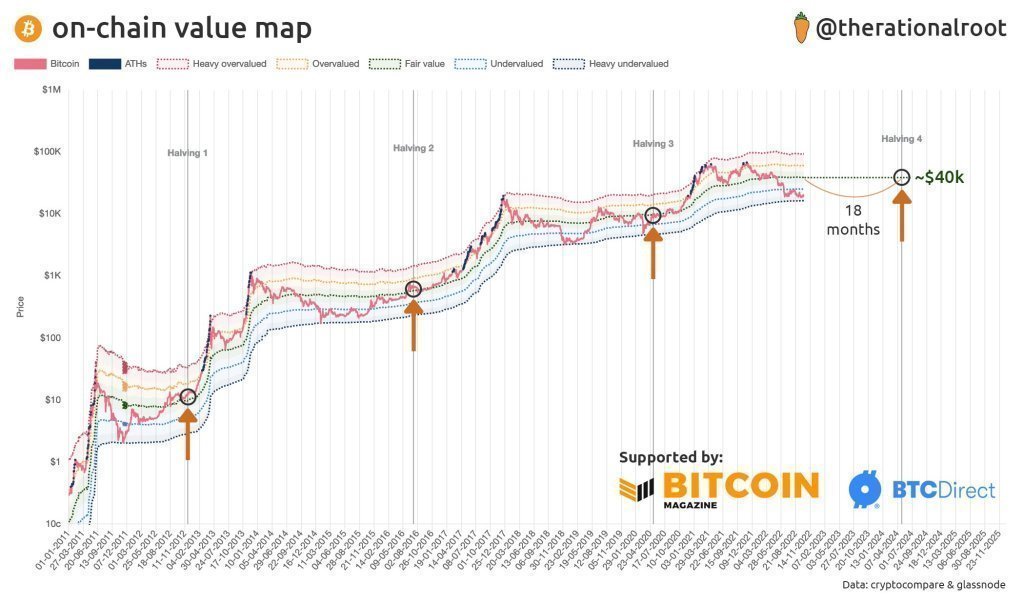

The data-driven Twitter account “Root” showed interesting results using the Bitcoin on-chain value map. Accordingly, it showed that the price on the halving has historically been at a fair value. According to the analysis, the BTC price is likely to reach around $40,000 in 18 months. For this, however, the fair value must not fall significantly. However, the analysis also reveals another critical factor that is important for the price rise. cryptocoin.comAs we have reported, this is the macroeconomic environment that draws attention with the FED and global inflation.

When will BTC bottom out?

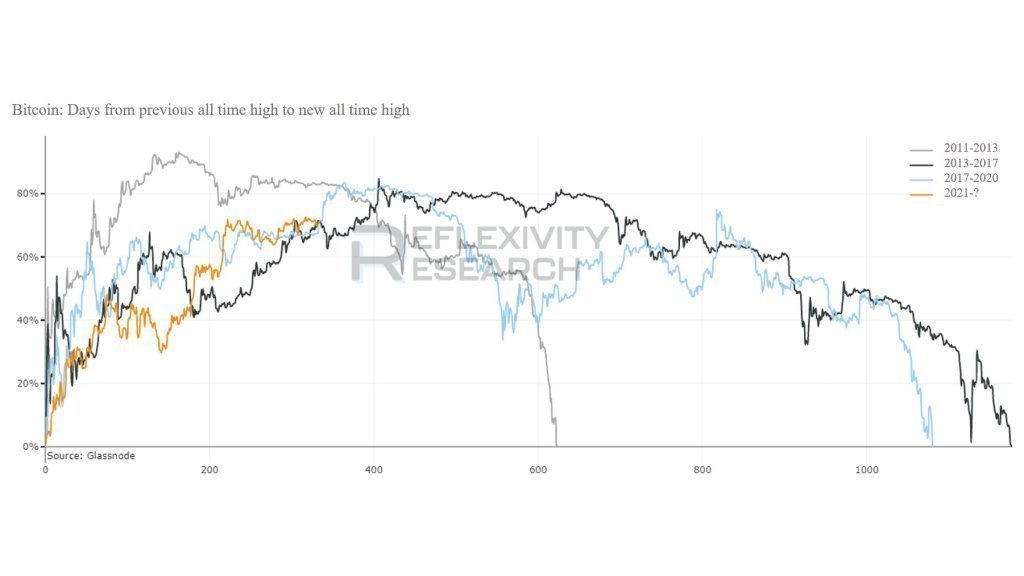

Capriole CEO Charles Edwards evaluated previous cycles to determine where BTC might end up bottoming out. Analyst Will Clemente has published a chart in the past comparing the distance between Bitcoin ATHs and macro bottoms. Accordingly, in 2014 and 2018, BTC formed a macro bottom after an all-time high. Referring to Clemente’s chart, Charles Edwards said, “We are on the 90-day chart where the last 2 Bitcoin cycles have bottomed out.”

At the time of writing, Bitcoin is trading 71% lower than the record high of $64,000 set in November 2021. Accordingly, the leading cryptocurrency is currently changing hands at $ 19,400. This price is still less compared to the bottom of 2018, so the price is likely to go even lower. It looks like BTC hasn’t bottomed yet.

“Bitcoin will fall to these levels”

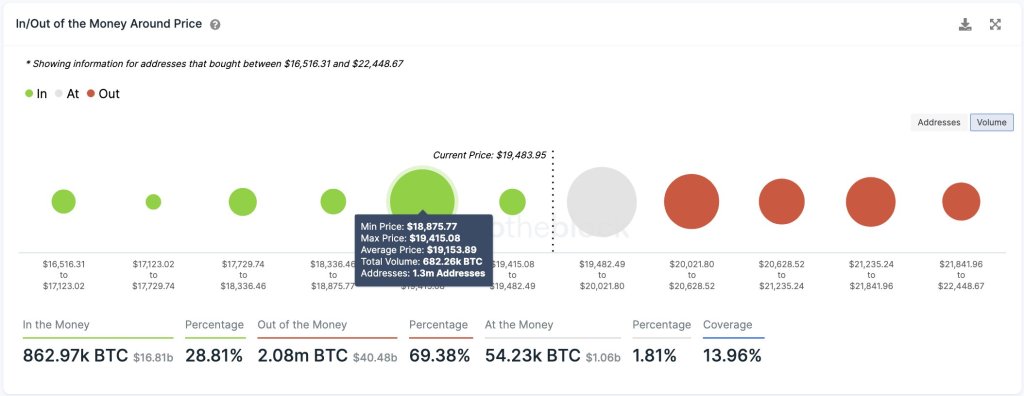

Crypto analyst Ali Martinez outlined what it takes to prevent a sharp drop in Bitcoin. Accordingly, BTC needs to maintain the $19,000 support level. The analyst claims that at this price level, there are 1.3 million addresses 680,000 BTC. According to him, on-chain data shows that there is virtually no support underneath it. Meanwhile, Ki Young Ju, CEO of CryptoQuant, comes up with another prediction. The CEO predicts that a significant amount of USDC stablecoins will flow to exchanges.

According to him, when this happens, the next bull cycle for BTC will begin. Currently, 94% of the USDC supply is held by large over-the-counter companies such as a Goldman Sachs. However, crypto-native stablecoins like BUSD are officially popping up on exchanges right now. This shows that some crypto natives are hoarding some specific coins.