3 Bitcoin price metrics show that the 10% jump on September 9 marks the bottom of the last cycle. Is the Bitcoin (BTC) drop over? The data indicates that the bears have lost their tight control of the market.

Recent bounce points to correction according to these 3 Bitcoin metrics

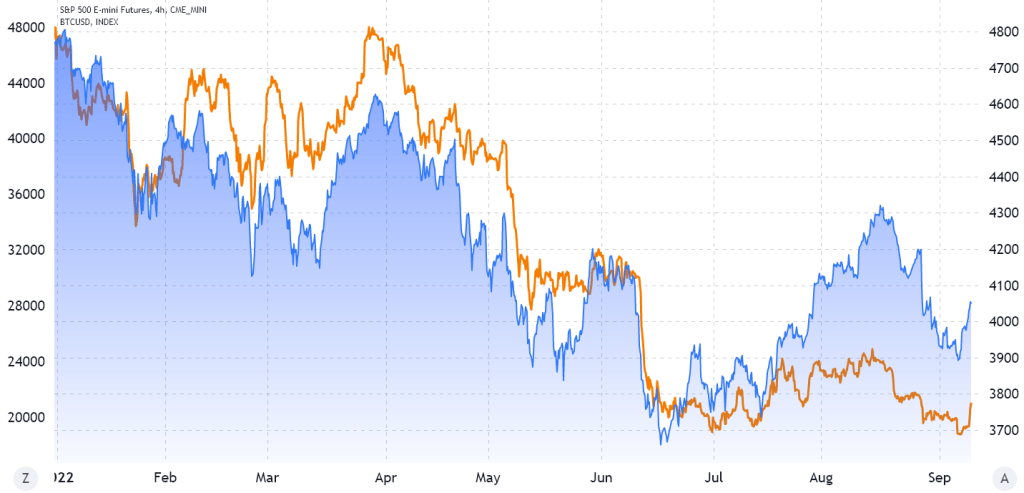

The correlation between Bitcoin and exchanges has been unusually high since mid-March. This means that the two markets are moving in almost the same direction. The data could explain why the 10% rally above $21,000 was rejected by most traders, especially considering that S&P 500 futures gained 4% in two days. However, Bitcoin trading activity and the derivatives market are strongly supporting recent gains.

Interestingly, the current Bitcoin rally comes a day after the White House Office of Science and Technology Policy released a report investigating energy use associated with digital assets. The study recommended the implementation of energy reliability and efficiency standards. He also recommended that federal agencies provide technical assistance and initiate a collaborative process with industry.

It is remarkable how the highs and lows on both charts overlap. However, as investors’ perceptions and risk assessments change over time, the correlation changes. For example, between May 2021 and July 2021, the correlation reversed for most of the period. Overall, the stock market recorded steady gains as the cryptocurrency market crashed.

More importantly, the chart above shows that a huge gap has opened between Bitcoin and the stock market as stocks rise from mid-July to mid-August. Still, it is reasonable to conclude that historically these gaps have tended to close.

Professional traders didn’t expect Bitcoin to make a splash

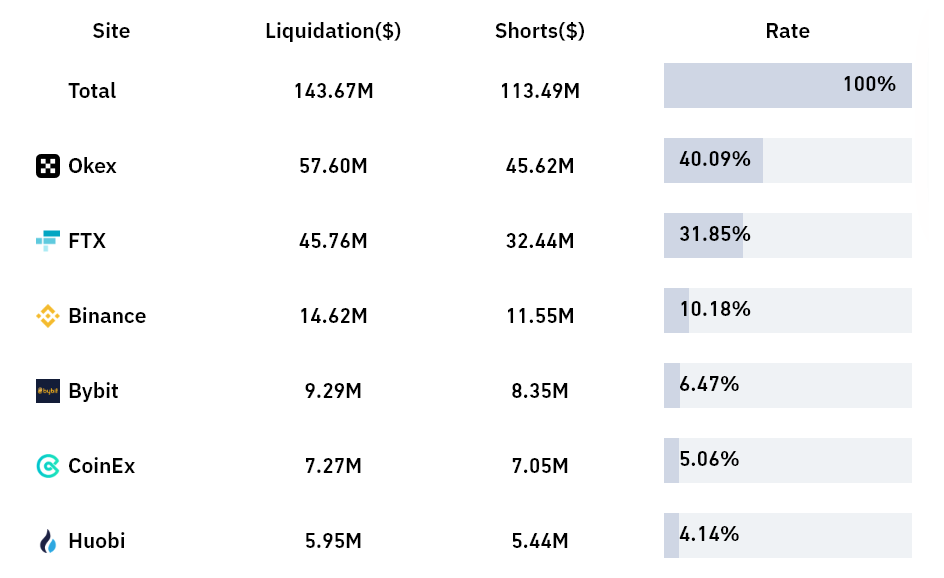

The bears have seen $120 million in futures liquidations, a peak since June 13. Typically, this result is not to be expected, given that Bitcoin has lost 13% in the two weeks to Sept. But shorts (bears) were surprised as the liquidation engine of the exchanges struggled to buy these orders.

However, there is other anecdotal evidence hidden in the liquidation data provided by derivatives exchanges.

It represents only 17.4% of the total forcibly closed orders of individual-focused exchanges (Binance and Bybit). It is noteworthy, however, that their combined market share in Bitcoin futures is 30.6%. The data leaves no doubt that it was the whales at OKX and FTX that got stuck.

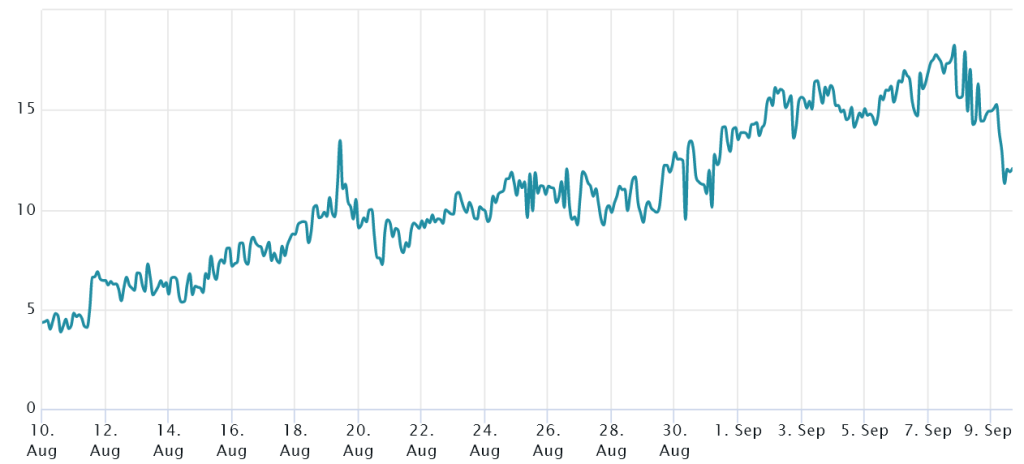

Fear erased from options markets

The 25% delta skew, the leading Bitcoin options “fear and greed” metric, has recovered enough to enter a neutral level.

If options traders fear a price drop, the skewness indicator rises above 12%. Meanwhile, investor sentiment tends to reflect a negative 12% skew. After peaking at 18% on September 7, the metric now stands at 12%. This is the extreme end of the neutral market. Therefore, the Bitcoin rally on September 9 signaled that professional traders are no longer charging excessive premiums for their protective put options.

Conclusion

Analyst Marcel Pechman draws the following inference about the bottom here from the 3 metrics above:

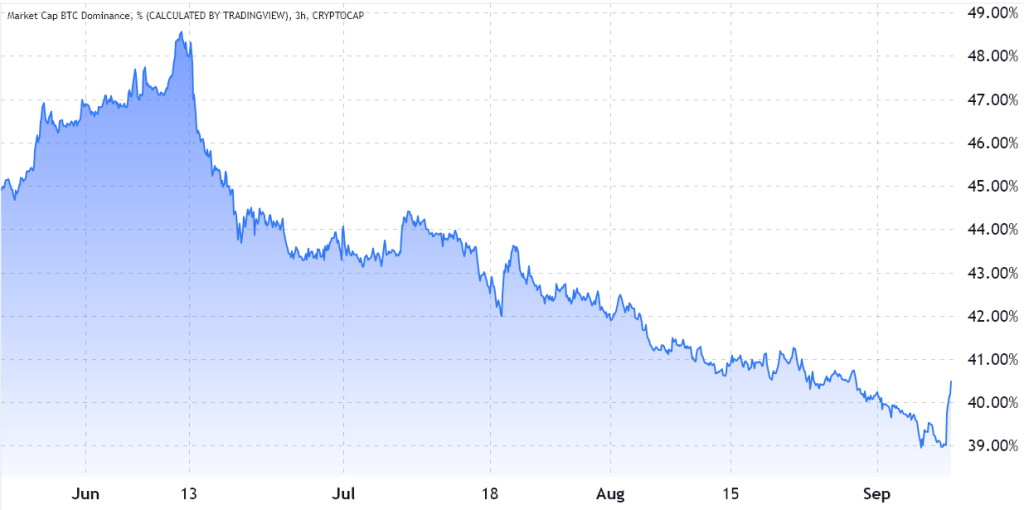

These three metrics support the relevance of Bitcoin’s last 10% rally. A $120 million liquidation in leverage deficits (bears) focuses less on “individually focused” derivatives exchanges. The 1.5% rise in Bitcoin’s dominance rate and options traders pricing similar upside and downside risks suggest that Bitcoin has finally found a bottom.